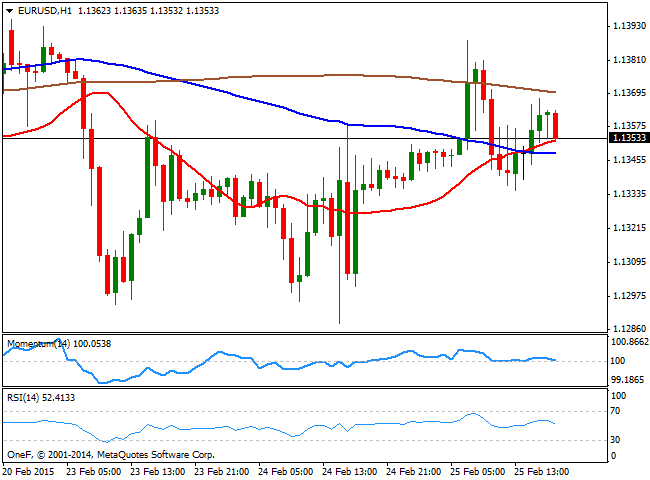

EUR/USD Current price: 1.1196

View Live Chart for the EUR/USD

The new month starts with the EUR weakening further against its rivals, as the market's attention shifted once again towards the upcoming launch of quantitative easing in Europe, expected to begin as soon as March 9. But the ECB won't be the only Central Bank to dominate the headlines, as among the major economies, there will be economic policy meetings also in Australia, the UK and Canada, whilst the Chinese one cut its benchmark interest rate by surprise for the second time in three months last Saturday. The surprise came as a slowing economy leads to disinflation in the second world economy. By opposition, the US continues to transit the path of growth, with above-expected readings for inflation, and Durable Goods Orders according to the latest data, favoring further dollar broad strength.

Aiming to start the week with a gap lower, the EUR/USD pair trades around 1.1180 early interbank trading, and the technical picture reaffirms the dominant bearish long term trend, after the pair broke below 1.1250, the support level that contained the downside for all of the past February. The 4 hours chart shows that the price develops below a strongly bearish 20 SMA whilst the Momentum indicator heads lower below 100 and the RSI indicators hovers around oversold territory. The immediate short term resistance comes at 1.1170, with scope to test the year low of 1.1097 should the level give up. To the upside, the mentioned 1.1250 price zone will probably attract selling interest if reached with a break above it is seen as unlikely at the time being.

Support levels: 1.1170 1.1130 1.1100

Resistance levels: 1.1250 1.1285 1.1320

GBP/USD Current price: 1.5428

View Live Chart for the GBP/USD

The British Pound continues to be the only currency able to battle against the dollar strength, as the GBP/USD holds around the 1.5430 as a new week starts. The BOE is expected to have its monthly policy meeting this week, although there are no expectations of a change in rates or the Assets Purchase Program. Last month, all of the 9 MPC voting members voted to keep rates on hold, so if there is going to be a surprise there, it may come from a change towards a rate hike from a minority, albeit chances are quite limited. In the meantime, the 4 hours chart for the pair shows that a short term ascendant trend line coming from February 12 daily low offers an immediate short term support around 1.5405 for this Monday, while the price stands below a flat 20 SMA, currently at 1.5480, and the technical indicators head lower below their mid-lines, all of which suggests the pair may head south in the short term, with a break below the mentioned trend line exposing the 1.5330 price zone.

