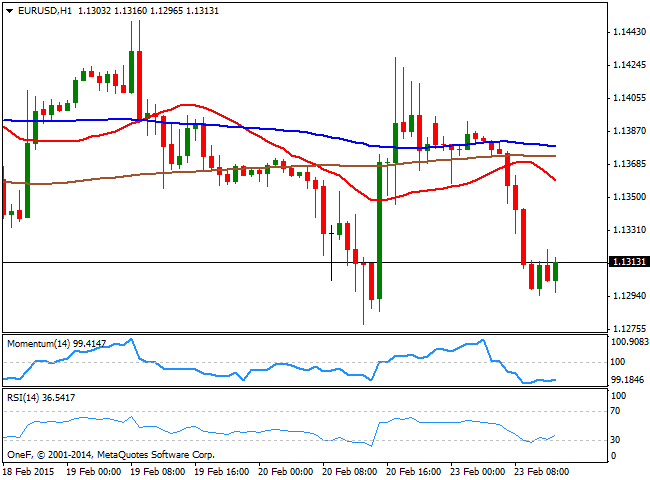

EUR/USD Current price: 1.1312

View Live Chart for the EUR/USD

The EUR/USD pair fell as low as 1.1294 this Monday, with broad dollar strength leading the European morning. The pair however, managed to bounce back above the 1.1300 figure despite the US Chicago activity index rose above expected, un to 0.13. In other order of news, Greece has presented its list of conditions to the EU group, aimed to ease austerity conditions, but the rest of the union needs to approve them, a new chapter in the Greek drama. From a technical point of view, the 1 hour chart shows that the price develops far below their midlines, whilst the technical indicator are showing a limited bounce from oversold territory. In the 4 hours chart the technical picture supports the downside, with indicators heading lower in negative territory, and the moving averages capping the upside in the 1.1380 price zone. A break below 1.1280 is required to confirm further declines towards the critical support at 1.1250, the level that contained the downside all of this February.

Support levels: 1.1280 1.1250 1.1200

Resistance levels: 1.1320 1.1350 1.1380

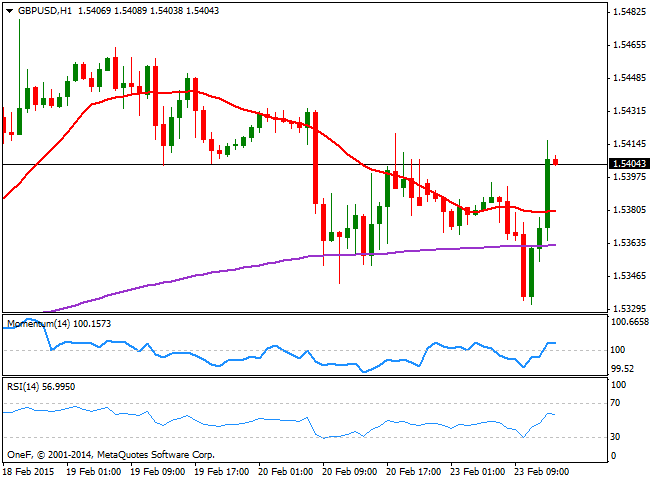

GBP/USD Current price: 1.5404

View Live Chart for the GBP/USD

The GBP/USD pair fell as low as 1.5331 before regaining the upside, surging above the 1.5400 level on self strength. The pair trades in positive territory, with the 1 hour chart showing that the price broke above its 20 SMA, while indicators overcame their midlines, albeit lost upward momentum as the price settled. In the 4 hours chart, the price stalled right around its 20 SMA in the 1.5415 price zone, while the technical indicators regained the upside, albeit below their midlines, limiting the upside at the time being. A break above the mentioned resistance is therefore required to confirm an upward continuation towards the 1.5490 price zone.

