Today's Highlights

Sterling levels after Scottish debate

Fed speakers to dominate USD

Canadian Dollar weaker ahead of retail sales data

FX Market Overview

I hope you had a fab weekend. We are in our new offices; we have computers and phones and coffee. All is right with the world. And, can I just say, Lewis Hamilton ...awesome and Bath Rugby Club...awesome. Nuff said.

As for the markets, well the repercussions from the Scottish vote were all over the papers at the weekend and are still banging around in the background today. The pace for change in voting rights for English, Scottish, Welsh and Irish MPs is the hot topic but it doesn't have a lot of effect on the value of the Pound. In fact Sterling has steadied around Friday's levels as we start the week. There isn't a lot of UK data this week; public sector borrowing and a bit of housing market data will be all we have to contend with so the Pound is likely to settle in its current range unless US data or European data causes a kerfuffle.

The US Dollar is the more influential of these. We are awash with speeches by Federal Reserve Chairpersons and if that isn't enough to keep things interesting, we will end the week with the final GDP growth data for Quarter 2. It isn't often that data is revised significantly at this stage but there is always scope for a surprise. Traders will be hoping for a slip from one of the Fed Chairs; a hint of the timing of the first interest rate hike would be very welcome.

As for the Euro, Tuesday's purchasing managers indices will be closely followed as this sector is doing rather badly even in Germany but it is the manufacturing sector that is essential for the recovery of the Eurozone. And speaking of Germany, we get the IFO business climate index on Wednesday. ECB Governing Council member Christian Noyer says there is no QE plan as yet but there is every chance another council member will contradict that this week so don't assume he is right just yet. There is also a smattering of consumer and business confidence indices this week but the Euro is struggling and anything negative will add a bit of oil to lubricate that slide.

The Canadian Dollar has weakened over the weekend after a strong showing last week in the wake of the higher inflation data. If the Canadian Retail Sales data is as poor as some have forecast, that weakening will increase later in the week.

We have a smattering of data from Australasia this week but perhaps not enough to cause any serious waves. However, both the Australian and New Zealand Dollars are flailing at the weaker end of their ranges and there is scope for a breakout if anything negative emerges from China or America; the most influential export markets for both economies.

And a California lawyer may lose her licence to practice after she was found to have photo-shopped herself into pictures showing her as a friend to the stars. She wasn't messing around with Z-listers either. The pictures on her website showed her hobnobbing with the likes of President Obama, Bill Clinton, George Clooney, Leonardo DiCaprio and Anne Hathaway. Perhaps it is all about who you actually know after all.

Currency - GBP/Australian Dollar

The bounce we have seen in the Sterling - Australian Dollar rate over the last 11 days is pretty dramatic. Sterling rallied from A$1.72 on 8th September to A$1.8460 overnight. That was the knee jerk reaction to the 'No' vote in the Scottish referendum but the fact that the Pound is now comprehensively above the downtrend which started in January makes it easier to see further gains. In the short term, don't be surprised if we see a correction back to the top of the trend line at A$1.8000 but, as long as the Pound stays above there, A$1.8580 beckons. The converse is also true though, a break back below A$1.80 puts us back into the downtrend that dominated this exchange rate up until 3 days ago.

Currency - GBP/Canadian Dollar

The pattern of the year in this GBP-CAD exchange rate altered in late August when the Pound dropped below C$1.80. Other than the spike after the referendum results overnight, there has been no reason to expect a rebound. We are awaiting Canadian inflation this afternoon and that ought to be a tad weaker than last month. If so, Sterling might just maintain its position in positive territory against the Canadian Dollar. If we go into the weekend with the Pound above C$1.80, there is a chance but no guarantee that we will see another rally. So, in short, the current range is C$1.74 to C$1.80 and the potential upper range is C$1.80 to C$1.8425 if this pair stays above C$1.80 at the close of the day. Clear as mud I suspect.

Currency - GBP/Euro

This could be a momentous time for the Sterling – Euro exchange rate. Since the initial weakness in 2000, the Euro has been strengthening in a pattern topped by the red line on the chart above. That resistance line has been breached for the first time in the wake of the Scottish referendum and, at the time of writing, Sterling is still in that uncharted territory. If that line is broken, Sterling has the potential to rally significantly. €1.30 and €1.3250 are the initial targets but the trend has changed at that point and the longer term direction of this pair looks far from clear. For those needing to buy Euros, the targets are above but there should be some consideration of what might happen if the support for sterling slips. Risk management is a good policy at this point. For Euro sellers, protect against the possibility of not just €1.30 but much higher levels if the Eurozone's dramas continue to weigh on the Euro.

