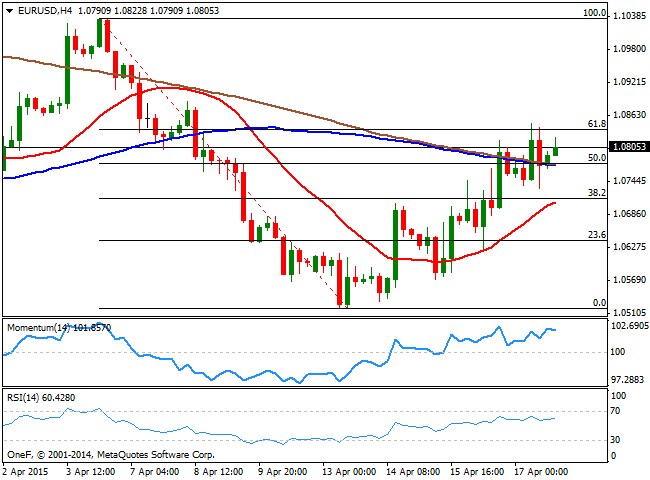

EUR/USD Current price: 1.0805

View Live Chart for the EUR/USD

The wires have been hot over the weekend, with news coming from all fronts. First, Mario Draghi, ECB's head, said that "It is pointless to go short on the euro," referring to the irreversibility of the European single currency. Whilst his words were unintended to speculators, it may have some effects Sunday opening, particularly considering the EUR has been refusing to give up. Secondly, Greek FM Varoufakis in an interview, indicated that Greek authorities could default if the country's creditors retain a tough stance in negotiations and leave authorities with no other choice, which may balance Draghi's words. Finally, the Chinese Central Bank cut the reserve requirement ratio for all banks by 100 basis points on Sunday, in an attempt to boost bank lending and combat slowing growth.

The EUR/USD pair recovered some ground last week, surging up to 1.0847 on Friday, amid generally weak US macroeconomic data. The technical picture shows that the price stalled around the 61.8% retracement of the latest daily decline measured between 1.0134 and 1.0519, last week low, at 1.0838, becoming the immediate resistance level. In the 4 hours chart, the 20 SMA advanced below the current price and stands around 1.0700, whilst the technical indicators hold in positive territory, suggesting a break above the mentioned resistance should lead to further advances. The 50% retracement of the same rally stands at 1.0775, with a break below denying the upside in the short term.

Support levels: 1.0775 1.0745 1.0710

Resistance levels: 1.0840 1.0880 1.0920

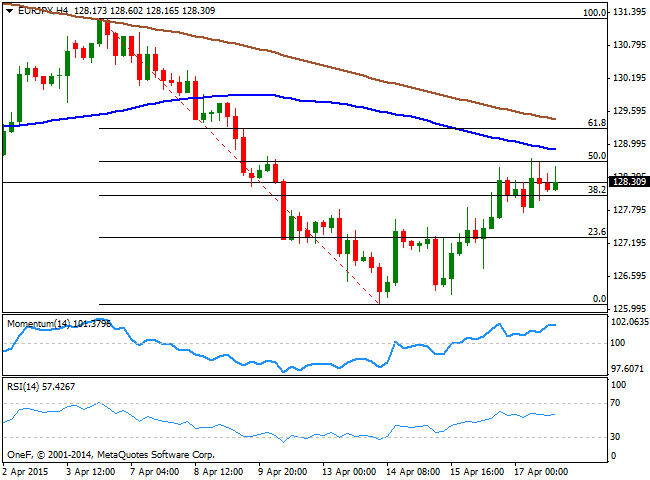

EUR/JPY Current price: 128.30

View Live Chart for the EUR/JPY

The EUR/JPY cross has managed to regain some ground after posting a fresh year low last week at 126.08, as the yen found strength in dollar weakness, with the USD/JPY down for six straight sessions amid diminishing optimism in the US economy. The 4 hours chart, shows that the price managed to recover up to the 50% retracement of its latest daily decline, stalling around the 128.70 price zone. In the same chart, the 100 and 200 SMAs head lower above the current level, limiting the upside, whilst the technical indicators present a mild positive tone well above their mid-lines, anticipating additional advances should the price accelerate above the mentioned static resistance.

