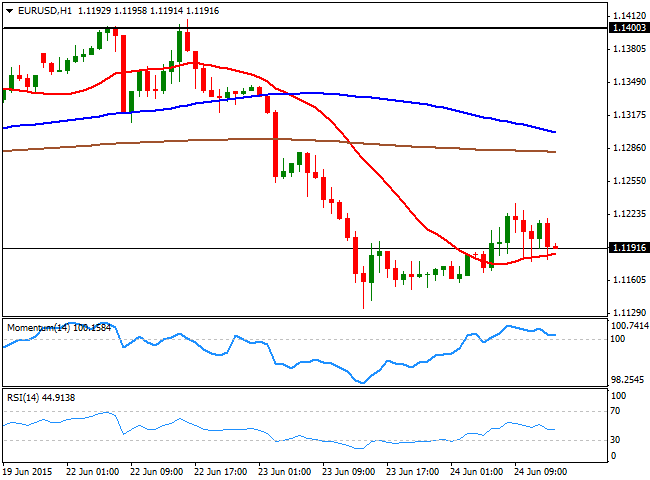

EUR/USD Current price: 1.1191

View Live Chart for the EUR/USD

The EUR/USD pair has broke lower on news Greece and its creditors have failed to reach an agreement, for the umpteenth time. The optimism built up these week crashed, with stocks down in the red in Europe and America, and the greenback firming up across the board. In the US, the latest revision of the first quarter GDP came as expected at -0.2%, signaling the economy actually contracted, although better-than-expected consumer spending within the GDP report saved the day. The EUR/USD pair is pressuring the 1.1180 support level, with the 1 hour chart showing that the price is holding a few pips above a mild bullish 20 SMA, whilst the technical indicators have turned lower above their mid-lines. In the 4 hours chart however, the bias is bearish, as the technical indicators have resumed their declines near oversold territory, whilst the 20 SMA maintains a strong bearish slope above the current price.

Support levels: 1.1160 1.1120 1.1050

Resistance levels: 1.1200 1.1245 1.1290

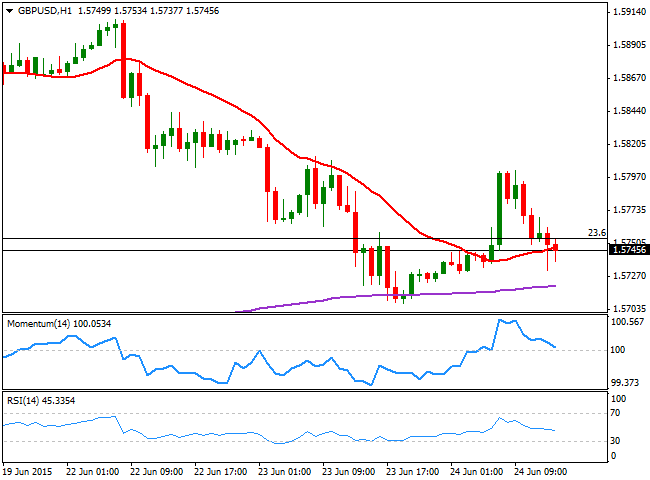

GBP/USD Current price: 1.5745

View Live Chart for the GBP/USD

The GBP/USD pair trades near its daily lows after failing to recover the 1.5800 level earlier in the day. The data coming from the UK resulted slightly positive, as mortgage approvals rose, albeit below expected. Nevertheless, the pair came under pressure after Grexit talks resumed, and the 1 hour chart shows that the price stands a few pips below the 23.6% retracement of the latest bullish run at 1.5750, whilst the technical indicators are heading lower around their mid-lines, maintaining the risk towards the downside. In the 4 hours chart, the price has extended below its 20 SMA, whilst the technical indicators turned lower after a limited upward corrective in bearish territory, supporting a retest of the 1.5700 level, should the greenback continues to advance.

Support levels: 1.5700 1.5650 1.5620

Resistance levels: 1.5750 1.5790 1.5840

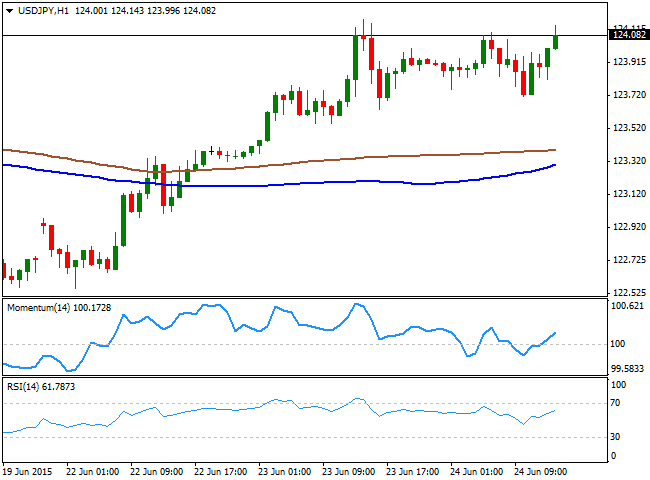

USD/JPY Current price: 124.08

View Live Chart for the USD/JPY

The USD/JPY pair advanced on dollar strength, struggling to hold above the 124.00 mark, and with a short term bullish tone, as the 1 hour chart shows that the price continues to advance above its moving averages, whilst the technical indicators head higher above their mid-lines. In the 4 hours chart, the technical indicators head higher near overbought territory, supporting additional advances. Nevertheless, sellers have been surging between the 124.10/45 level, and there's little room for additional advances beyond it this Wednesday.

Support levels: 123.70 123.30 122.90

Resistance levels: 124.10 124.45 124.90

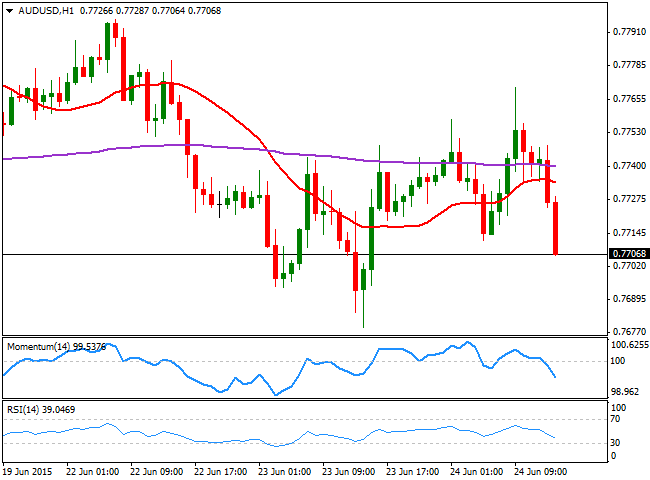

AUD/USD Current price: 0.7705

View Live Chart for the AUD/USD

The AUD/USD pair continues to trade range bound, although dollar strength is pushing the pair down to the 0.7700 level, where it stands ahead of the US opening bell. Technically, the 1 hour chart supports additional declines, with the price below its 20 SMA and the technical indicators heading lower into negative territory, whilst in the 4 hours chart the technical picture is still quite neutral. At this point, the pair needs to break below the 0.7680 level to confirm a downward continuation that can extend down to the 0.7600 figure during the upcoming sessions.

Support levels: 0.7680 0.7640 0.7600

Resistance levels: 0.7750 0.7785 0.7820

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.