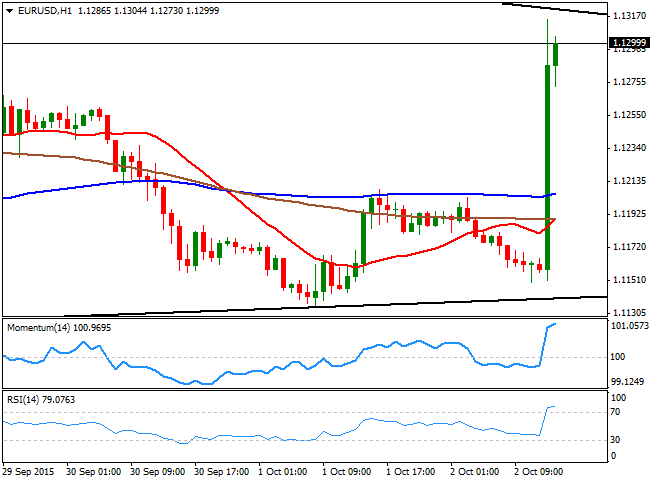

EUR/USD Current price: 1.1299

View Live Chart for the EUR/USD

The dollar was firmer ahead of the US jobs report, but plummeted afterwards, with a much worse-than-expected Nonfarm Payroll report. The US economy added just 142,000 new jobs in September, far below the 203,000 expected and the weakest in over a year. The unemployment rate remained steady at 5.1%, but wages were also a huge disappointment, flat at 0.0%. Markets are dumping their dollar holdings, with the US 10y note higher, and yields down below 2.0% in over a month.

The EUR/USD pair advanced up to 1.1315, and consolidates nearby early in the US session, having approached a daily descendant trend line coming from 1.1713, August high. The 1 hour chart shows that the pair has advanced over 150 pips, accelerating through its moving averages, and with the technical indicators losing their strength in extreme overbought levels. Nevertheless, the pair holds to its highs, suggesting further gains ahead, particularly on a break above the 1.1330 price zone, the immediate short term resistance. In the 4 hours chart, the technical indicators present a strong upward momentum in positive territory, supporting the shorter term view.

Support levels: 1.1270 1.1240 1.1200

Resistance levels: 1.1335 1.1370 1.1410

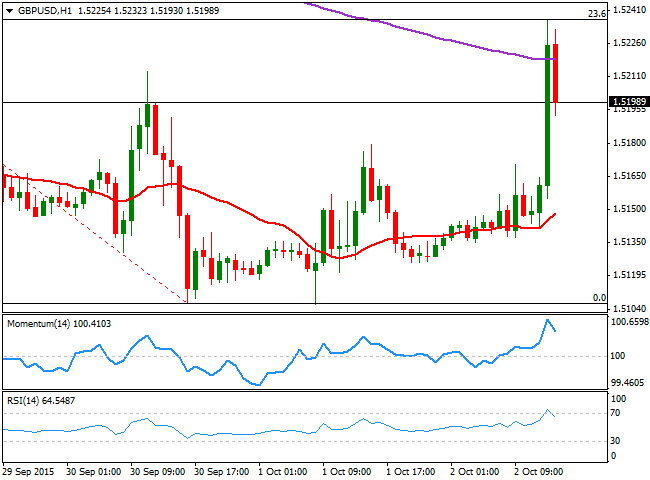

GBP/USD Current price: 1.5198

View Live Chart for the GPB/USD

The GBP/USD pair surged up to 1.5236, reaching the 23.6% retracement of its latest weekly decline before stalling. Despite the ongoing dollar weakness, the pair is struggling to hold above the 1.5200 level, and the 1 hour chart shows that the technical indicators are retreating from overbought levels, whilst the price is well above a mild bullish 20 SMA. In the 4 hours chart, the technical picture is mild positive, with the price above its 20 SMA and the technical indicators aiming higher around their mid-lines, far from confirming an upward continuation as long as the mentioned high holds.

Support levels: 1.5160 1.5125 1.5090

Resistance levels: 1.5235 1.5280 1.5320

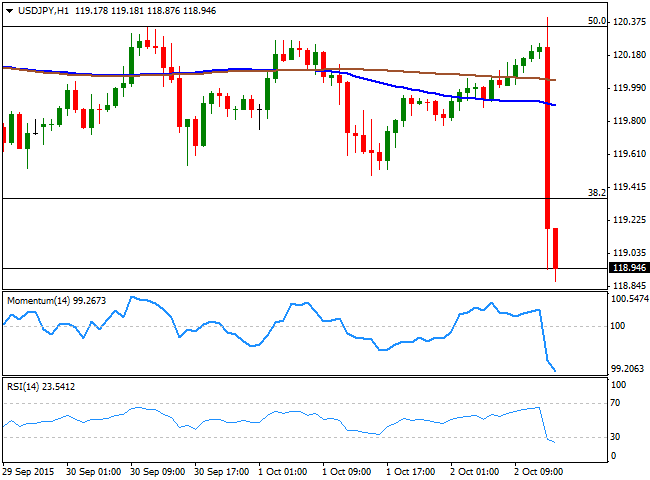

USD/JPY Current price: 118.95

View Live Chart for the USD/JPY

Breaking through 119.00. The worse-than-expected US employment data has sent the pair down to a low of 118.87, level not seen since early September. Trading nearby at the beginning of the US session, the pair is aiming to test the lowest of its latest range at 118.56, with a daily close below it opening doors for a continued decline towards the 116.00 region, the low set in August. Short term, the 1 hour chart shows that the technical indicators are losing their bearish strength in extreme oversold readings, whilst the price has plunged below its 100 and 200 SMAs, maintaining however, the risk towards the downside. In the 4 hours chart, the technical indicators turned south from their mid-lines, and stand at their lowest in over two weeks, supporting the shorter term view. The immediate resistance is now the 38.2% retracement of its latest weekly decline at 119.35, and as long as below it, the downward potential will remain intact, with scope to extend its bearish movement down to the 118.00 level later on in the day.

Support levels: 118.55 118.30 117.90

Resistance levels: 119.35 119.70 120.10

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.