Forex News and Events

In a surprise action, the Swiss National Bank pulled the interest rate on sight deposits to -0.25% and reiterated its commitment to defend the 1.20 floor on EUR/CHF. The target CHF libor has been widened to -0.75%/0.25%, its usual width of 1%. While the aggressive cut in libor target lower bound will certainly not impact interbank market, as banks will place their excess liquidity at the better -25bp therefore defining the interbank floor at this level, the extent of the action is seen as a concrete signal to the market: the SNB will dare lower rates, if needed. The euroswiss interest rate futures spiked to 100.200, highest since mid-2011. The anxiety on the Swiss rate markets has just begun. On a side note, the negative rates will be applied to sight deposits above an exemption threshold: for accounts subject to minimum reserve requirement (RR), this threshold stands at twenty times the statutory minimum RR, for the others the threshold is set to 10 billion francs, effective from January 22nd. Domestic authorities are not subject to new measures for the time being. There is no direct implication for the general public as customer deposit rates are fixed by the commercial banks, which however may need to “adjust their lending and deposit conditions to changes in money market interest rates.”

The SNB action, itself, has not been a massive surprise, but the timing did. We would expect the SNB to pull out the rate weapon as reaction to a potential policy action across its borders in the Q1 of 2015, certainly not before Christmas! This is why, with no guidance regarding the timing of the unexpected cut, we suspect that this week has cost the SNB plenty protect the floor. With the ECB signaling full blown QE, “grexit” coming back into traders vernacular, the heavy sell-off in ruble and the FOMC’s cautious stand regarding the timing of the first FF rate hike, it was clear that the SNB’s already bloated balance sheet was poised to expand again. “The Swiss franc has been experiencing renewed upward pressures vis-à-vis the euro in the last few days” stated the official communication, “The worsening of the crisis in Russia was a major contributory factor in this development.”

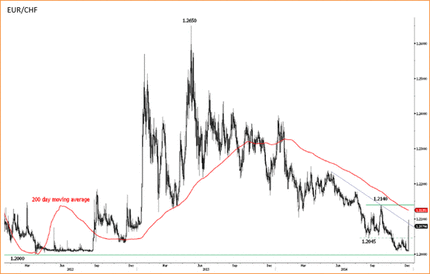

Today’s action will temporary ease the selling pressures on EUR/CHF, especially on the speculative camp. Yet more steps will certainly be needed as the ECB hasn’t said its last words yet. The correlation between EUR/USD and EUR/CHF is now null. The 1-month 25-delta EUR/CHF risk reversals switch to positive territory (+36 pts) for the first time since end-October. With better volatilities, we expect the put sellers to pull the balance back to negative.

In the FX markets, the reaction could have been stronger. EUR/CHF spiked to 1.20974 before rapidly easing below 1.20500. For CHF-lovers and risk-heaven trades, EUR/CHF close to 1.21 has certainly been a good long Swissy entry price in the current risk-off setting. We see little follow through above the reaction high of 1.20974 in the absence of fresh intervention.

As knee-jerk reaction, USD/CHF advanced to 0.9848, highest since August 2012. The trend and momentum indicators reversed. The MACD should step in the bullish zone for a daily close above 0.9810, suggesting extension of October-December bull-trend. We see decent option related bids above 0.9600 before the week-end.

EUR/CHF spikes on negative SNB rates

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.