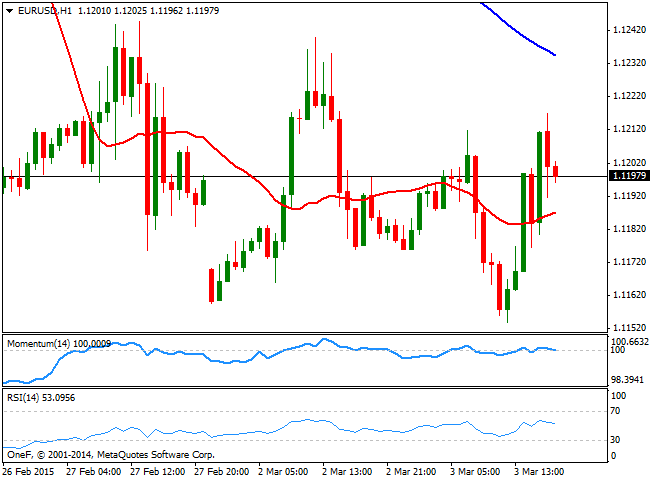

EUR/USD Current price: 1.1187

View Live Chart for the EUR/USD

From a technical point of view, the intraday charts offer a neutral stance, as the price moved back and forth around a flat 20 SMA, whilst the Momentum and the RSI indicators present a mild bearish slope around their mid-lines. The 100 SMA in the mentioned time frame stands around 1.1240, whilst selling interest also awaits in the area, making it difficult for the pair to advance beyond that unless a huge catalyst triggers EUR demand. In the 4 hours chart the price is struggling around a bearish 20 SMA whilst the technical indicators stand directionless below their mid-lines, giving no much clues on what's next. Nevertheless, a break below 1.1140 should trigger some stops and favor a retest of the 1.1097 year low posted last January.

Support levels: 1.1140 1.1095 1.1050

Resistance levels: 1.1210 1.1250 1.1285

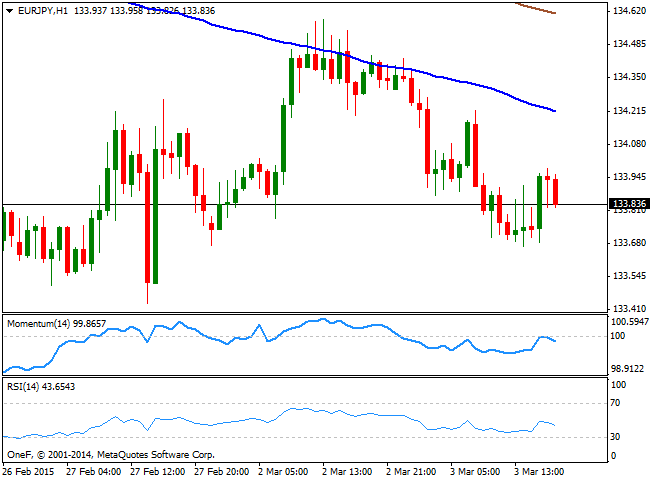

EUR/JPY Current price: 133.83

View Live Chart for the EUR/JPY

The Japanese Yen surged against most of its rivals during the previous Asian session, supported by comments from Etsuro Honda, an economic adviser of Japanese Prime Minister Shinzo Abe, saying the BOC should refrain from adding further stimulus at least for some time, in an interview given earlier today to the Wall Street Journal. The EUR/JPY fell as low as 133.66 during the American afternoon, bouncing as stocks recovered from their lows, although capped by 134.00. The 1 hour chart shows that the price continues to trade below a bearish 100 SMA currently around 134.20, whist the technical indicators turned lower after testing their mid-lines. In the 4 hours chart the technical indicators maintain a neutral stance, hovering around their mid-lines, whilst the price develops below its moving averages, pointing for some additional declines, particularly if the pair breaks below 133.45, this week low.

