Good morning from a sunny Hamburg and welcome to our first Daily FX Report for this week. Recep Tayyip Erdogan, the prime minister of Turkey, has won the country’s first direct presidential election in the first round after taking more than 50 percent of the votes, according to the Turkey’s election board. This marks a continuation of Erdogan’s more than 10-year rule over the country and the vote itself has been seen as a milestone in Turkish politics since popular vote have been used for the first time in the country’s history.

Anyway, we wish you a successful trading week!

Market Review – Fundamental Perspective

International markets have been under pressure as crisis have emerged last months. Especially the Ukraine civil crisis which has led to a diplomatic conflict between Western countries (E.U. and U.S.A.) and Russia, the war between Israel and Palestina, the rise of the I.S.I.S in Irak and the decision of Barack Obama to enter this military conflict have sprayed uncertainty all over the financial markets.

In fact those crisis also have a direct effect besides increasing skepticism. The DAX has fallen more than 10 percent from its July record high, the inflation level in the euro zone dropped to 0.4 percent and the European Central Banks President Mario Draghi has already cautioned against the further potential effects of this tensions.

Furthermore the yen has fallen against most of its peers as concerns about the tension in Ukraine continued. The USD/JPY fell 0.1 percent to 102.11 per dollar and the EUR/JPY reached 136.81 which market a slight decrease.

The Turkish lira gain 0.1 percent to 2.1438 against the US dollar. Nevertheless according to the official Bloomberg analysis, in the past year, it’s the fourth-worst performer among major currencies, depreciating about 10 percent.

Finally the euro has fallen against most of its counterparties. Because of strong sceptisicsm on the ability of the euro zone to overcome economical as well as political issues. The EUR/NZD has fallen 0.143 percent to 1.5824 and the EUR/AUD has fallen 0.146 percent to 1.4437.

Daily Technical Analysis

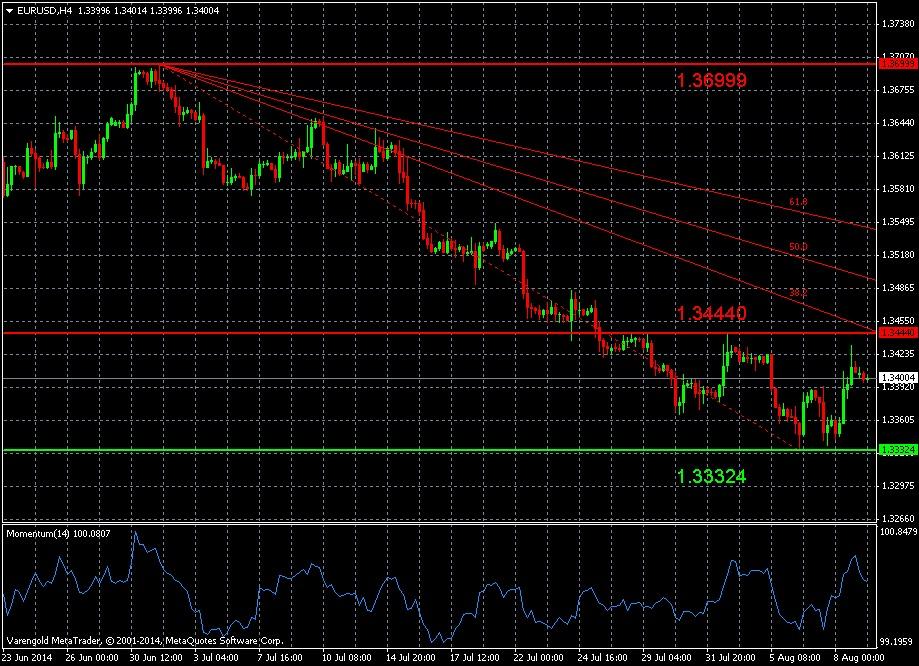

EUR/USD (4 Hours)

After reaching the first resistance line at 1.3699 this pair seems to have entered a bearish trend along the Fibonacci-Fan. Eventhough it was able to cross the first Fibonacci line and to reach the second one, the bearish movement seems to have continued and might go on further. The Momentum might support this hypothese and crossing the support level at 1.33324 could be a signal that this trend persists.

Support & Resistance (4 Hours)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.