Support levels: 127.70 127.30 126.90

Resistance levels: 128.70 129.20 129.65

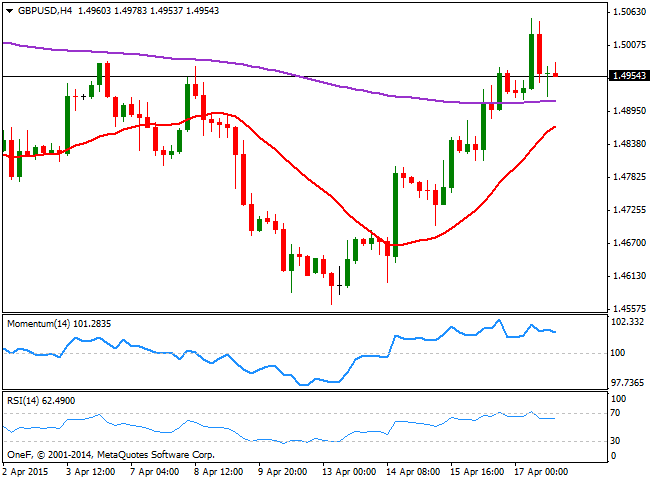

GBP/USD Current price: 1.4954

View Live Chart for the GBP/USD

The British Pound advanced to a fresh 4-week high against the greenback of 1.5053 last Friday, albeit the pair failed to sustain above the 1.5000 mark and retreated around 100 pips before the close. The Pound has been under some mild pressure ahead of the UK May elections, as the prospect of a political gridlock seems quite real, whilst at the same time, economic data over this past few weeks gave some signs of weakness, with a widening trade deficit and weaker industrial production. Nevertheless, investors weighed USD weak economic data more, and the GBP/USD pair 4 hours chart shows that the price broke above its 200 EMA, currently around 1.4910, for the first time since early March, which suggests the pair may continue advancing in the midterm, as long as the level holds. In the same chart the 20 SMA heads higher around 1.4870, albeit the technical indicators retrace from overbought levels, anticipating some downward corrective movement ahead.

Support levels: 11.4910 1.4870 1.4830

Resistance levels: 1.5000 1.5045 1.5085

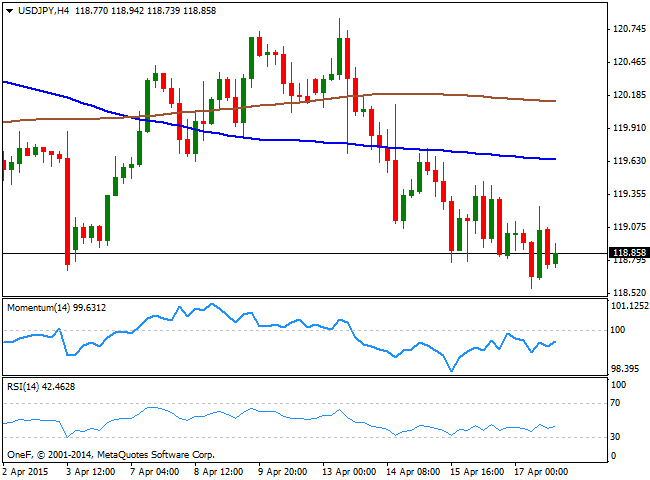

USD/JPY Current price: 118.85

View Live Chart for the USD/JPY

The Japanese yen strengthened steadily against the greenback last week, with the pair reaching 118.56 before stalling. The pair's weekly decline has been of around 200 pips, and that may seem little relevant. However, it has been trading steadily for most of these last three days below its 100 DMA, which reflects an increasing selling interest that may lead to a longer term downward continuation. Technically, the 4 hours chart favors the downside, as the price extended further below its moving averages, whilst the technical indicators aim higher, but below their mid-lines. Shorter term, the 1 hour chart shows that the 100 SMA extended below the 200 SMA, with the shortest now offering dynamic resistance in the 119.30 region, whilst the technical indicators aim higher, but remain below their mid-lines. The pair needs to break below the 118.50 price zone to confirm additional declines towards the 116.80 price zone.

Support levels: 118.50 118.15 117.70

Resistance levels: 118.90 119.30 119.80

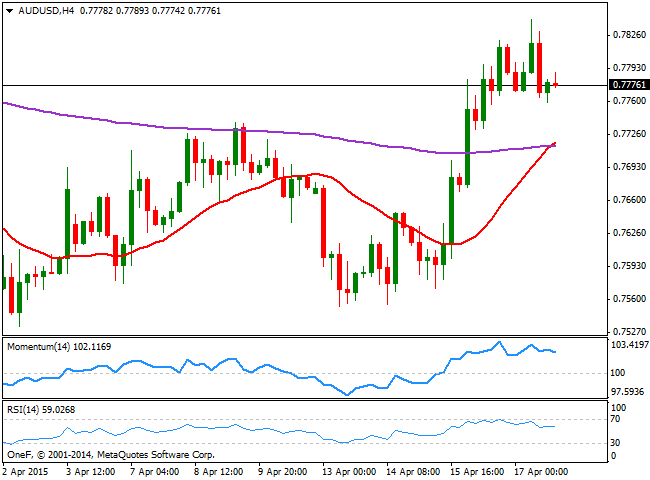

AUD/USD Current price: 0.7776

View Live Chart for the AUD/USD

The Australian dollar got a boost last week from improved local data, with a strong jobs report sending the AUD/USD to a 3-week high of 0.7842, before the pair retreated to close the week sub 0.7800. The Chinese news over the weekend may favor the upside, particularly considering the considering the imbalance between both economies' data and rates, as investors have scale back expectations for a RBA rate cut next month. Technically the 4 hours chart shows that the price has broken well above its 200 EMA last week, currently around 0.7705, whilst the 20 SMA crosses it towards the upside, reflecting a strong upward momentum, whilst the technical indicators are barely retreating from extreme overbought levels. The pair has stalled several times in the mentioned 0.7840 price zone, now a critical static resistance level, as a break above it should favor a 100 pip rally towards March high, set at 0.7937.

Support levels: 0.7760 0.7720 0.7685

Resistance levels: 0.7800 0.7840 0.7900

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.