Good morning from rainy Hamburg and welcome to our Daily FX Report. Yesterday a gunman attacked Canada’s parliament but he was shot dead and the Prime Minster Stephen Harper was safely removed. Before the gunman get killed he shot dead a soldier, who was guarding the National War Memorial in central Ottawa. Security in Ottawa came under criticism after the gunman was able to run through the unlocked front door of the main parliament building. Until now no group claimed responsibility for the attack.

Anyway, we wish you much success in trading today.

Market Review – Fundamental Perspective

Yesterday the Dow Jones Index of shares dropped 0.9 percent and the Standard & Poor’s Index fell 0.7 percent. On Wednesday data showed that applications for U.S. home mortgages increased last week. The Mortgage Bankers Association said it seasonally adjusted index, which includes both refinancing and home purchase demand, gained 11.6 percent. In addition another report showed that U.S. consumer-price index rose 0.1 percent after dropping 0.2 percent in August. Core inflation, excluding volatile food and fuel, also strengthened 0.1 percent after being nearly unchanged in August. As a result the USD advanced to a one-week high versus its major peers as the data underscored that the world’s largest economy is gaining momentum. The USD/JPY rose for a fifth day which is the longest streak in more than a month. The EUR declined versus nearly all major peers as the market weighed the prospects of additional easing measures from the ECB. The EUR/USD weakened 0.5 percent to 1.2649 and the EUR/JPY tumbled 0.4 percent to 135.52. The USD/JPY strengthened 0.1 percent to 107.14.

Yesterday minutes of the Bank of England’s last meeting showed that policy makers saw larger risks to the U.K. from a euro-area slump, damping investor bets on an increase in interest rates. Only two officials voted to raise rates by 25 basis points and the remaining seven opted to keep it at 0.5 percent. The GBP/USD tumbled 0.4 percent to 1.6047.

Yesteday the Bank of Canada left interest rates unchanged at 1 percent but removed the word neutral from a statement on its next move, fueling bets it may be a chance for an interest rate increase. The USD/CAD traded at 1.1240 after touching 1.1184, the strongest since October 13. The NZD was set for the largest drop in three weeks after a report showed the consumer price index tumbled to 1 percent. the NZD/USD fell 0.7 percent to 0.7873.

Daily Technical Analysis

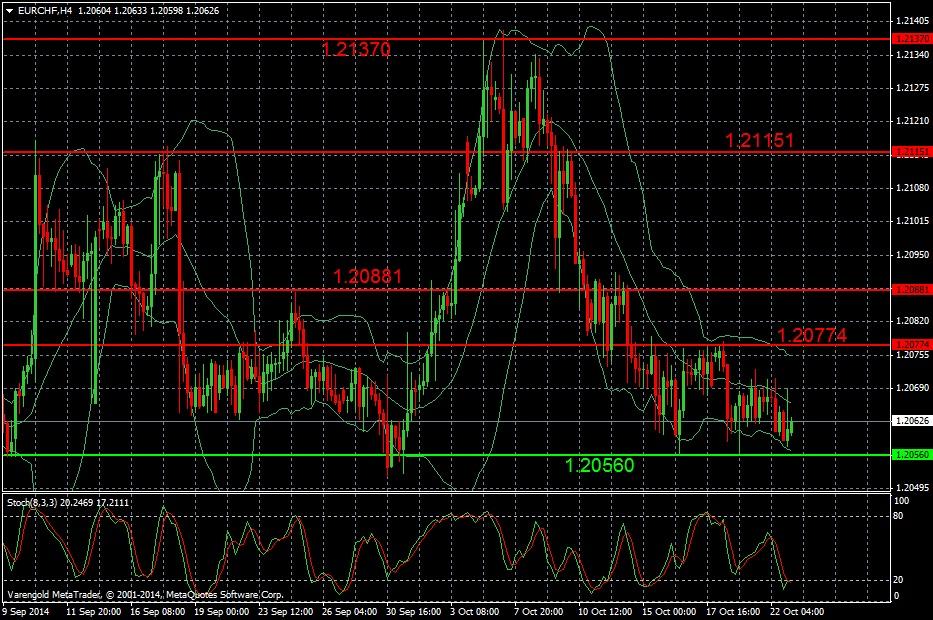

EUR/CHF (4 Hours)

The EUR/CHF dropped from a two month high around 1.2137 to the support level around 1.2056. Since then it is in a sideways trend and rebounded several times at the strong resistance level around 1.2077. Currently it is at the lowest Bollinger band and we might expect another attempt to cross the upper hurdle while the Stoachastic shows signs of a bullish movement.

Support & Resistance (4 Hours)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.