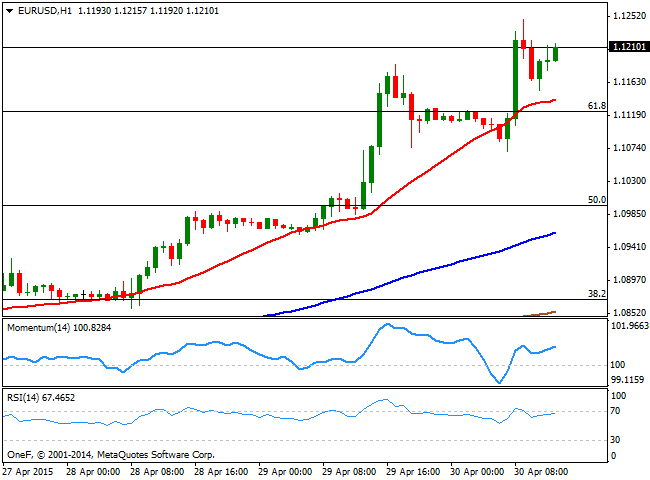

EUR/USD Current price: 1.1180

View Live Chart for the EUR/USD

The EUR/USD pair consolidates its latest gains above the 1.1200 level, having been as high as 1.1248 earlier in the day. The dollar has been under selling pressure ever since the US released its first quarter advanced GDP figures early Wednesday, and not even a mild hawkish FED was able to revert the bearish momentum in the currency. Earlier in the day, European news showed that unemployment in the area remained at 11.3% against expectations of a decline towards 11.2%, whilst the annual inflation reading reached 0.0%, moving away from deflationary readings. US data came out mixed, with better-than-expected weekly unemployment claims, but poor Personal income and spending readings.

Technically, the 1 hour chart shows that the price holds well above its 20 SMA, whilst the technical indicators have corrected extreme overbought readings and head higher in positive territory, keeping the risk towards the upside. In the 4 hours chart the technical indicators continue to head north despite in overbought territory, whilst the 20 SMA converges with the 50% retracement of the bearish run between 1.1533 and 1.0461, around 1.1000. The first round of strong buying interest stands at 1.1120, the 61.8% retracement of the same rally.

Support levels: 1.1160 1.1120 1.1080

Resistance levels: 1.1230 1.1280 1.1315

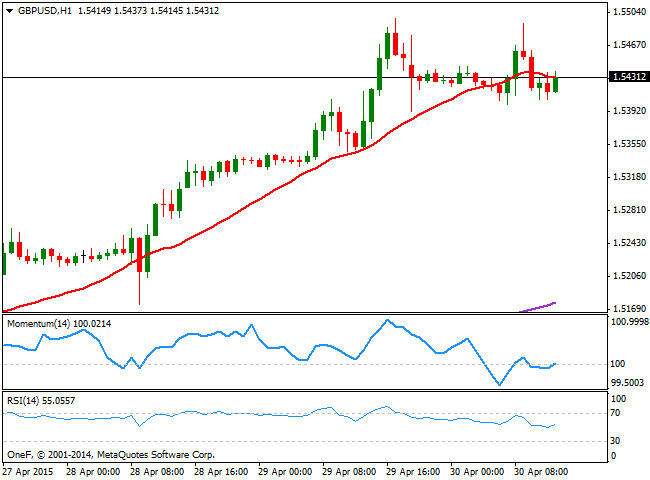

GBP/USD Current price: 1.5433

View Live Chart for the GBP/USD

The GBP/USD consolidates near Wednesday's high, albeit unable to advance further as the UK election and the risk of a hung Parliament weighs on Pound. There were no fundamental releases in Britain this Thursday, and from a technical point of view, the 1 hour chart shows that the price struggles right below a flat 20 SMA, whilst the technical indicators are aiming to cross their mid-lines to the upside, favoring further declines, should the price break below the 1.5400 figure. In the 4 hours chart the technical indicators have turned flat in overbought territory, whilst the 20 SMA heads strongly higher below the current levels, suggesting a downward move should be consider corrective, as long as above it, currently around 1.5340.

