EUR/USD Current price: 1.0751

View Live Chart for the EUR/USD

The EUR/USD pair trades at its lowest since December 3rd, with the dollar broadly higher and the common currency being hit by softer-than-expected EU inflation figures. Following poor German inflation on Monday, the euro area annual inflation in December 2015 is estimated to have been of 0.2% below expectations of an advance up to 0.3%, while the core reading retreated to 0.8% from the previous 0.9%. The pair fell further with the news, and points to extend its decline during the upcoming American session, given that the price has been unable to bounce in its way south. The 1 hour chart shows that the price has extended below a bearish 20 SMA, currently around 1.0810, while the technical indicators are losing their bearish strength in oversold territory, rather reflecting the ongoing short term consolidation than suggesting an upward move. In the 4 hours chart, is clear that the price is below the 50% retracement of the December rally, whilst the technical indicators are hovering near oversold readings, and the price develops below a bearish 20 SMA, all of which favors a downward continuation.

Support levels: 1.0720 1.0685 1.0660

Resistance levels: 1.0780 1.0810 1.0845

GBP/USD Current price: 1.4678

View Live Chart for the GBP/USD

The GBP/USD pair established yet a fresh 8-month low at 1.4660 this Tuesday, under pressure despite the UK December construction PMI resulted above expected, printing 57.8 against the previous 55.3. The pair maintains the bearish tone seen on previous updates, and will likely continue sliding as in the 1 hour chart, the price develops below a bearish 20 SMA, whilst the technical indicators head lower well below their mid-lines, following a limited upward corrective move. In the 4 hours chart, the price remains well below a bearish 20 SMA, although the technical indicators lack bearish strength near oversold territory, pointing fo r a consolidative stage, before the next directional move.

Support levels: 1.4660 1.4620 1.4585

Resistance levels: 14725 1.4755 1.4790

USD/JPY Current price: 119.02

View Live Chart for the USD/JPY

Yen holds to its strength. The USD/JPY pair recovered some ground during the Asian session, but selling interest capped the rally in the 119.60 region, keeping the short term bearish trend firm in place. The recovery was supported by easing risk aversion, yet the Japanese yen refuses to give back the ground gained earlier this week. Technically, the 1 hour chart shows that the technical indicators remain biased south below their mid-lines, whilst the price is declining well below its 100 and 200 SMAs, both sharply bearish. In the 4 hours chart, the technical bias is also towards the downside yet a break below 118.70 is required to confirm a new leg lower towards the 118.00 region.

Support levels: 118.70 118.35 118.00

Resistance levels: 119.20 119.60 120.00

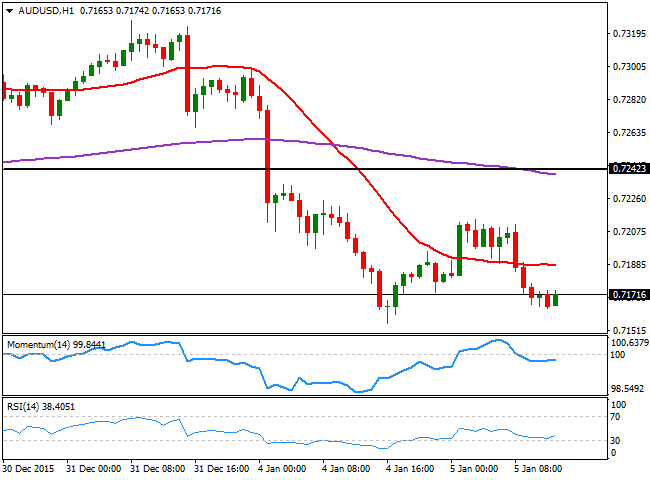

AUD/USD Current price: 0.7171

View Live Chart for the AUD/USD

The Australian dollar advanced against its rivals during the Asian session, reaching 0.7214 against the greenback before turning back south early Europe, on broad dollar's strength. Despite holding above the weekly low, the rejection from the 0.7200 figure indicates an increasing bearish potential, and the 1 hour chart shows that the price is below a flat 20 SMA, whilst the technical indicators have turned horizontal within negative territory. In the 4 hours chart, the bearish tone is even clearer, given that the technical indicators have resumed their declines after a limited upward corrective move, whilst the 20 SMA has turned sharply lower above the current level, now reinforcing the static resistance level at 0.7240.

Support levels: 0.7160 07130 0.7100

Resistance levels: 0.7205 0.7240 0.7280

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.