Good morning from cloudy and cold Hamburg and welcome to our Daily FX Report. Dozens of people, including women and children, were killed fleeing fighting in eastern Ukraine on Monday when their convoy of buses was hit by rocket fire. Ukraine accused pro-Russian rebels of targeting the convoy but the separatist denied responsibility for the attack. Meanwhile the resolution of the circumstances behind the attack may take some more time, it has certainly hardened the situation between both parties and brings in more fuel into the conflict.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

Caused by signs of economic recovery which supported the case for the Fed to normalize policy, the USD held gains versus its major peers on Monday. As a result, the Bloomberg Dollar Spot Index rebounded from a two-week low before the Labor Department releases consumer price-data today and as Federal Reserve Chair Janet Yellen and central bankers prepare to meet at an annual conference. In contrast to the USD, the EUR experienced the biggest loss in almost two weeks before a report this week is expected to show that manufacturing activity in the region cslowed and amid speculation the European Central Bank will expand monetary stimulus.

After Bank of England Governor Mark Carney said that a recovery in wages may prompt policy makers to increase interest rates, the GBP climbed from near a four-month low versus the USD and gained 0.2 percent to reach $1.6727 per GBP. The GBP also strengthened against the EUR and appreciated 0.5 percent to 79.90 pence per EUR. Overall, the GBP has appreciated 8.1 percent in the past year and was the best performer among the 10 developed-nation currencies tracked by Bloomberg Correlation-Weighted Indexes. The same data reveals that the EUR gained 0.6 percent and the USD rose 0.3 percent.

After producer output prices in New Zealand fell by 0.5 percent in the second quarter of this year, the NZD dropped and depreciated by 0.2 percent versus the USD to 84.58 U.S. cents. The AUD is also expected to depreciate in the near future after the RBA cut its projections for the economy. It now predicts a more moderate growth in gross domestic product and a higher inflation. Yesterday, the CBA, one of the biggest banks in Australia, cut its year-end forecast for the AUD to 94 U.S. cents. The change in sentiment is clearly demonstrating the problems Australia’s economy is currently experiencing.

Daily Technical Analysis

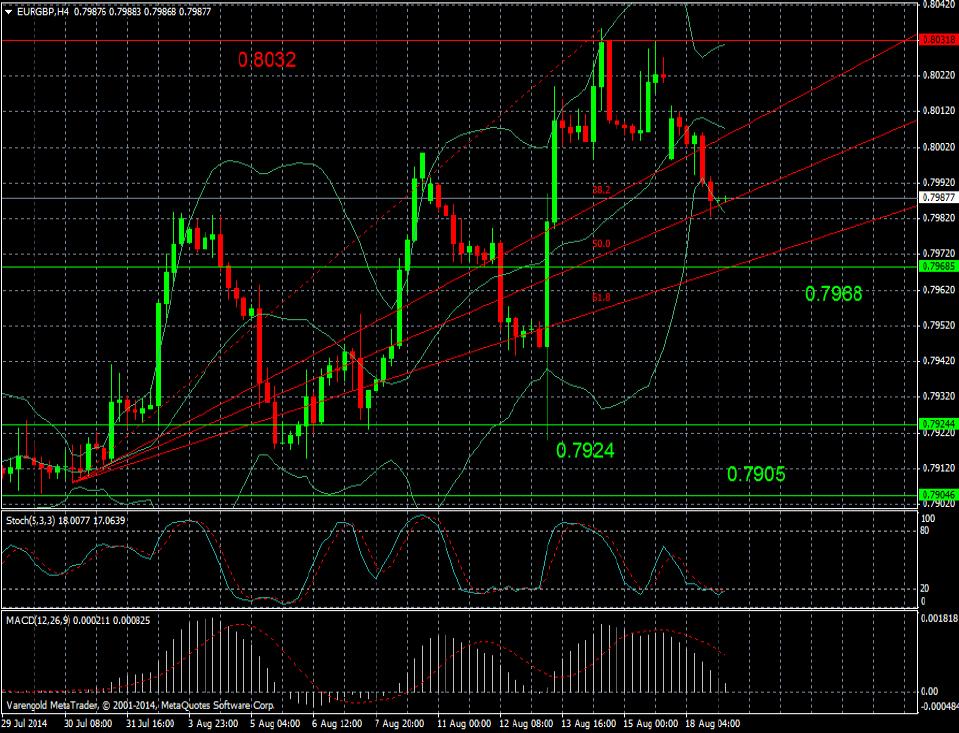

EUR/GBP (4 Hours)

Since the end of July 2014 the currency pair experienced an upward movement among the Fibonacci Fan till it reached the resistance level at 0.8032 GBP per EUR. At the moment, we see a slightly decline which may end when the support level at 0.7968 is reached. In the long run, a further upward movement seems to be likely.

Support & Resistance (4 Hours)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.