Support levels: 1.5390 1.5340 1.5300

Resistance levels: 1.5445 1.5500 1.5535

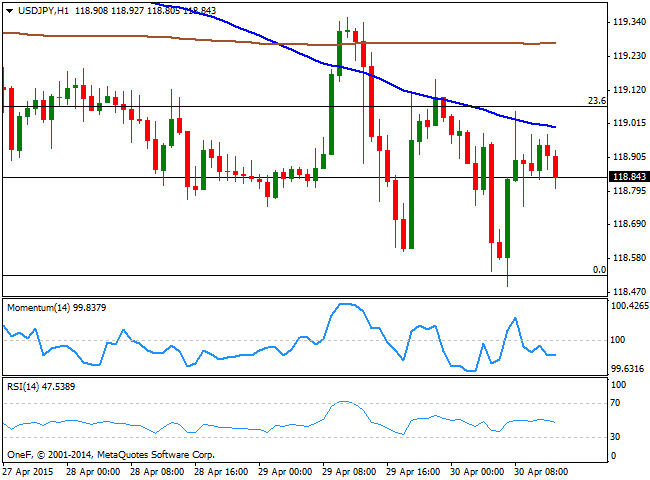

USD/JPY Current price: 119.00

View Live Chart for the USD/JPY

The USD/JPY remains within a familiar range, albeit the pair has managed to post a lower low for the month at 118.48 from where it bounced back towards the 119.00 level. Despite the lack of directional momentum, the pair maintains a negative tone, as the 1 hour chart shows that the price has been rejected from a bearish 20 SMA, whilst the technical indicators head lower in negative territory. In the 4 hours chart, the price stands well below its moving averages, whilst the technical indicators present a mild negative tone below their mid-lines, albeit with limited downward strength.

Support levels: 118.50 118.10 117.70

Resistance levels: 119.10 119.50 120.00

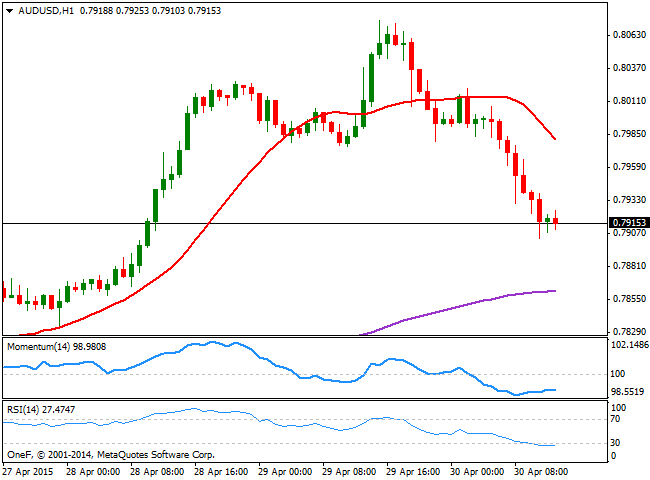

AUD/USD Current price: 0.7915

View Live Chart for the AUD/USD

The Australian dollar retraced sharply against the greenback, falling down to 0.7903. The commodity currency was weighed early Asia by a dovish RBNZ that sent NZD lower, dragging Aussie with it. The 1 hour chart shows that the pair is aiming to correct higher, as well as technical indicators that hold near oversold levels. The 20 SMA in the mentioned time frame heads sharply lower above the current price, limiting chances of a strong recovery in the short term. In the 4 hours chart the price develops below a bullish 20 SMA, whilst the technical indicators are now flat above their mid-lines, having corrected the extreme overbought readings reached after the FED. A break below the 0.7900 figure should lead to additional declines, particularly considering next week risk events in Australia.

Support levels: 0.7900 0.7860 0.7825

Resistance levels: 0.7940 0.7980 0.8025

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.