Support levels: 1.5405 1.5380 1.5330

Resistance levels: 1.5450 1.5490 1.5535

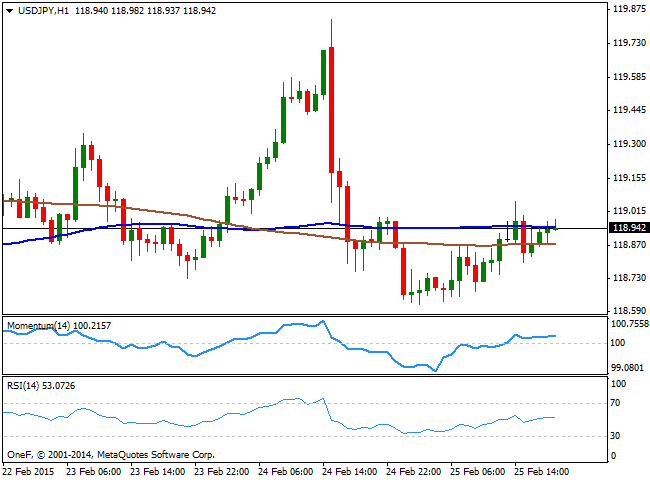

USD/JPY Current price: 119.54

View Live Chart for the USD/JPY

The USD/JPY pair continues to push higher towards the 120.00 level, as better-than expected US data has finally helped the pair firm up above the 119.00 level late last week. The early interbank quotation shows a limited 30 pips to the upside, supporting the constructive outlook of the pair. Technically, the 4 hours chart shows that the price holds well above its 100 SMA, which moved further above the 200 SMA. The momentum indicator in the mentioned time frame holds above 100, having partially lost its strength amid late Friday consolidation, whilst the RSI indicator retraced from overbought territory, but remains well above the 50 level. A steady advance above 119.85 should lead to a test of the next upward resistance level around 120.47, February monthly high, whist an extension above this last exposes the 121.50 price zone, this year high. Buyers should surge on approaches to 119.40 to keep the upside favored, with a break below this last risking a downward correction down to the 118.80 price zone.

Support levels: 119.40 118.80 118.25

Resistance levels: 119.85 120.45 120.90

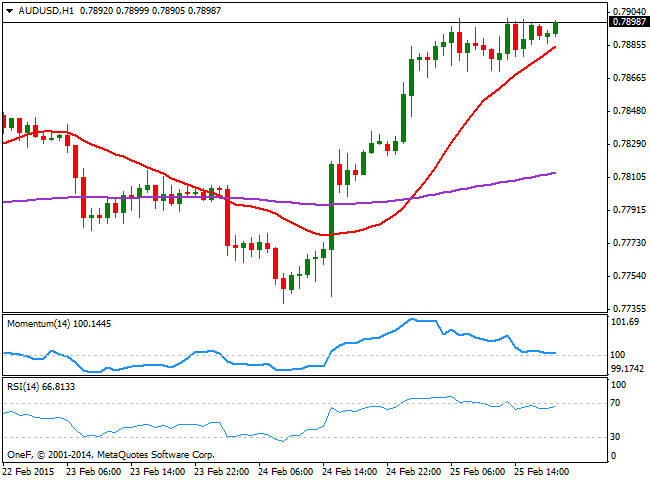

AUD/USD Current price: 0.7807

View Live Chart for the AUD/USD

The AUD/USD pair trades steady around the 0.7800, mute with mixed news from China, as following the surprise rate cut, the country's Services PMI reading beat expectations: Non manufacturing PMI printed 53.9 in February against 53.7 expected, while the NBS Manufacturing reading reached 49.7 against 49.9 expected. The Aussie may be on hold as there are some market talks about a possible rate cut coming next Tuesday with the RBA meeting. The Central Bank already cut rates last month and historically, there are no precedents of two rate cuts in a row, which dilutes the chances, albeit investors seem to have turned into cautious mode. Technically, the 4 hours chart shows that the price stands below a mild bullish 20 SMA, while the price failed to overcome its 200 SMA last week, currently around 0.7890. The indicators in the mentioned time frame head lower below their mid-lines, keeping the risk towards the downside. The key support stands at 0.7720 with a break below it probably seeing the pair resuming the long term bearish trend.

Support levels: 0.7770 0.7720 0.7680

Resistance levels: 0.7840 0.7890 0.7935

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.