EUR/USD Current price: 1.1024

View Live Chart for the EUR/USD

The EUR/USD pair sunk to a daily low of 1.1021, and trades a few pips above the level ahead of the US opening, after breaking through the 1.1050 level. The common currency has retreated from the high set at 1.1126 on Monday, trading back inside a daily descendant channel coming from June high of 1.1435. There was no catalyst behind the latest slide, albeit quieter stocks in Asia and a mild recovery in European share markets may be helping the greenback to recover against the EUR and the JPY. Later on in the day, the US will release its consumer confidence data for July, and the Markit PMIs, which may set the tone for the rest of the day, albeit the intraday range is expected to shrink as the day goes by, ahead of FED's economic policy statement on Wednesday.

The 1 hour chart shows that the 20 SMA has turned south above the current level, now converging with the roof of the channel, whilst the technical indicators are approaching oversold levels. In the same chart, the 100 SMA stands around 1.0990, providing the next intraday support. In the 4 hours chart, however, the price remains above its 20 SMA whilst the Momentum indicator heads higher above the 100 level and the RSI indicator hovers around 54, all of which limits the downside at the time being.

Support levels: 1.0990 1.0950 1.0920

Resistance levels: 1.1080 1.1125 1.1160

GBP/USD Current price: 1.5581

View Live Chart for the GPB/USD

The British Pound advanced against the greenback up to 1.5617, getting a boost from the UK Q2 GDP readings, in line with expectations and showing that the economy grew 0.7% during the past three months. The pair however, was unable to sustain gains beyond the 1.5600 level, and retreated some, but maintaining a positive intraday tone. Technically, the 1 hour chart shows that the price is now above a mild bullish 20 SMA, whilst the technical indicators are recovering their upward slopes above their mid-lines, keeping the risk towards the upside. In the 4 hours chart, the price is above its moving averages that anyway are far from supporting additional advances, whilst the technical indicators have lost their upward strength, but hold above their mid-lines. A mild positive tone prevails, albeit the pair needs now to extend beyond the mentioned daily high, to confirm additional advances towards the 1.5650/70 region.

Support levels: 1.5545 1.5500 1.5460

Resistance levels: 1.5590 1.5620 1.5660

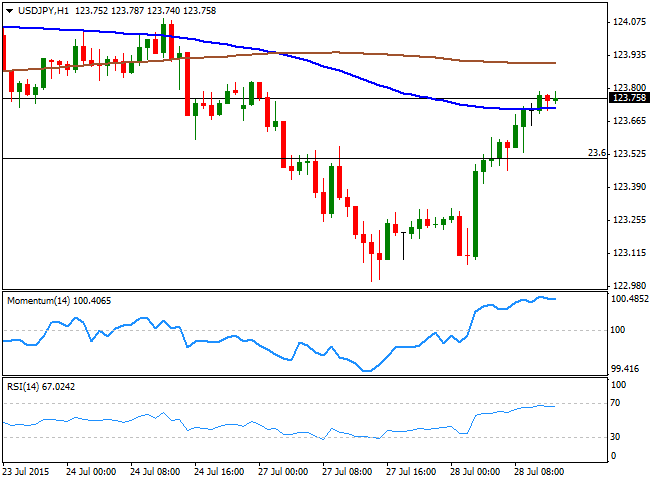

USD/JPY Current price: 123.74

View Live Chart for the USD/JPY

Up to 124.45 with strong US data. The USD/JPY pair recovered most of the ground lost this week, with the Japanese Yen weakening as local share markets stabilized following Monday's sell-off. Also, European equities are trading higher whilst pre-opening, US indexes are in the green. Trading above 123.70, the USD/JPY 1 hour chat shows that the price is now finding short term support around its 100 SMA, while the technical indicators are losing their upward strength in overbought levels. In the 4 hours chart, the technical indicators have turned flat around their mid-lines, rather reflecting the ongoing range than suggesting the pair has lost its upward potential. Upcoming movements will likely be dependent on US data, with up beating manufacturing and confidence readings favoring a rally towards the 124.20 price zone. Further gains however, seem unlikely, as sellers have been surging on spikes towards the 124.00/40 region since late May. Worse-than-expected US data on the other hand, can send the pair down to 123.30, where intraday buyers should halt the slide.

Support levels: 123.30 122.90 122.40

Resistance levels: 124.20 124.45 124.90

AUD/USD Current price: 0.7307

View Live Chart for the AUD/USD

The AUD/USD pair trades higher in range, having been as high as 0.7326 during the Asian session. The 1 hour chart for the pair presents a mild positive tone, as the price develops above its 20 SMA, whilst the technical indicators are turning lower, but above their mid-lines. In the 4 hours chart, the price hovers around a bearish 20 SMA whilst the technical indicators present a neutral-to-bearish stance, favoring a retest of the daily low set around 0.7260.

Support levels: 0.7260 0.7225 0.7185

Resistance levels: 0.7325 0.7350 0.7390

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.