EUR/USD Current price: 1.0820

View Live Chart for the EUR/USD

The more dovish than expected FED, resulted in the well needed USD bearish corrective movement that then resulted in a higher EUR/USD: the pair saw a short lived spike up to 1.1041, before closing the week below 1.0865, the 38.2% retracement of the latest bearish rally, measured from 11533, to the record low set this month at 1.0460. Many are speculating the pair has set a low and is due for a stronger upward continuation, but that's quite an early call considering the pair has been in a steady decline for almost a year already, from a top se at 1.3992 in April 2014. Nevertheless, this 350 pips recovery has been the largest upward corrective move in the same time frame, and can extend particularly if the US data continues to miss expectations. During the upcoming days the country will release housing data, CPI figures, Durable Goods Orders and its GDP by Friday, and all of them will make a clearer picture of what's next for the pair.

In the meantime, the intraday picture favors the upside, as the price holds below the mentioned Fibonacci level, tested last Friday, whilst the 20 SMA presents a strong bullish slope below the current price, offering dynamic support around 1.0690. In the same chart, the Momentum indicator turned lower, losing its upward strength, but holding well into positive territory, while the RSI indicator stands flat around 64, all of which should keep the downside limited in the short term.

Support levels: 1.0790 1.0745 1.710

Resistance levels: 1.0865 1.0910 1.0955

EUR/JPY Current price: 129.73

View Live Chart for the EUR/JPY

The Japanese yen maintained a mild strength last week, when the main theme was the dollar weakness, preventing the EUR/JPY to rally, despite EUR temporal strength. The pair flirted a couple of times with the 130.00 level, but remains so far below it, finding intraday sellers around a strongly bearish 100 SMA, currently at 130.70 according to the 4 hours chart. In the same time frame, the technical indicators turned lower well into positive territory, lacking bearish signals at the time being. Shorter term, the 1 hour chart shows that the technical indicators retraced from overbought territory as the price retraced from the mentioned high, whilst the 100 SMA crosses above the 200 SMA below the current level, with the shorter acting as support around the 128.80 level.

Support levels: 129.55 129.20 128.80

Resistance levels: 130.10 130.70 131.20

GBP/USD Current price: 1.4931

View Live Chart for the GBP/USD

The British Pound also benefited by US Central Bank less optimistic message, surging temporarily up to 1.5164 against the greenback last week. But the GBP/USD pair failed to sustain gains beyond the 1.5000 critical level, still a line in the sand between bullish and bearish strength. Technically, the 1 hour chart shows that the technical indicators are giving signs of upward exhaustion near overbought levels, and are turning lower, whilst the 20 SMA maintains a strong bullish slope well below the current level, at 1.4830. In the 4 hours chart the price develops well above a mild bullish 20 SMA, currently around 1.4810, while the Momentum indicator turned sharply lower from overbought levels and the RSI indicator consolidates around 58, all of which limits chances of a downward acceleration. Nevertheless, an upward acceleration through the 1.5000 figure is required to confirm additional advances, eyeing then a probable test of the 200 EMA in the 4 hours chart at 1.5120.

