Good morning from Hamburg and welcome to our last Daily FX Report. Russia will keep cooperating with the United States and its partners to fight Islamic State in Syria, but that cooperation will be in jeopardy if there are any repeats of Turkey's shooting down of a Russian jet, Russia's Vladimir Putin said. Speaking after talks in the Kremlin with French President Francois Hollande, Putin voiced lingering anger at Turkey's actions, saying he viewed the downing of the jet as an act of betrayal by a country Moscow had thought was its friend. But he said he would order Russia's military to intensify cooperation with the French armed forces - including exchanges of information about targets - and viewed that as part of creating a broader international coalition bringing together Russia and Western states.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

The dollar, euro and yen found themselves in familiar territory early on Friday, having shuffled sideways in thin trade with U.S. markets shut for the Thanksgiving Day holiday. The euro managed to hold above $1.0600 and last stood at $1.0606. It remained within reach of a 7-1/2 month trough of $1.0565 set earlier in the week. Against the yen, the common currency was flirting with 130.00 EURJPY, not far off a 7-month low of 129.77. The prospect of more easing from the European Central Bank at next week's policy review has been keeping the euro under pressure. Traders suspect this trend will probably continue in another subdued session with an early close for U.S. markets on Friday. The Reserve Bank of Australia and Bank of Canada also hold their respective policy meetings in the week ahead. In contrast to the ECB, the Federal Reserve seems likely to hike U.S. interest rates in December. Against the yen, the greenback fetched 122.65, remaining pretty much in consolidation mode after reaching a three-month high of 123.77 last week. Commodity currencies were resilient this week, thanks in part to higher oil prices and as investors turned less bearish on some base metals. Oil prices fell on Thursday after six days of gains, as concerns that escalating tension in the Middle East could disrupt supply faded, and the focus returned to a persistent market glut. The downing of a Russian jet by Turkey on Monday helped push up oil prices this week on the risk that rising geopolitical tension could hit Middle East supplies.

Daily Technical Analysis

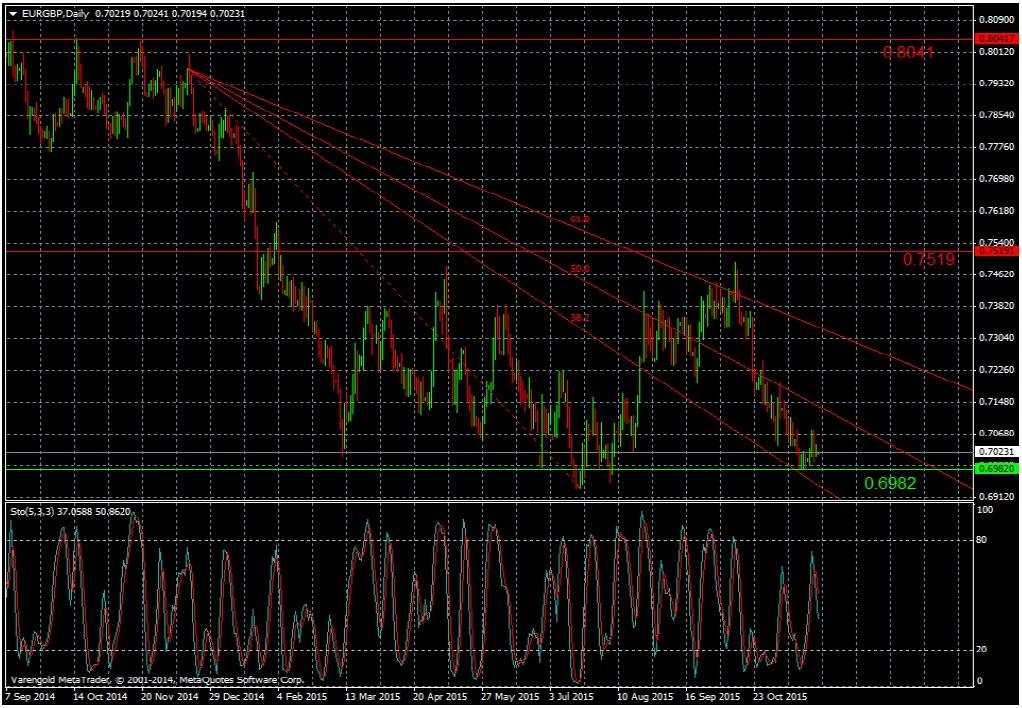

EUR/GBP (Daily)

