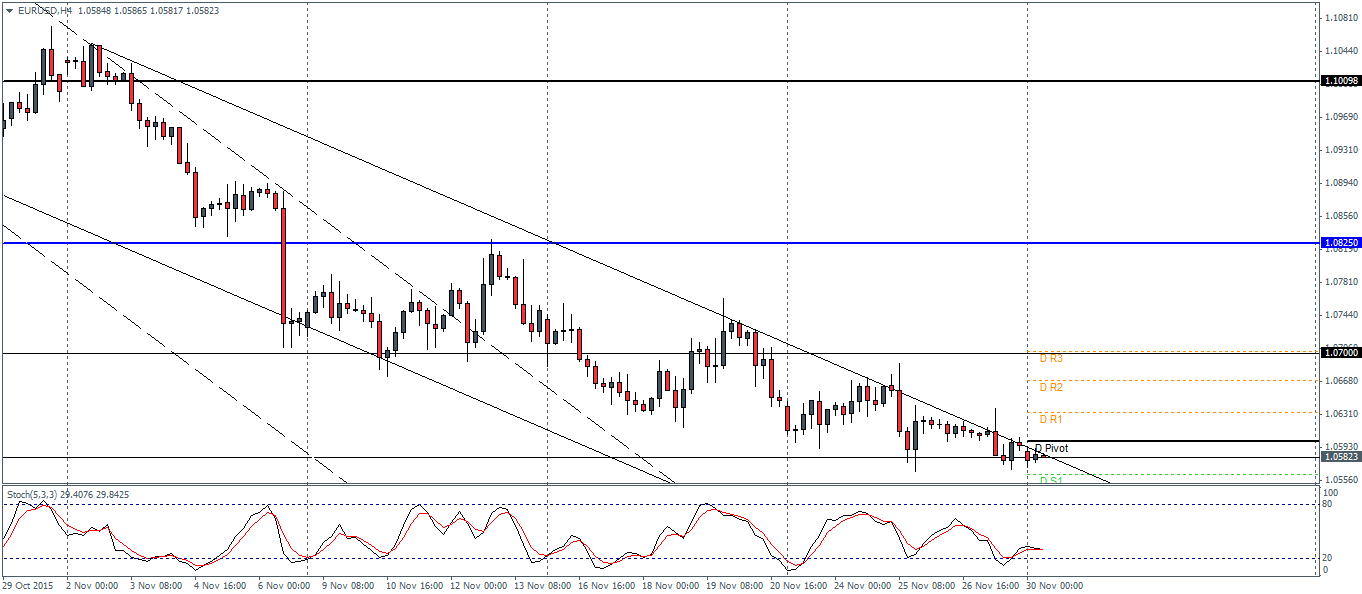

| R3 | 1.0702 |

| R2 | 1.0669 |

| R1 | 1.0632 |

| Pivot | 1.0599 |

| S1 | 1.0562 |

| S2 | 1.0530 |

| S3 | 1.0492 |

EURUSD (1.05): EURUSD has been trending below 1.0697 level of support for the past six days and the price action from the candlesticks indicate that the bearish momentum is stalling based on the small bodied candlesticks being formed. A retest to 1.0697 is very likely in the near term, which if holds could see EURUSD resume a new bearish leg to the downside to the lower support at 1.0488. On the 4-hour charts, with the Stochastics trading close to the 20 level and price action trading close to the new minor falling price channel, 1.07 remains a very likely price point that could be retested to establish resistance. On the 4-hour chart, there is a potential double bottom formed at 1.0578 region following the top near 1.05985. A breakout above this level could see EURUSD attempt to rally towards 1.07.

