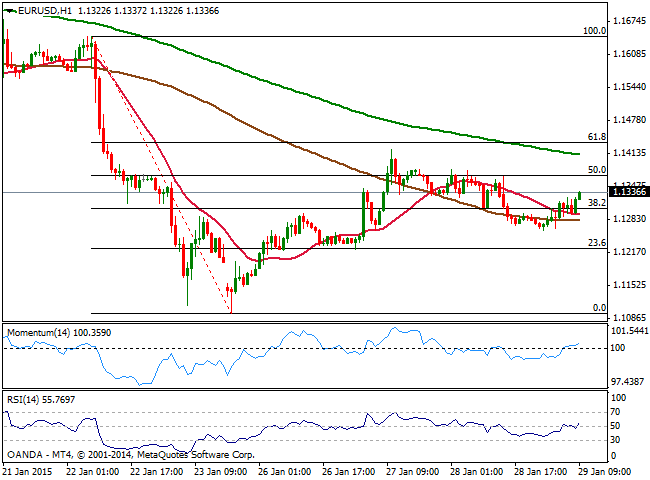

EUR/USD Current price: 1.1337

View Live Chart for the EUR/USD

Despite the day was fulfilled with fundamental data both shores of the Atlantic, the EUR/USD seems unable to gain directional strength, contained within yesterdays’ range. Trading slightly higher, the common currency was hardly affected by news German inflation fell for the first time in 5 years, confirming local deflation. True, earlier on the day unemployment rate in the number one country of the region fell to its lowest on record, at 6.5%. In the US, weekly unemployment claims fell sharply to 265K last week, a multi-year low that should have gave the greenback a bit more support considering NFP data next week. In fact, the USD is higher against most rivals, lower however against EUR and CAD. Technically, the 1 hour chart presents a mild bullish stance with indicators aiming higher above their midlines, and 20 and 100 SMAs almost together a few pips below the current level. In the 4 hours chart the price hovers around its 20 SMA that converges with the Fibonacci level at 1.1305, while indicators are also in neutral territory. A price extension either above 1.1365 or below 1.1205 is now required to define a clearer trend for the upcoming sessions.

Support levels: 1.1305 1.1250 1.1210

Resistance levels: 1.1365 1.1400 1.1440

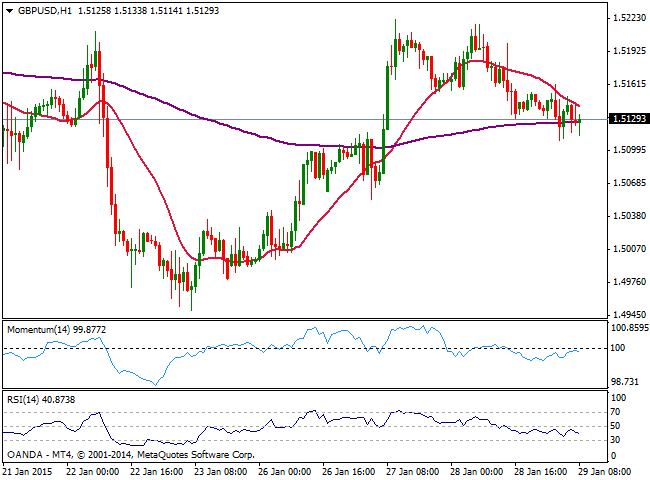

GBP/USD Current price: 1.5129

View Live Chart for the GBP/USD

The GBP/USD pair trades below its daily opening, having posted a daily low of 1.5109 during the European morning. The pair has been finding short term sellers in the 1.5160 price zone, the neckline of a short term double roof established around 1.5520. The 1 hour chart shows that price is being capped by a bearish 20 SMA while indicators present a tepid bullish tone below their midlines. In the 4 hours chart the price hovers around a bullish 20 SMA whilst indicators are turning horizontal around their midlines, limiting chances of a strong decline. A break below the 1.5100/10 price zone is required to confirm a new leg south, aiming for a test of 1.5050, while above the mentioned 1.5160 level, the pair may regain the upside and retest recent highs.

Support levels: 1.5100 1.5070 1.5020

Resistance levels: 1.5160 1.5225 1.5265

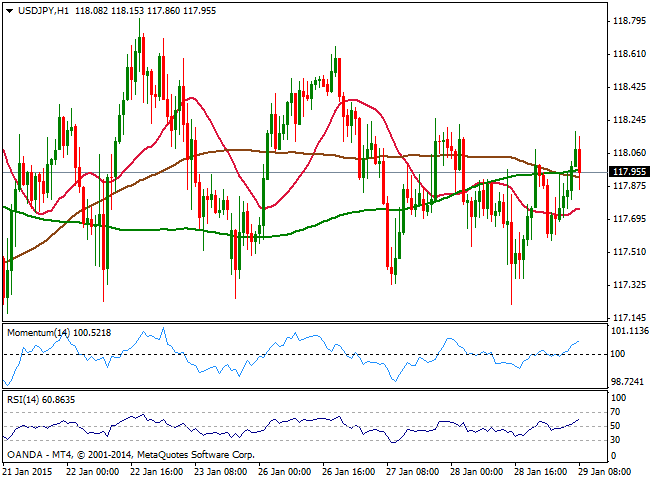

USD/JPY Current price: 117.95

View Live Chart for the USD/JPY

The USD/JPY continues to trade within range, slowly gaining a short term bullish tone according to the hourly chart as per indicators heading higher above their midlines and price hovering around its 100 and 200 SMAs, both together in the 118.00 region. In the 4 hours chart however, indicators hold directionless in neutral territory, while moving averages maintain their bearish slopes above current levels, limiting chances of a stronger advance. US stocks are pretty much flat ahead of the opening, but will likely be the main driver for the pair, favoring a break lower particularly if index extend their recent decline.

Support levels: 117.60 117.30 117.00

Resistance levels: 118.00 118.40 118.90

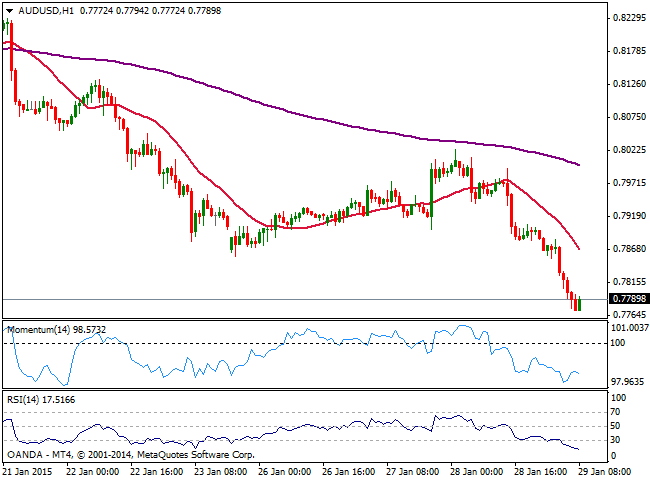

AUD/USD Current price: 0.7790

View Live Chart of the AUD/USD

The AUD/USD fell sharply this Thursday, triggering stops below 0.7900 and accelerating towards a fresh over 5-year low of 0.7772. The heavy tone in gold that trades around $1,270/oz is adding to the negative tone of Aussie. The 1 hour chart shows indicators slightly exhausted in extreme oversold levels, whilst 20 SMA maintains a strong bearish slope well above current price. In the 4 hours chart technical readings maintain a strong bearish momentum despite RSI stands at 24, supporting further declines after a limited upward correction.

Support levels: 0.7700 0.7665 0.7630

Resistance levels: 0.7810 0.7860 0.7900

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.