Good morning from a sunny Hamburg and welcome to our second-last Daily FX Report for this week. On Wednesday President Barack Obama said that they plan to fight Islamic State until it is no longer a force in the Middle East and will seek justice for the killing of Americans. He added that destroying the militant group will take time because of the power vacuum in Syria. Beyond that, President Putin outlined plans for a ceasefire in eastern Ukraine but Ukraine’sprime minister dismissed the proposal.

Anyway, we wish you a great trading day!

Market Review – Fundamental Perspective

Yesterday the Dow Jones Index of shares climbed 0.1 percent and the Standard & Poor’s Index weakened 0.1 percent. Also as expected the Bank of Canada left interest rates unchanged at 1 percent after data showed a jump in exports. Officials said that foreign trade must be sustained to trigger broader economic growth. The USD/CAD tumbled the most in a week to 1.0871 before gaining to 1.0888.

A report yesterday showed that new orders for U.S. factory goods posted a record advance in July and therefore offering further signals that the U.S. economy is gaining momentum. Orders for manufactured goods inceased 10.5 percent on robust demand for aircraft and cars, compared to a 1.5 percent gain in June. In addition the MBA mortgage applications advanced 0.2 percent in the past month. In addition data yesterday showed that retail sales in the euro zone weakened more than estimated to 0.8 percent in July. Economists forecasted that today data will show a pickup in U.S. employment, supporting the bets the Federal Reserve will increase interest rates. A report by ADP Research Institute might probably show today that U.S. payrolls rose last month by more than 200,000 for a seventh-straight month. Moreover reports might show today expansion in service industries. The EUR/USD traded at 1.3150 and the EUR bought 137.88 JPY. The USD/JPY was 0.5 percent from its strongest level in almost eight months at 104.90. The European Central Bank faces intense market pressure to take policy action today and risks losing credibility if it does not succeed to back up a dovish message delivered by Mario Draghi. The Bank of England will also today announce its interest rate decision and the market estimated that it will be left unchanged at 0.5 percent.

Daily Technical Analysis

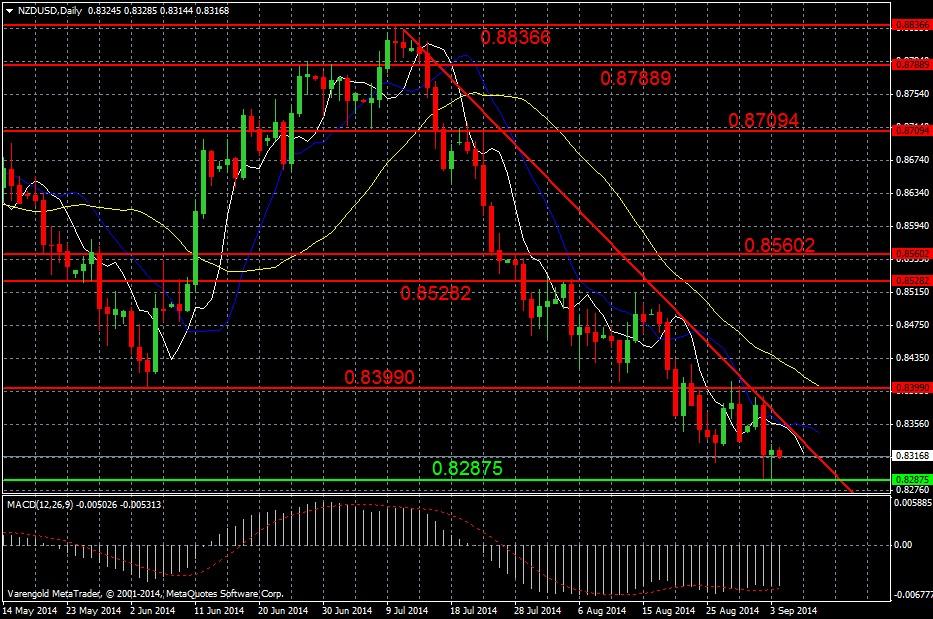

NZD/USD (Daily)

Since the 11th of July the NZD/USD decreased along a long term bearish trend line and touched a six month low around 0.8287. We might expect a continuation of the current trend while the moving average and the MACD still support the bears.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.