EUR/USD Current price: 1.0920

View Live Chart for the EUR/USD

The dollar remains on demand after solid US data reinforced the idea that a rate hike is around the corner. The Advanced GDP figures for the second quarter of 2015 resulted slightly below expected, but much better than the previous, printing 2.3%. The first quarter number was revised to the upside from -0.2% to 0.6%, whilst unemployment claims came out at 267K, against expectations of 270K. The EUR/USD pair break to fresh daily lows after the US opening, an approaches the 1.0900 level, with the 1 hour chart showing that the price is now below all of its moving averages, and that the technical indicators have turned south deep in the red, entering oversold territory. In the 4 hours chart, the technical indicators have resumed their decline near oversold levels, supporting a continued decline towards the lows in the 1.0800/20 region for the upcoming sessions.

Support levels: 1.0880 1.0850 1.0810

Resistance levels: 1.0960 1.1010 1.1050

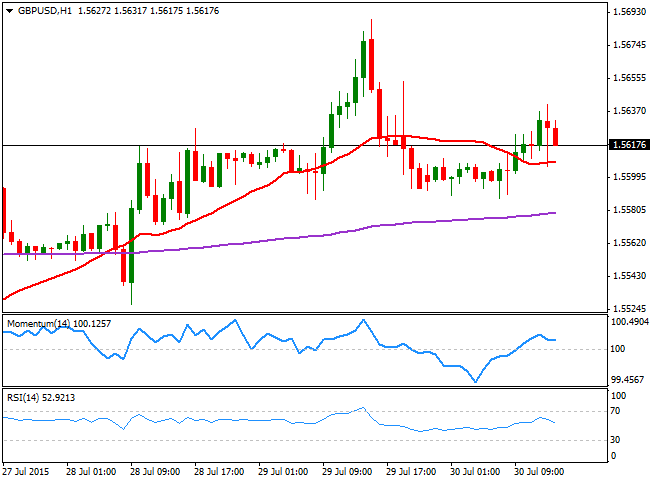

GBP/USD Current price: 1.5620

View Live Chart for the GPB/USD

The GBP/USD pair holds above the 1.5600 level, with the Pound refusing to give up to broad dollar's strength. Despite there were no fundamental releases in the UK, the pair has been maintaining its latest positive tone, albeit the bearish potential increases in the US session, as the 1 hour chart shows that the price is approaching a horizontal 20 SMA, whilst the technical indicators have turned south above their mid-lines. In the 4 hours chart, however, the price holds above a bullish 20 SMA, whilst the technical indicators lack directional strength above their mid-lines, limiting chances of a stronger decline, as long as buyers continue surging around 1.5580/90.

Support levels: 1.5580 1.5545 1.5500

Resistance levels: 1.5635 1.5670 1.5730

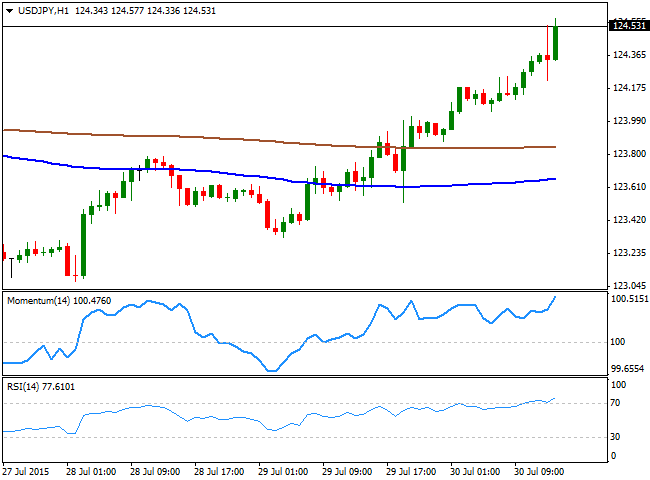

USD/JPY Current price: 124.63

View Live Chart for the USD/JPY

Fresh highs, scope to test 125.00. The USD/JPY pair trades at levels not seen since mid June, struggling however to extend its gains. The pair printed a high of 124.57 so far in the day, and maintains a strong positive short term tone, as the 1 hour chart shows that the technical indicators continue to head strongly higher despite being in overbought territory, whilst the price has extended far above its moving averages. In the 4 hours chart, the 100 SMA posts a mild advance above the 200 SMA, whilst the technical indicators are losing their upward strength well in positive territory, signaling some temporal exhaustion. Nevertheless, as long as the pair holds above 124.00, the upside remains favored, with scope to extend up to 125.00 on a break above the mentioned daily high.

Support levels: 124.10 123.70 123.30

Resistance levels: 124.60 125.00 125.30

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.