Support levels: 1.5390 1.5350 1.5310

Resistance levels: 1.5410 1.5450 1.5490

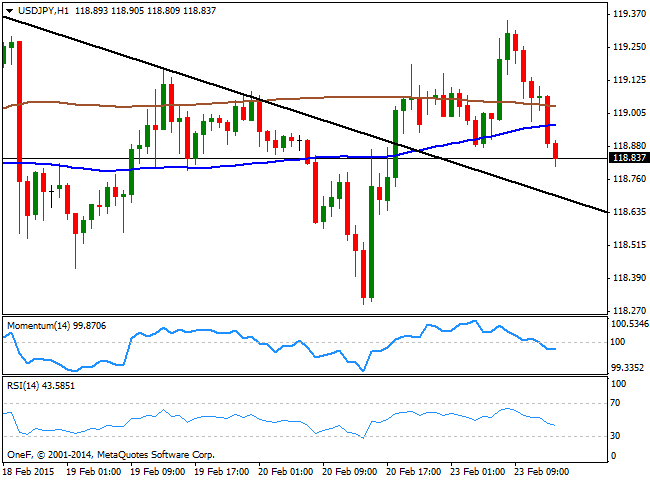

USD/JPY Current price: 118.83

View Live Chart for the USD/JPY

The USD/JPY pair retraces from a daily high of 119.34 posted earlier on the day on dollar momentum, now trading in the red as stocks all over the world are under selling pressure. Technically, the pair has failed several times during the last 2 weeks, to overcome the 119.30/40 area, which reflects that strong selling interest is aligned around it. In the short term, the 1 hour chart shows that the price stands below its 100 and 200 SMAs, while the technical indicators head lower below their midlines, supporting some additional declines. In the 4 hours chart the technical indicators have crossed their midlines to the downside, supporting some the shorter term view, particularly if the price extends below the 118.60 level, the immediate support.

Support levels: 118.60 118.25 117.80

Resistance levels: 119.00 119.40 119.85

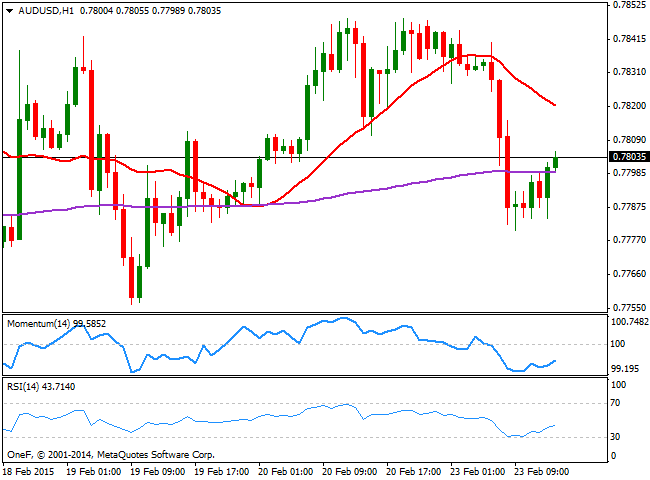

AUD/USD Current price: 0.7802

View Live Chart for the AUD/USD

The AUD/USD retraced from 0.7848 and holds barely above the 0.7800 level ahead of US opening, maintaining an overall negative tone. The 1 hour chart for the pair shows that the price stands below a bearish 20 SMA whilst the technical indicators stand flat below their midlines, lacking downward strength but far from suggesting further recoveries. In the 4 hours chart the price stands below a flat 20 SMA while indicators hover around their midlines, presenting a quite neutral technical stance at the time being.

Support levels: 0.7780 0.7750 0.7720 0.7680

Resistance levels: 0.7830 0.7865 0.7900

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0700 ahead of key EU inflation, GDP data

EUR/USD is keeping the red near 1.0700, undermined by a broad US Dollar rebound and a mixed market mood early Tuesday. Germany's Retail Sales rebound fail to impress the Euro ahead of key Eurozone inflation and GDP data releases.

GBP/USD remains pressured toward 1.2500 on US Dollar rebound

GBP/USD is extending losses toward 1.2500 in European trading on Tuesday. A cautious risk tone and a decent US Dollar comeback weigh negatively on the pair. The focus now shifts to mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

Data fuels China optimism

China's factory activity has expanded for a second consecutive month, marking the best streak in over a year and fueling optimism for the sustainability of the world's second-largest economy's recovery.