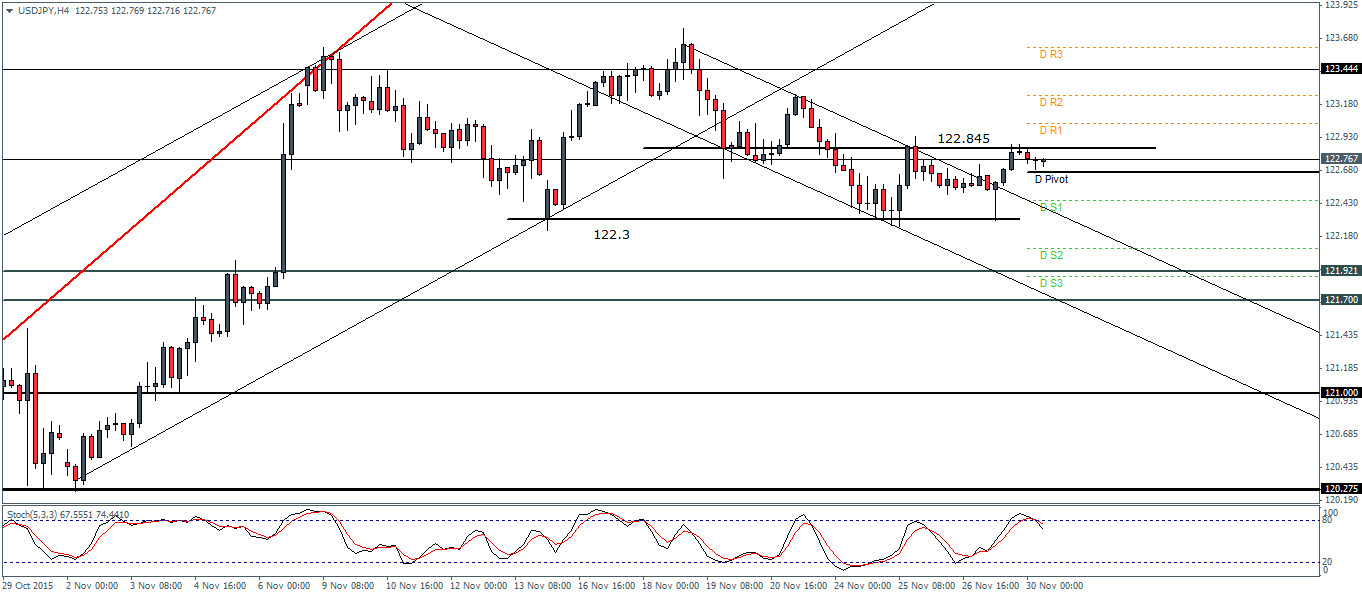

| R3 | 123.608 |

| R2 | 123.245 |

| R1 | 123.033 |

| Pivot | 122.663 |

| S1 | 122.452 |

| S2 | 122.089 |

| S3 | 121.877 |

USDJPY (122.7): USDJPY's consolidating near the breakout level of the bullish flag pattern is indicative of a potential new bullish leg being resumed in prices. 122.5 region of support therefore remains of importance. Price action is trading within 122.845 resistance and 122.3 support and this ranging price action on the 4-hour chart could point to a strong breakout in either direction in the near term. An upside breakout could see USDJPY test 123.44 previous highs, while a break below 122.3 could see a break to 121.92 - 121.7 level of support in the near term. With the Stochastics being in oversold levels, we move to the downside looks like a possibility but considering that USDJPY broke out from the falling price channel, a retest to 122.3 will likely keep prices supported to the upside.

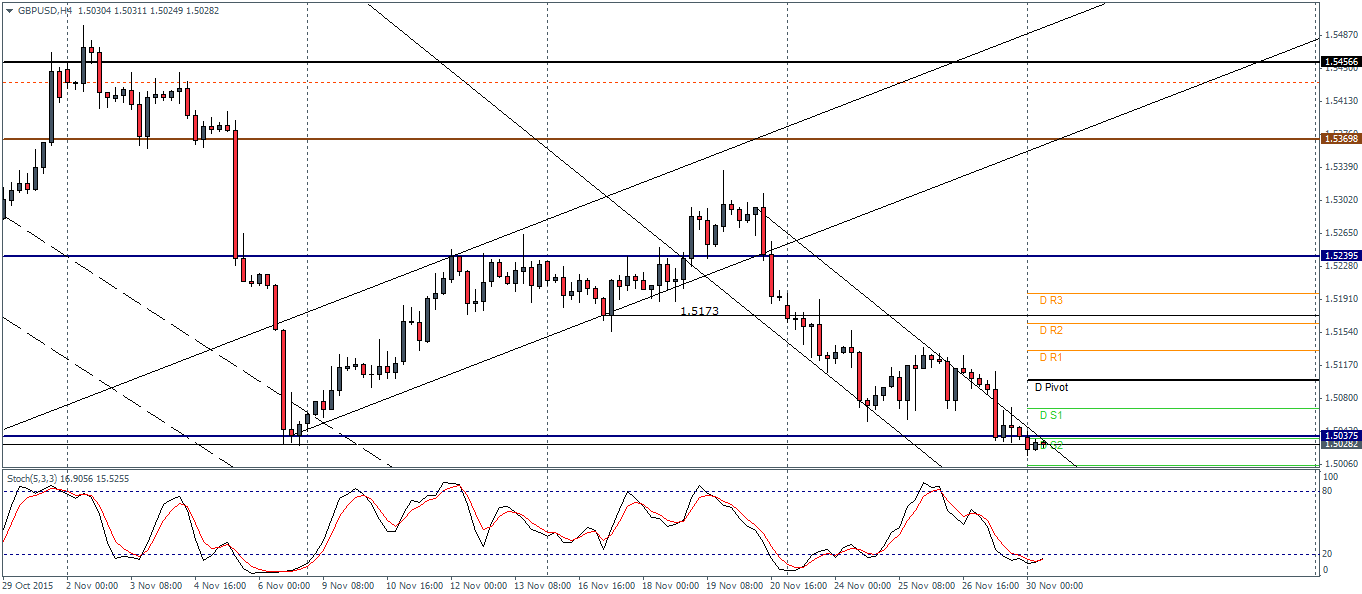

| R3 | 1.5166 |

| R2 | 1.5138 |

| R1 | 1.5087 |

| Pivot | 1.5059 |

| S1 | 1.5008 |

| S2 | 1.4979 |

| S3 | 1.4929 |

GBPUSD (1.50): GBPUSD closed Friday's session on a strongly bearish note. On the 4-hour chart, prices are trading near 1.50375 level of support marking a retest to the previous lows of the rising price channel. The Stochastics is currently moving away from the oversold levels so a short term correction in prices is likely. The untested broken support at 1.52395 remains a possibility for a retest to establish resistance to this level. Plotting the new falling price channel, watching for a break out from this level will be key that could signal a corrective move to the upside.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.