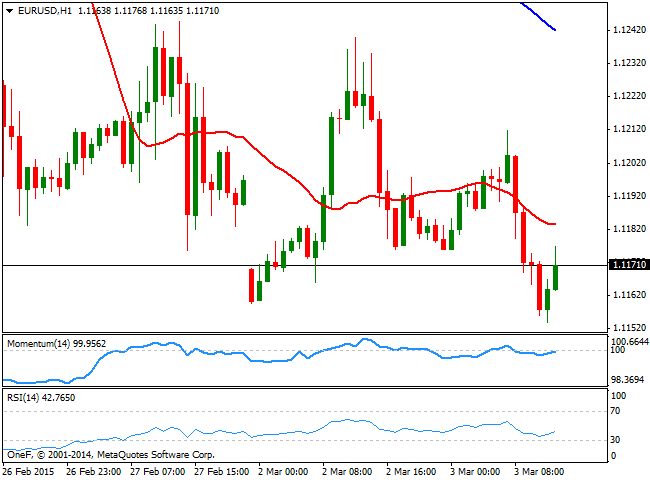

EUR/USD Current price: 1.1196

View Live Chart for the EUR/USD

Support levels: 1.1140 1.1095 1.1050

Resistance levels: 1.1210 1.1250 1.1285

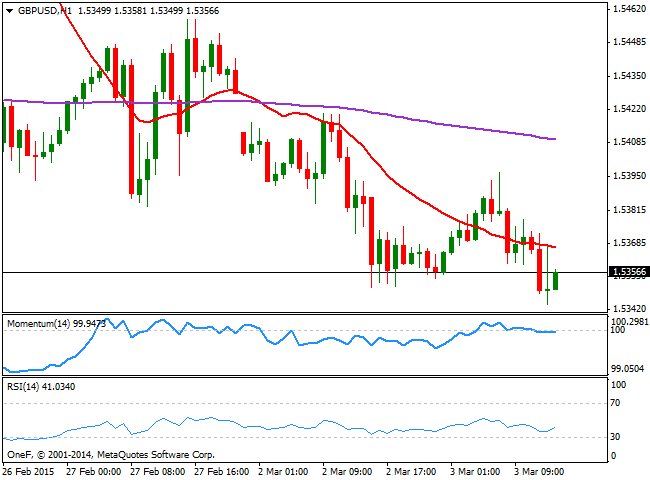

GBP/USD Current price: 1.5357

View Live Chart for the GBP/USD

The GBP/USD trades near a daily low set at 1.5343 so far today, presenting a limited bearish tone in the short term, as the 1 hour chart shows that the price holds below a bearish 20 SMA, whilst the technical indicators remain directionless in negative territory. In the 4 hours chart the technical picture favors the downside, as the 20 SMA gained bearish slope, now coping the upside around 1.5400, while the technical indicators head lower below their mid-lines. Nevertheless, the 200 EMA offers a strong dynamic resistance around 1.5335, and it will take a clear break below it to confirm additional declines towards the 1.5290 price zone.

Support levels: 1.5335 1.5290 1.5250

Resistance levels: 1.5400 1.5450 1.5490

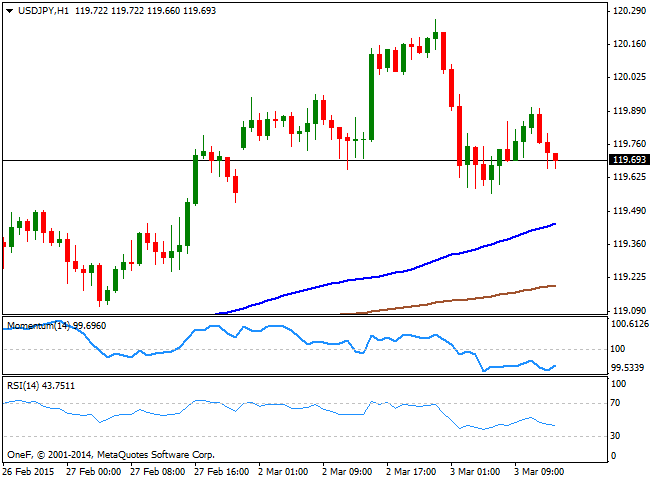

USD/JPY Current price: 119.68

View Live Chart for the USD/JPY

The USD/JPY pair eased back below the 120.00 level during Asian trading hours, back towards its weekly opening levels. Having failed once again to sustain gains beyond the critical figure, and having posted a lower high weekly basis, the risk of a new leg south has increased substantially. From a technical point of view and in the short term, the 1 hour chart shows that the price continues to develop above its 100 and 200 SMAs, but the technical indicators are now below their mid-lines, with the RSI heading south around 44, anticipating some further decline. In the 4 hours chart the indicators are heading lower and approaching their midlines, which means a break below 119.40 support is required to confirm the bearish extension, eyeing then the 118.80 price zone.

Support levels: 119.40 118.80 118.50

Resistance levels: 119.95 120.45 120.90

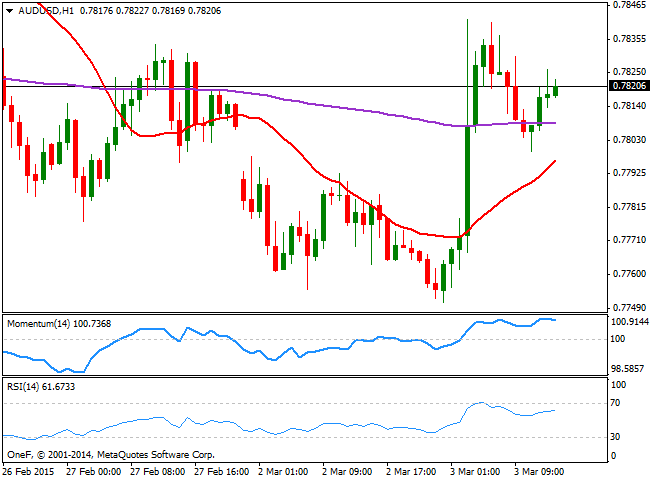

AUD/USD Current price: 0.7820

View Live Chart for the AUD/USD

The Aussie surged on relief, after the RBA decided to keep rates on hold this month, with the AUD/USD surging to a fresh weekly high of 0.7831, and finding short term buying interest around the 0.7800 figure, now the immediate support. The 1 hour chart shows that the price stands well above a bullish 20 SMA, although the technical indicators lack upward strength but stand in positive territory. In the 4 hours chart, the pair presents a neutral technical stance, with the price above a bearish 20 SMA and indicators flat around their midlines, suggesting the upward strength may be over, but not yet confirming an upcoming leg lower.

Support levels: 0.7800 0.7755 0.7720

Resistance levels: 0.7840 0.7890 0.7925

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.