Good morning from a sunny Hamburg and welcome to our first Daily FX Report for this week. As the stalemate in Crimea continues, the biggest story of the weekend is of the crash Malaysian Airlines flight MH370 and the ensuing search for the remains of the aircraft. Speculation is mounting to what exactly occurred but until parts of the wreckage is found, there will be more questions than answers. The search is currently being conducted near the southern tip of Vietnam by more than 20 aircraft and 40 ships from seven different countries.

Nevertheless, we wish you a successful trading week!

Market Review – Fundamental Perspective

As the news in Crimea takes centre stage, markets around the world have started the week with a lot of caution. This combined with a drop in Chinese exports has led to the yen having a strong start to the week. The Japanese currency rose against all of its 16 biggest trading pairs with a twoday meeting of the Bank of Japan beginning overnight. The yen increased 0.2 percent against the US dollar to 103.09 and gained 0.1 percent against the euro to 143.16. The safehaven currency could receive more support dependent upon the general risk sentiment and any change in policy from the BoJ which is due tonight European time. The Australian dollar lead the weakness against the yen as it tumbled 0.5 percent to 93.20 versus the Japanese currency.

Shares in Asia were weak overnight as the MSCI Asia Pacific Index fell 1 percent. This move is in line with concerns by the market as tensions rise in Crimea. Pro-Russian forces have crept further into the region of Ukraine as the war of words between the Russian President Vladimir Putin, German Chancellor Angela Merkel and American President Barack Obama is beginning to heat up. Interestingly, Bloomberg reports that hedge funds are actually increasing their predictions in the euro against the dollar as the number of players who are long reached it’s highest level since December last week.

The biggest news for the Eurozone last week was industrial production which picked up 0.5 percent in January and Mario Draghi’s press conference after the ECB’s rate decision late last week. The President of the ECB raised expectations for Europe’s growth and also reported his belief that deflation risks are easing in the Eurozone. In fact, inflation is predicted to return to the ECB’s target range by the end of 2016.

Daily Technical Analysis

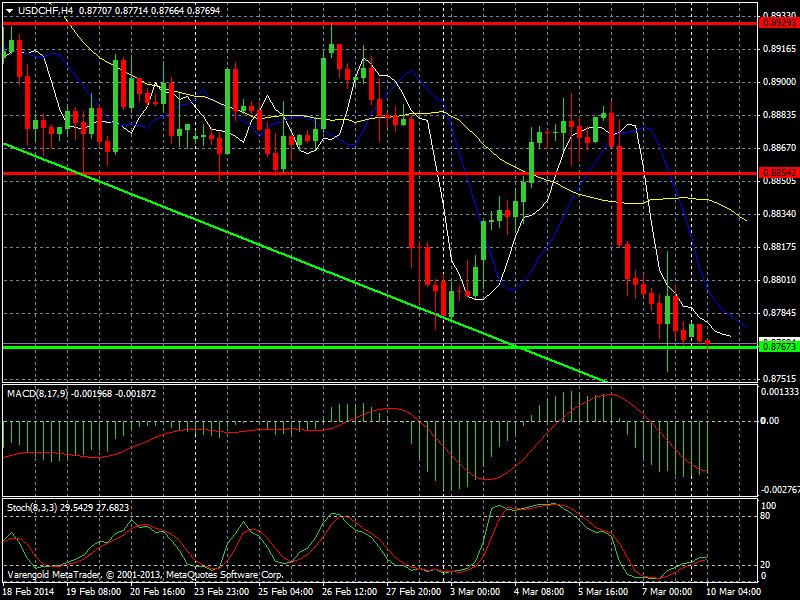

USD/CHF (4 Hours)

As can be seen in the chart below, the USD has been strong against the Swiss franc for the last few weeks. After spending two weeks in a range between 0.8854 and 0.8929, the pair took two attempts to make a break of the resistance level of that range. As the trendline shows, there is still more room for the franc to depreciate against the US dollar but the important factor here will be the reaction to the latest jobs data in the US and the escalating crisis in Ukraine.

Support & Resistance (4 Hours)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.