EUR/USD Current price: 1.0887

View Live Chart for the EUR/USD

Following an upward extension up to 1.0947, the EUR/USD pair finally succumbed to dollar's strength, dropping down to 1.0880 ahead of the US opening. The lack of progress coming from Greece allegedly deal with its creditors underway announced yesterday, took its toll over the common currency. In the US, weekly unemployment claims resulted worse-than-expected, reaching 282K for the week ended May 22th, triggering a bounce in the pair back above the 1.0900 level, which was quickly erased. Technically, the 1 hour chart shows that the price is now moving back and forth around a flat 20 SMA, whilst the technical indicators are turning higher in neutral territory, lacking a clear directional strength. In the 4 hours chart, the price is unable to advance above a bearish 20 SMA, whilst the Momentum indicator heads higher around 100, but the RSI maintains its bearish tone around 41. Unless some encouraging news come from Greece, the upside will likely remain limited, with renewed selling interest below 1.0890 favoring a bearish continuation for today.

Support levels: 1.0850 1.0810 1.0770

Resistance levels: 1.0930 1.0960 1.1000

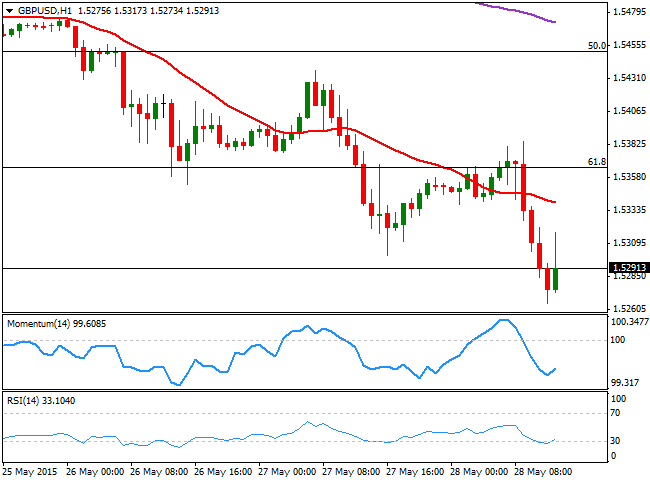

GBP/USD Current price: 1.5292

View Live Chart for the GBP/USD

The British Pound fell below the 1.5300 level against the greenback, reaching a fresh 3-week low of 1.5265 as a result of a tepid UK GDP second reading for the first quarter of this 2015. The market was expecting a revision higher, up to 0.4%, but the figures remained steady at 0.3%. The pair has a strong static support around 1.5260, and considering the pair is having a hard time to recover the 1.5300 level, the downside remains favored. Technically, the 1 hour chart shows that the 20 SMA maintains a strong bearish slope above the current price, whilst the technical indicators are aiming higher near oversold readings. In the 4 hours chart, the price extended further below its moving averages, whilst the technical indicators stand flat well into negative territory, supporting a breakout lower should the price extend below the mentioned 1.5260 level.

Support levels: 1.5260 1.5220 1.5180

Resistance levels: 1.5310 1.5365 1.5400

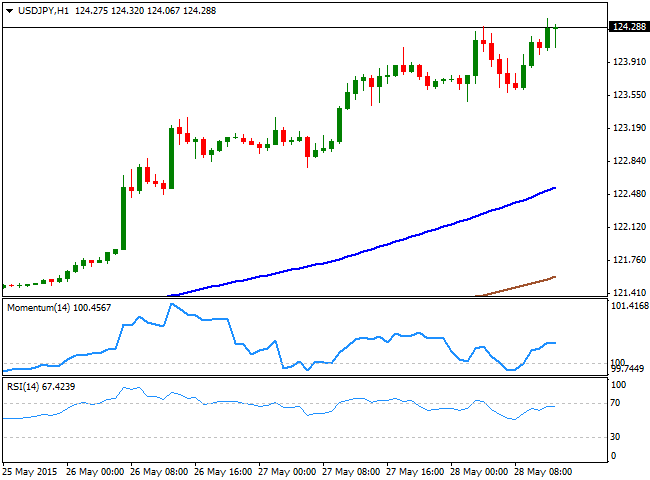

USD/JPY Current price: 124.27

View Live Chart for the USD/JPY

The USD/JPY pair extended its advance to 124.38, level not seen since December 2002, holding nearby despite US tepid employment data. The bullish trend stands firm in place, with the 1 hour chart showing that the price continues to develop well above its 100 and 200 SMAs, whilst the technical indicators are well above their mid-lines, partially losing their upward strength. In the 4 hours chart, the RSI heads higher around 75 whilst the Momentum indicator diverges lower in overbought territory. Nevertheless, the upside remains favored with a break above 124.40 exposing additional advances towards the 125.00 region.

Support levels: 124.05 123.65 123.30

Resistance levels: 124.40 124.85 125.10

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold price struggles for a firm intraday direction, hover above $2,300

Gold price fails to lure buyers amid a fresh leg up in the US bond yields, modest USD uptick. A positive risk tone also contributes to capping the upside for the safe-haven precious metal. Traders, however, might prefer to wait for the US NFP report before placing aggressive bets.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.