Good morning from beautiful Hamburg and welcome to our last Daily FX Report for this week. U.S. jobless claims hit more than eight-year low and declined by 19,000 to a seasonally adjusted 284,000 for the week ended July 19. It is the lowest level since February 2006. Economist had expected claims to rise to 308,000. In a separate report, new home sales dropped 8.1 percent to a seasonally adjusted annual rate of 406,000 units in June. It was the biggest decrease in new home sales since July of last year. Economist said the Fed will look at the claims data favorably as it considers when to raise interest rates.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

The USD continues its upward trend and yesterday the Dollar Spot Index, which tracks the currency against 10 major counterparts climbed to its highest in a month. According to the Bloomberg Correlation-Weighted Indexes the dollar has gained 0.8 percent in the past month. The JPY climbed 0.9 percent and the GBP appreciated by 0.8 percent.The USD is now traded at 101.82 yen and was headed for a 0.4 percent weekly gain. It was little changed against the EUR after having risen 0.4 percent since July 18. After a report showed Japan`s core inflation slowed from the strongest level since 1982, the JPY depreciated. Japane`s consumer prices rose 3.3 percent in June from a year earlier. The GBP was set for a third straight week of losses after a report showed that retail sales rose by less than economists had predicted. The GBP was little changed at $1.6990. However it dropped by 0.6 percent since July 18.Gross dometic data is due today and may cause a reversal.

Since 2009 the AUD experienced gains which may come to end as soon as the central bank is willing to maintan its record-low benchmark interest rate. Alone, this year the AUD has risen more than 6 percent according to the Bloomberg Correlation-Weighted Indexes and was by far the best performer. Speculators assume that when the AUD falls below 93 U.S. cents, then it may depreciate even by further 2.4 percent to reach a four-month low of 90.78. The NZD tumbled the most in 11 months on Thursday after Wheeler said in his policy statement that he will postpone an increase in interest rates and that the appreciation of the NZD is “unjustified”. Due to a statistic of Bloomberg, the currency was the best performer among 31 peers over the the last five years. Now traders are anticipating a change in course.

Daily Technical Analysis

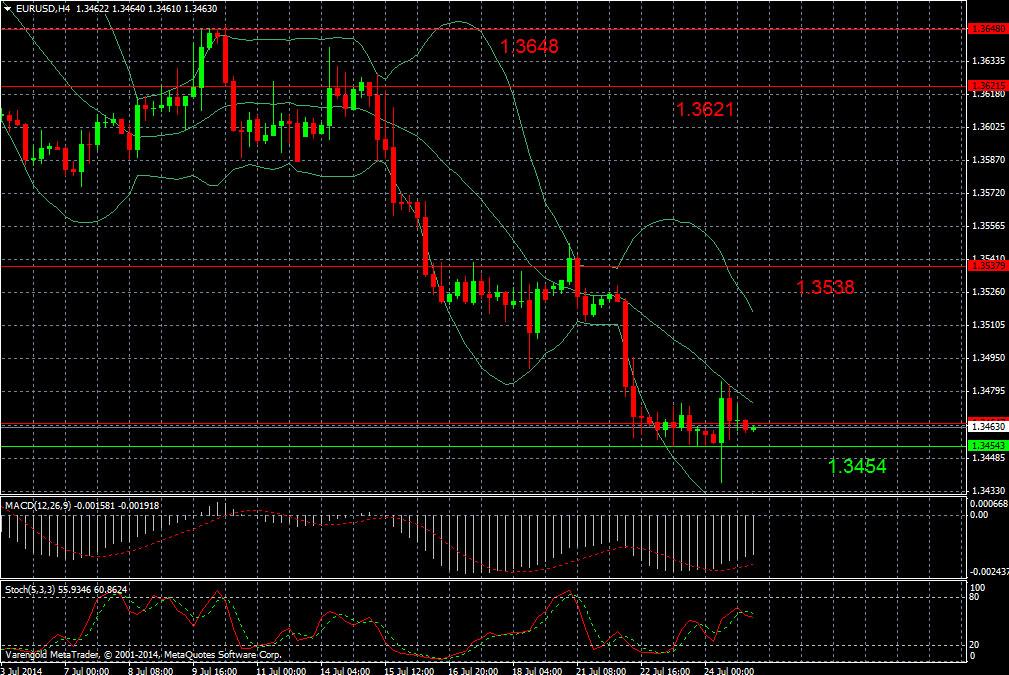

EUR/USD (4 Hours)

On Monday this week we were talking about the bearish trend of the currency pair and assumed that further losses may be likely in the near future. The chart of today shows that the EUR further lost in value against the USD and declined to the support level at 1.3454. Now we see a sideward movement and it remains to be seen whether the support level at 1.3454 will be strong enough to prevent the pair from more losses.

Support & Resistance (4 Hours)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.