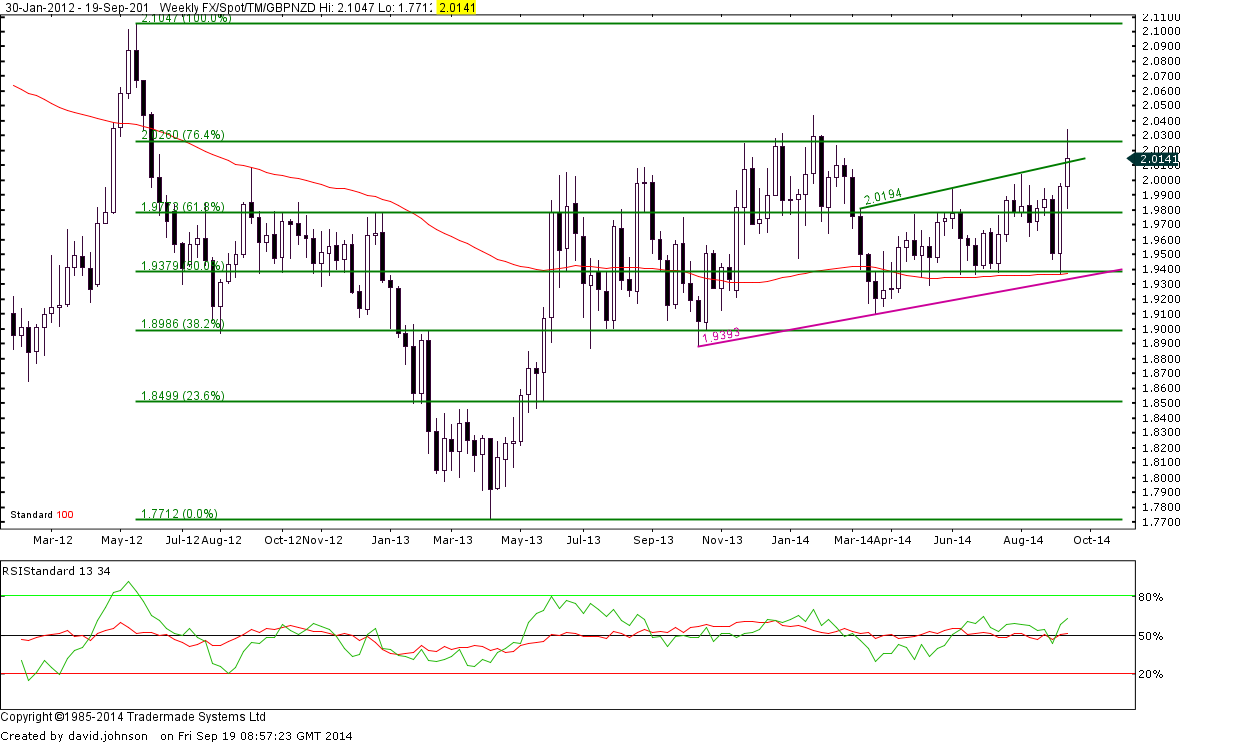

Currency - GBP/New Zealand Dollar

This exchange rate is a stubborn little sucker. Traders appear to have a real mental block when it comes to the NZ Dollar reaching anything above 2.00 to the Pound. We saw a spike through that level yesterday and, almost on cue, the Pound drops back to NZ$2.00 again just as it did in November, December and January. The trend us upward, the strength in the UK economy and the conclusion of the Scottish independence question are helping Sterling to strengthen and NZ data is rather erratic so there are reasons for the direction of travel in the GBP-NZD rate. Could Sterling slacken off? Yes it could. And is there a case for saying the Bank of England may delay their first interest rate hike? Yes there is. So nothing is certain but another test above NZ$2.00 is very likely in the days ahead.

Currency - GBP/US Dollar

As soon as it became clear that the Scots had rejected independence, the Pound rose against the US Dollar. The Spike to $1.6450 was short lived though and a slow decline ensued. Nevertheless, this pair remains above at the top of its recent downward trend and may yet make a push to $1.6633. If that doesn't happen, the current trading range is $1.6050 to $1.6450 but, without that break to higher levels, the trajectory is downward.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 even as USD struggles ahead of data

EUR/USD has erased gains to trade flat near 1.0700 in the European session on Thursday. The pair comes under pressure even as the US Dollar struggles, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD turns south toward 1.2500, US data eyed

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair struggles, despite the US Dollar weakness on dovish Fed signals. A mixed market mood caps the GBP/USD upside ahead of mid-tier US data.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.