Support levels: 1.4890 1.4850 1.4810

Resistance levels: 1.4950 1.5000 1.5045

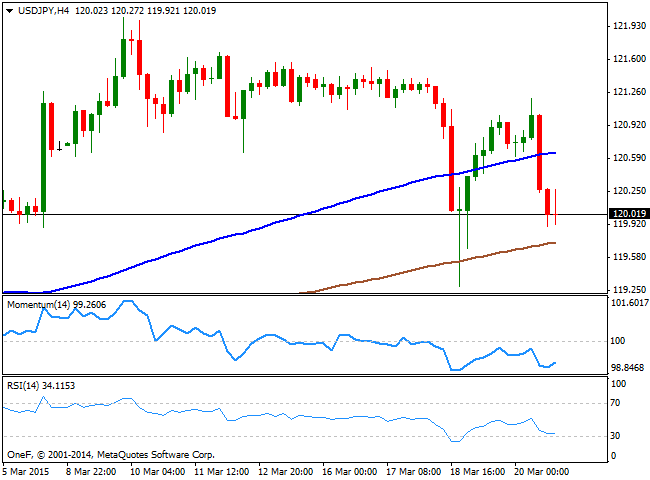

USD/JPY Current price: 120.02

View Live Chart for the USD/JPY

The USD/JPY pair shed ground falling as low as 119.29 before bouncing some, but still struggling to remain above the 120.00 level. During the weekend, BOJ Governor Kuroda once again supported the ongoing QE in the country, although at this point, market has already priced in all of the upcoming easing, which means the effect it may have in the economy is now limited, and the yen can surge, particularly if the dollar bearish corrective movement extends this week. From a technical point of view, the 1hour chart shows that the price was rejected from its moving average, with the 100 and 200 SMAs gaining bearish slopes well above the current level, while the technical indicators maintain their strong bearish slopes and are nearing oversold territory. In the 4 hours chart the technical indicators are aiming slightly higher from oversold levels, but with the price pressuring the lows the risk remains towards the downside, eyeing a retest of last week low should the 120.00 level give up.

Support levels: 120.00 119.60 119.25

Resistance levels: 120.40 120.85 121.30

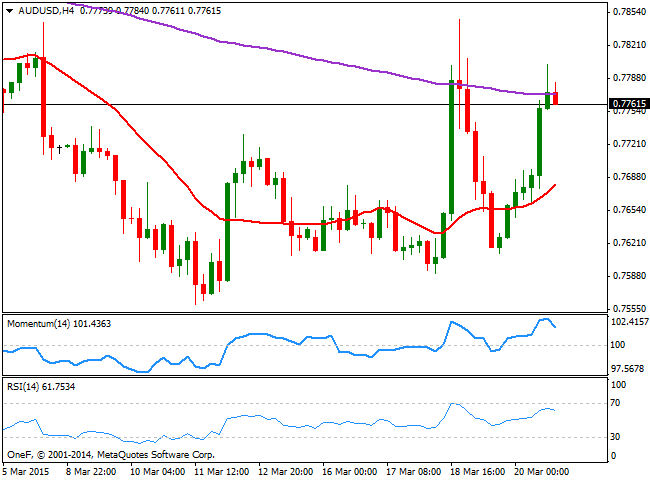

AUD/USD Current price: 0.7761

View Live Chart for the AUD/USD

The AUD/USD pair's recovery has been quite shallow compared to other majors, as it held below the 0.7800 by the end of the week, signaling the dominant bearish term remains in place in the long term. From a technical point of view, the 1 hour chart shows that the price holds above a bullish 20 SMA, currently around 0.7710 offering intraday support, whilst the technical indicators have turned lower from overbought territory, with the RSI heading lower around 63, and supporting some further declines. In the 4 hours chart the price faltered around a mild bearish 200 EMA a couple of times last week, despite some spikes above it, still acting as a strong dynamic resistance around the 0.7780 level, whilst the technical indicators are turning lower from overbought levels, lacking bearish strength at the time being. With dollar current weakness, the pair may advance some over the upcoming sessions, but selling higher is still the preferred view in the pair.

Support levels: 0.7740 0.7695 0.7660

Resistance levels: 0.7780 0.7810 0.7840

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700 as USD struggles ahead of data

EUR/USD is posting small gains above 1.0700 in the European session on Thursday. The pair remains underpinned by a sustained US Dollar weakness, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD stays firm above 1.2500 amid US Dollar weakness

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair's uptick is supported by a broadly weakness US Dollar on dovish Fed signals. A mixed market mood could cap the GBP/USD upside ahead of mid-tier US data.

Gold price trades with modest losses amid positive risk tone, downside seems limited

Gold price edges lower amid an uptick in the US bond yields, though the downside seems cushioned. A positive risk tone is seen as another factor undermining demand for the safe-haven precious metal.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.