Since January 2014 this currency pair is experiencing a strong control of the bears as it is falling below an downward Fibonacci fan. It could touch the third resistance line (61.8) two times but couldn’t strengthen its position and dropped again. The support line around 0.7063 was broken several times and doesn’t seem reliable any more. Nevertheless looking at the Stochastic one can see that it moves under the Center line, signaling that some losses might be possible.

Support & Resistance (Daily)

| Support Levels around | Resistance Levels around |

| 0.6982 | 0.7519 |

| N/A | 0.8041 |

| N/A | N/A |

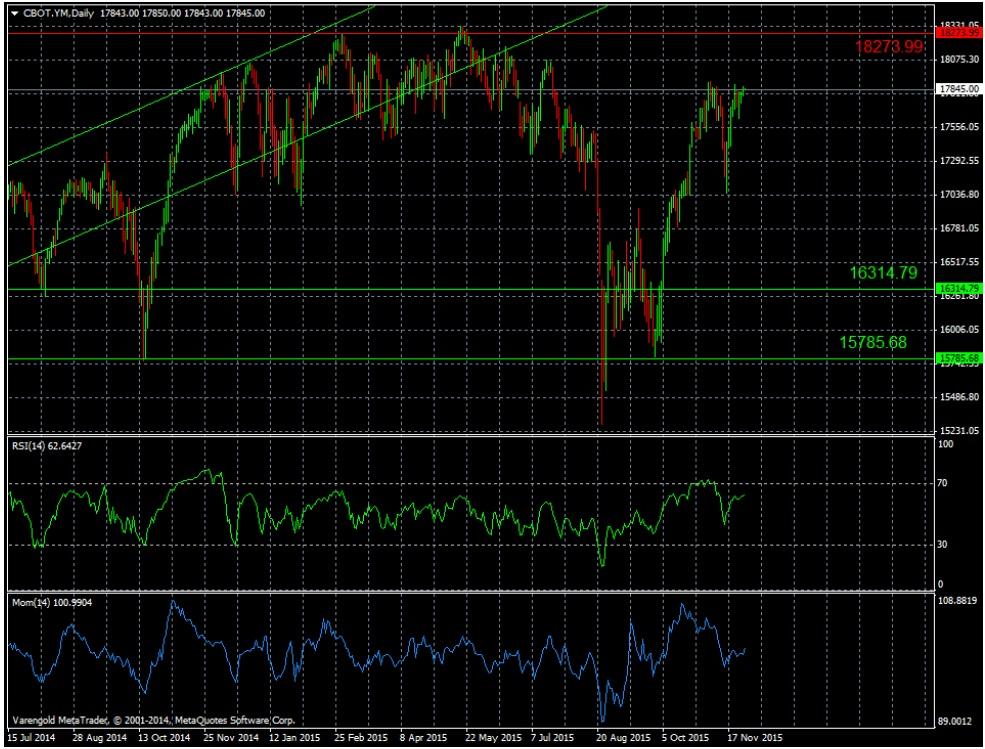

CBOT.YM (Daily)

Looking long term the main American index Dow Jones is recovering since October 2013. It was moving inside an upward trend channel, although there were some short term break-outs. The U.S. economic growth as well as the low unemployment rate help the bulls to dominate here long-term. Recently there was a sharp fall, based on turbulences in China. The RSI is signaling the index is moving slightly upward currently, as well as the Momentum.

Support & Resistance (Daily)

| Support Levels around | Resistance Levels around |

| 16314.79 | 18273.99 |

| 15785.68 | N/A |

| N/A | N/A |

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.