Support levels: 133.45 133.10 132.70

Resistance levels: 134.20 134.75 135.20

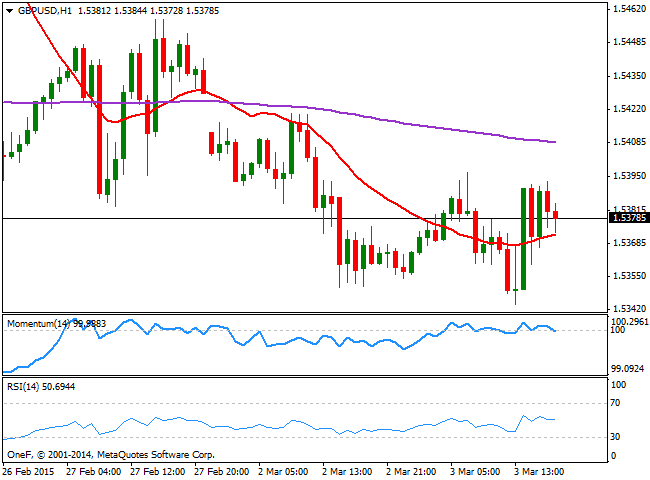

GBP/USD Current price: 1.5378

View Live Chart for the GBP/USD

The GBP/USD pair traded within a constrained range this Tuesday, with the Pound receiving some attention during the European session, following the release of the UK Construction PMI, up to 60.1 in February. The pair surged up to 1.5393 on the day, but failed to post a higher high, although reach a fresh low at 1.5349, keeping the risk towards the downside in the long run. Short term and according to the 1 hour chart, the technical indicators are heading lower right below their mid-lines, whilst the price pressures a flat 20 SMA a few pips below the current level, supporting another leg south. In the 4 hours chart the overall bias is bearish, with the price developing below its 20 SMA, the Momentum indicator heading south below 100 and the RSI indicator hovering around 40. However, the pair has found intraday buyers around the 200 EMA in this last time frame that continues to act as immediate and strong support around 1.5335. Should the pair accelerate below it, the risk towards the downside will increase, eyeing 1.5250 as a possible bearish target for the upcoming 24 hours.

Support levels: 1.5335 1.5290 1.5250

Resistance levels: 1.5400 1.5450 1.5490

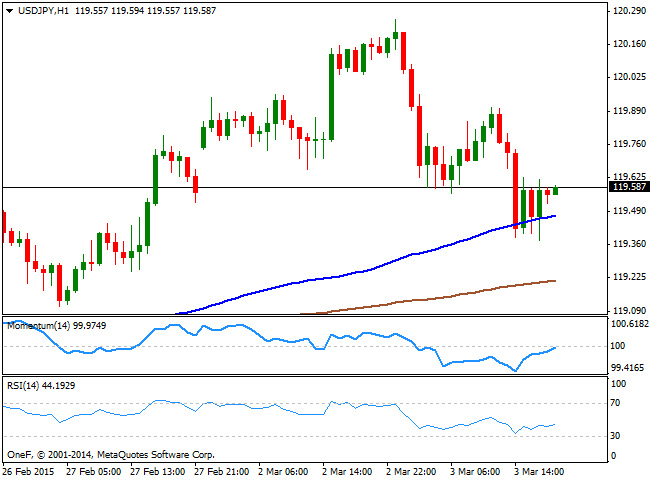

USD/JPY Current price: 119.58

View Live Chart for the USD/JPY

The USD/JPY pair erased all of its weekly gains, back to square one right above the 119.40 level by the end of the US session. The 1 hour chart for the pair shows that the price found support around a bullish 100 SMA currently around 119.50, whilst the 200 SMA stands around 119.20, acting as the next dynamic support in the case the first gives up. The technical indicators in the mentioned time frame head higher right below their mid-lines, which should keep the downside limited in the short term, although as long as the price holds below the 119.90/120.00 area, there's no scope for more sustainable gains. In the 4 hours chart, the technical indicators have fallen sharply towards their mid-lines, and stand ready to cross them lower, suggesting that a price acceleration below the 119.50 support may lead to a stronger decline down to the 118.80 price zone.

Support levels: 119.50 119.10 118.80

Resistance levels: 119.95 120.45 120.90

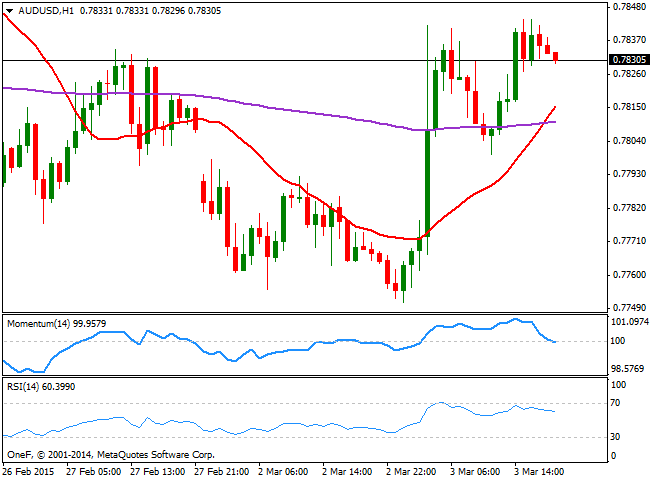

AUD/USD Current price: 0.7830

View Live Chart for the AUD/USD

The Australian dollar got a nice boost from the RBA during the past Asian session, as the Central Bank, unexpectedly, decided to keep its cash rate unchanged at 2.25%, although authorities remarked that policy easing may still be appropriate in the near future. The AUD/USD pair surged up to 0.7842 following the news, finding afterwards buying interest on an approach to the 0.7800 figure. The pair retested the highs in the American afternoon, but was unable to rally beyond the strong static resistance level. From a technical point of view, the 1 hour chart shows that the price holds above a strongly bullish 20 SMA currently around 0.7805, whilst the technical indicators maintain their bearish slopes, particularly with the Momentum indicator pressuring the 100 level, which should at least keep the upside limited. In the 4 hours chart the technical readings maintain a neutral stance, with the indicators flat around their mid-lines, and the price barely above a bearish 20 SMA.

Support levels: 0.7800 0.7755 0.7720

Resistance levels: 0.7840 0.7890 0.7925

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.