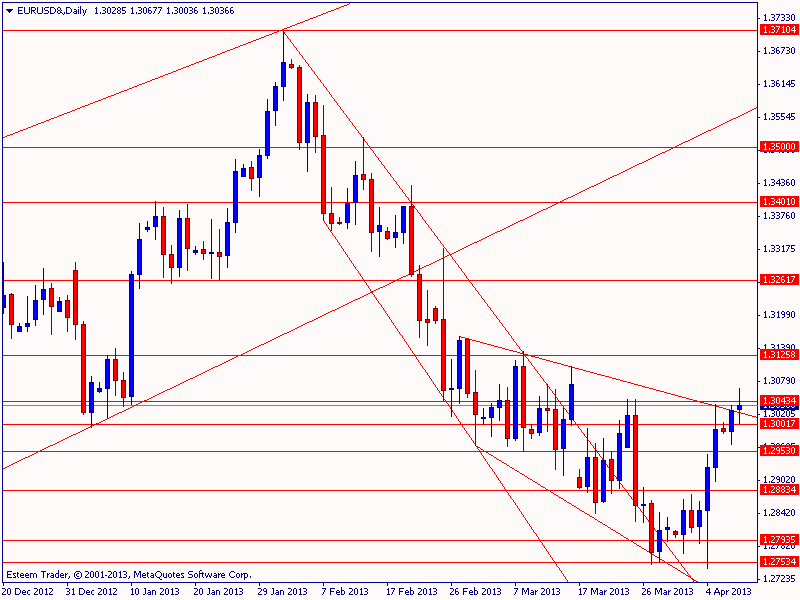

Just noticing a developing situation on the EUR/USD daily chart that merits bringing to everyone’s attention. Right now price is trading above even the new channel that we’ve been watching develop over the last month. Of course, I would like to see a daily close above this channel before I get too excited but take a look at today’s candle so far, in the chart at the bottom.

Of course, we have FOMC Meeting Minutes from the March 19-20 meeting coming out on Wednesday. This will give us some potentially market moving information about what the FED folks were thinking a few weeks back. They did not have the terrible employment data from last week in their hands at that point so it’s just another somewhat stale peek but as far as technical situations go, a break above this channel could signal a willingness to move higher from here. Stay tuned and let’s see what happens. If I plan any trades I’ll update things here.

As always, please remember, this is NOT a trade call, just an opinion I’m sharing as things develop in real time. Please plan your own trading accordingly and take responsibility for whatever you do with your own account.

1) Grentone Inc (a trading name of Grentone Capital Management (NZ Ltd) is not a broker-dealer. Grentone Inc is in the business of traders education and training. Grentone Inc's products and services are delivered through the internet and in person. For the purpose of education, Grentone Inc offers a virtual trading environment, where a community through which are independent traders (subscribers), as well as OkaFX (a trading name of Esteem Financials (AUS) Pty Ltd), observes the virtual trading environment 2) OkaFX (a trading name of Esteem Financials Pty Ltd) is a Registered ASIC Broker-Dealer and licensed under the Australian Financial Services Licence No. 400364. All trading and assessments conducted by Grentone Inc and Grentone Capital Management (NZ) Ltd are done through OkaFX. 3) All illustrations and presentations made to you by Grentone Inc are for the purpose of education only. All information present must never be, nor should be construed, as an offer, or a solicitation of an offer, to buy or sell any investment products. You shall be fully responsible for any investment decision you make, and such decisions will be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.