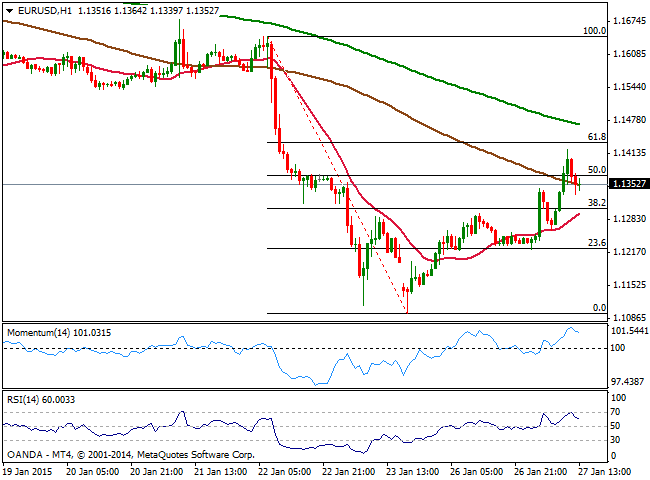

EUR/USD Current price: 1.1365

View Live Chart for the EUR/USD

The EUR/USD pair recovered up to 1.1422 this Tuesday on the back of tepid American data and more SNB. Early Europe, the Switzerland National Bank vice chairman announced the Bank is watching franc against EUR and USD, and may intervene if necessary, giving the EUR some intraday support and boosting the pair above the 1.1300 figure. But most of dollar weakness came from US indexes fall, as disappointing earnings reports drove DJIA down around 380 points intraday. US Durable Goods Orders decreased 3.4% in December a straight 4-month drop, and pointing out the global slowdown is affecting American companies. Later on the day, Markit Services PMI and Consumer confidence ticked higher yet were not enough to revive dollar demand. The FED will have its first meeting of the year tomorrow, and market players are anticipating the Central Bank may hold back on a rate hike considering inflation is likely to remain subdue. Nevertheless, majors will likely range ahead of the news, for most of this upcoming Wednesday.

From a technical point of view, the 1 hour chart shows that the EUR/USD pair trades around the 50% retracement of the post ECB QE announcement fall, although price holds well above its 20 SMA and indicators regain the upside after a limited correction from overbought levels. In the 4 hours chart technical indicators maintain a strong upward momentum, while 20 SMA turns flat below current price, suggesting the rally may extend, particularly if the pair manages to extend its gains above 1.1440, the 61.8% retracement of the same rally.

Support levels: 1.1335 1.1310 1.1250

Resistance levels: 1.1400 1.1440 1.1485

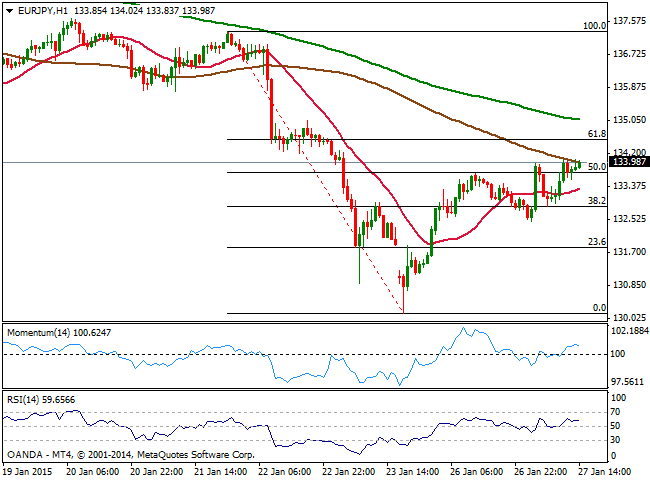

EUR/JPY Current price: 133.99

View Live Chart for the EUR/JPY

The EUR/JPY pair struggles around the 134.00 figure, having followed EUR/USD in its upward corrective movement. The Japanese yen strengthened earlier on the day, as stocks fell in the US, but late recovery in index from their daily lows, push the JPY lower in the American afternoon. The 1 hour chart for the pair shows that price pressures the 100 SMA around current levels, whilst indicators hold above their midlines, albeit showing no actual strength. The pair has corrected the 50% of its latest fall, with immediate support now at 133.70. In the 4 hours chart indicators are biased higher above their midlines, supporting a continued advance particularly if the pair manages to break above 134.55, 61.8% retracement of the same decline.

