EUR/USD Current price: 1.0942

View Live Chart for the EUR/USD

The EUR/USD traded as high as 1.0949 this Tuesday, maintaining its newly achieved gains on the back of hopes Greece will made some progress with its creditors after PM Tsipras removed Varoufakis from the negotiation team. Investors are also dumping the greenback ahead of the 2-day US Federal Reserve meeting staring later today, anticipating a dovish stance amid economic weakness during Q1.

Trading at a 3-week high, the EUR/USD pair seems slightly overbought in the short term, as the 1 hour chart shows that indicators are turning lower in overbought territory, albeit the price remains well above a bullish 20 SMA, currently around 1.0880. In the 4 hours chart the technical picture favors the upside, as the Momentum indicator heads higher above 100 whilst the 20 SMA also present a strong upward slope below the current level. The 1.0950 level has proved strong during these last two months, so some consolidation below it is to be expected, although as long as above 1.0910, the upside remains favored, with a break above the mentioned resistance level favoring an approach to the 1.1000 level later on in the day.

Support levels: 1.0910 1.0860 1.0820

Resistance levels: 1.0950 1.1000 1.1040

GBP/USD Current price: 1.5291

View Live Chart for the GBP/USD

The British Pound shrug off a worse-than-expected Q1 GDP reading, showing that the economy grew just 0.3% against expectations of a 0.5% advance. The GBP/USD pair fell down to 1.5174 following the news, although quickly recovered to a fresh 8-week high at 1.5304. Considering the wide intraday range, seems unlikely the pair can advance further in the short term, without some consolidation or correction in the middle. Technically, the 1 hour chart shows that the price stands above a bullish 20 SMA, whilst the Momentum indicator heads higher above 100 and the RSI stands flat near overbought territory. In the 4 hours chart, indicators stand flat in overbought readings, whilst the 20 SMA heads sharply higher around the daily low, supporting the ongoing upward strength.

Support levels: 1.5250 1.5220 1.5175

Resistance levels: 1.5305 1.5340 1.5385

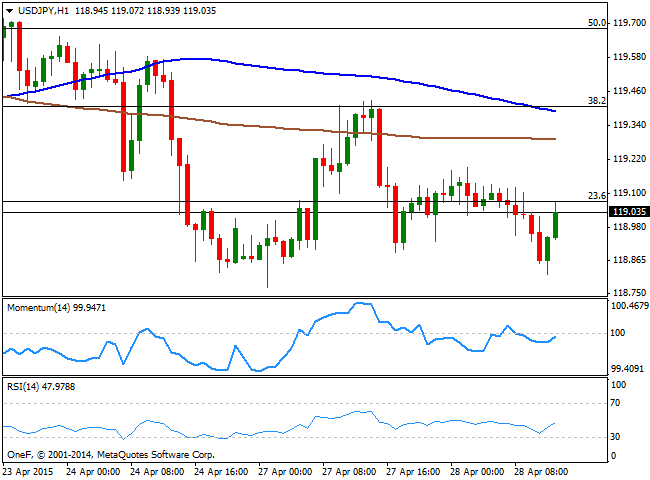

USD/JPY Current price: 119.03

View Live Chart for the USD/JPY

The USD/JPY pair continues to consolidate in a tight range around the 119.00 level, with the 1 hour chart showing that the price remains below its moving averages, and that the technical indicators correct higher but remain below their mid-lines. Broad dollar weakness should prevent the pair from advancing, unless upcoming US data surprises to the upside. In the 4 hours chart the downside is favored, with the Momentum indicator turning lower below 100 and the RSI hovering around 45. Nevertheless, the pair needs to break below 118.52, this month low, to confirm additional declines during the upcoming sessions.

Support levels: 118.50 118.10 117.70

Resistance levels: 119.50 120.00 120.40

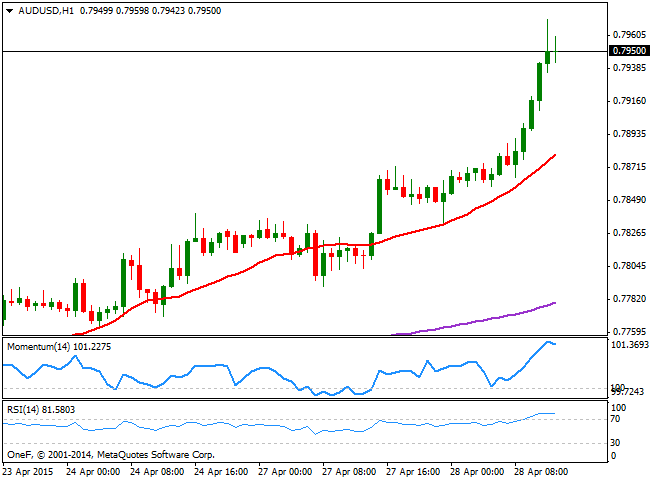

AUD/USD Current price: 0.7950

View Live Chart for the AUD/USD

The AUD/USD soared to a 3-month high of 0.7971 on the back of dollar weakness, as rate differentials continue to favor the antipodean currency despite the RBA keeps a rate hike on the table. The short term picture suggest some limited downward corrective movement ahead, as in the 1 hour chart, indicators are looking exhausted in extreme overbought levels. In the 4 hours chart however, technical readings are biased higher, supporting at least a test of the key 0.8000 level, whilst also helping to keep the downside limited.

Support levels: 0.7940 0.7900 0.7860

Resistance levels: 0.7990 0.8030 0.8065

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.