EUR/USD Current Price: 1.1374

View Live Chart for the EUR/USD

The EUR/USD pair trades slightly lower this Tuesday, having been unable to rally beyond the 1.1400 level ever since the week started. Nevertheless, the downside remains limited, in spite of the ongoing risk aversion sentiment, as the pair stands pretty much unchanged from its weekly opening. Data coming from Europe showed that March final Services PMI missed expectations, reflecting a sluggish growth in the sector during the first quarter of this 2016. Ahead of the release of US PMI non-manufacturing figures, the 1 hour chart for the pair shows that the price is below its 20 and 100 SMAs, whilst the technical indicators have bounced partially from oversold levels, but remain below their mid-lines, indicating no actual bullish strength. In the 4 hours chart, the pair is also developing below a now flat 20 SMA, whilst the Momentum indicator heads south below the 100 level, and the RSI hovers around 53, lacking clear directional strength. The pair will likely remain range bound ahead of upcoming ECB and FED's events on Wednesday and Thursday, with the downward potential remaining limited as long as the price remains above the 1.1280 immediate support.

Support levels: 1.1330 1.1280 1.1245

Resistance levels: 1.1410 1.1460 1.1500

GBP/USD Current price: 1.4179

View Live Chart for the GBP/USD

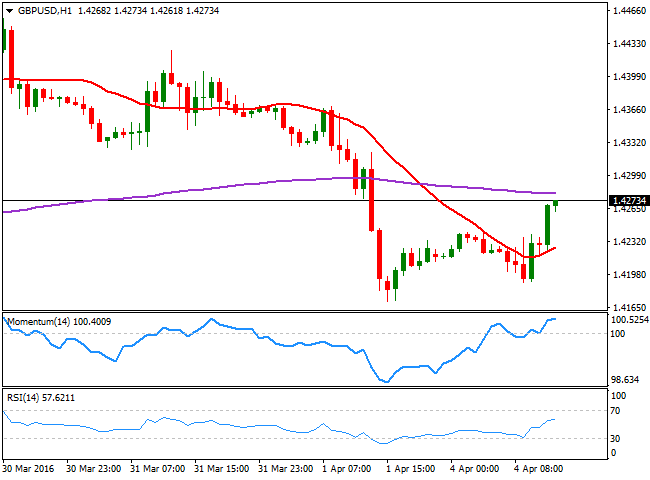

The GBP/USD pair extended its decline this Tuesday, and pressures 1.4170, Friday's low and the immediate support. The Sterling came under pressure after the release of the UK Services PMI for March, which resulted at 53.7, below the 54.0 expected, although above the previous 52.7. Also, weighing on Pound are lower oil prices, as the commodity returned to $ 35.00 a barrel on news an output freeze seems less likely. Technically, the 1 hour chart presents a strong bearish tone, as the technical indicators keep heading south, despite being near oversold readings, whilst the 20 SMA has turned south above the current level. In the 4 hours chart, the 20 SMA is crossing below the 200 EMA n the 1.4270 region, while the RSI indicator maintains its bearish slope well below its mid-line, supporting some additional declines for the upcoming hours.

Support levels: 1.4170 1.4140 1.4100

Resistance levels: 1.4220 1.4270 1.4315

USD/JPY Current price: 110.59

View Live Chart for the USD/JPY

Downward potential increases. The Japanese yen appreciated further during the past Asian session as local share markets plummeted, fueling demand for safe-haven assets. The USD/JPY fell down to 110.25, a level not seen since October 2014, and the following bounce was unable to reach the 111.00 figure, despite the BOJ offered its usual jawboning: chief cabinet secretary Suga said that authorities are watching FX movements with a "sense of urgency." The pair has corrected extreme oversold readings, but maintains a strong bearish tone, both short and long term, indicating a strong possibility of a break below 110.00, which may fuel the decline, despite the BOJ. The 1 hour chart shows that the price is well below its 100 and 200 SMAs, while the technical indicators have turned lower within bearish territory after correcting extreme oversold readings. In the 4 hours chart, the technical indicators have recovered partially within oversold territory, but with the price around its lows and far below its moving averages, the risk remains towards the downside.

Support levels: 110.25 109.90 109.50

Resistance levels: 110.70 111.20 111.60

AUD/USD Current price: 0.7538

View Live Chart for the AUD/USD

The AUD/USD pair fell to its lowest for the week on a worried RBA, as the Australian Central Bank expressed concerns over the strength of the Aussie. The pair seems to be finally poised to correct lower, particularly on a break below the 0.7500 figure, although the self strength of the Australian economy and the broad dollar's weakness suggests that the decline won't be as extended as the RBA pretends. Technically and for the short term, the 1 hour chart shows that the price remains near its daily low and well below a strongly bearish 20 SMA, whilst the technical indicators have turned flat within oversold territory. In the 4 hours chart, the price is well below a bearish 20 SMA, while the technical indicators have also lost downward potential, but remains near oversold territory with no signs of changing bias, maintaining the risk towards the downside.

Support levels: 0.7500 0.7460 0.7425

Resistance levels: 0.7540 0.7575 0.7620

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

How will US Dollar react to April jobs report? – LIVE

Following the Fed's policy announcements, market focus shifts to the April jobs report from the US. Nonfarm Payrolls are forecast to rise 238K. Investors will also pay close attention to revisions and wage inflation figures.

EUR/USD clings to gains near 1.0750 ahead of US jobs report

EUR/USD clings to modest gains at around 1.0750 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.