Support levels: 133.70 133.25 132.85

Resistance levels: 134.55 135.10 135.65

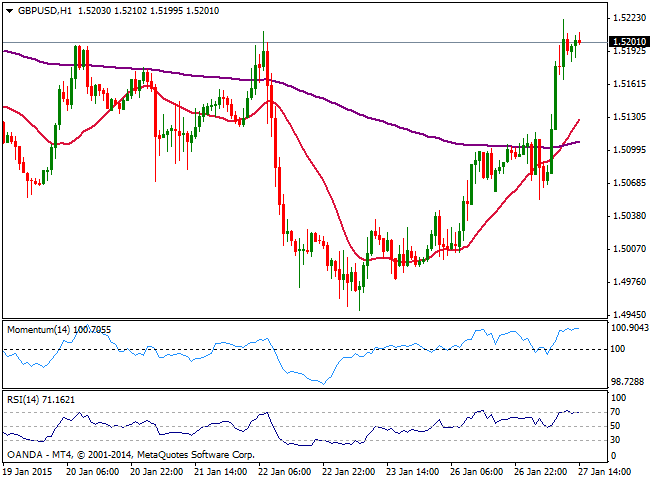

GBP/USD Current price: 1.5200

View Live Chart for the GBP/USD

The GBP/USD pair posted a strong intraday advance, considering it bounced from a daily low of 1.5054 reached after UK GDP release. In the European morning, news showed the UK economic growth slowed more than expected in 2014 as it only grew 0.5% in the last quarter of the year, leaving the annual rate at 2.7%. But strong demand surged on former highs and the pair finally triggered stops above 1.5125, reaching 1.5224 fresh 2-weeks high. Technically, the pair remains biased higher, as the 1 hour chart shows 20 SMA advancing strongly higher well below current price, whilst indicators turn flat in overbought territory, far from signaling an upcoming downward move. In the 4 hours chart indicators also present a strong bullish tone, supporting the shorter term view. A break above mentioned high should lead to an advance up to 1.5330, 200 EMA in this last time frame, while bulls may hesitate if price eases back below the 1.5120/30 price zone.

Support levels: 1.5170 1.5125 1.5080

Resistance levels: 1.5225 1.5265 1.5300

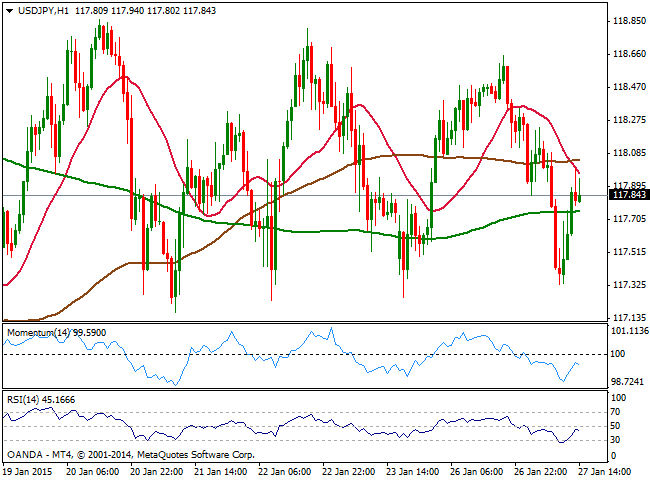

USD/JPY Current price: 117.84

View Live Chart for the USD/JPY

The USD/JPY pair remained contained within its latest range despite stocks’ strong slide and US 10Y yields falling down to 1.80%, as the pair bounced from a daily low of 117.33. The one hour chart shows 20 SMA crossed below the 100 one above current price, capping the upside around 118.00, while indicators turned lower right below their midlines, after correcting oversold readings. In the 4 hours chart the price stands below its moving averages whilst indicators present a mild bearish tone, as per heading lower right below their midlines. Wednesday FED decision may be the trigger the pair needs to breakout its range: if the Central Bank suggests a rate hike may be delayed to late in the year, stocks will welcome the news and the pair may follow, reverting the ongoing heavy short term tone.

Support levels: 117.60 117.30 117.00

Resistance levels: 118.00 118.40 118.90

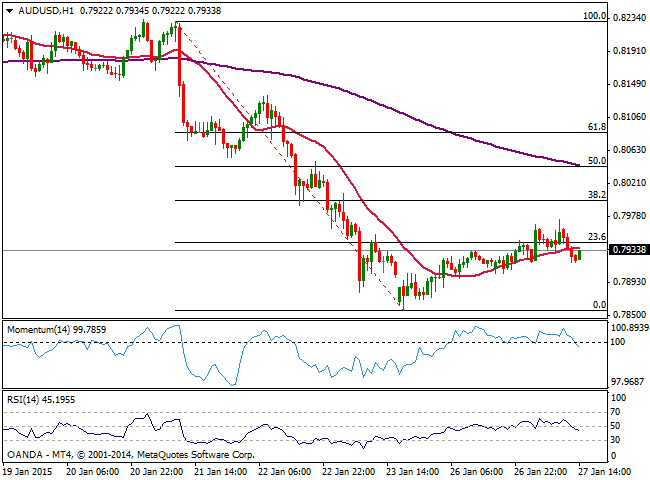

AUD/USD Current price: 0.7933

View Live Chart of the AUD/USD

Australian dollar remained subdued against the greenback, as the pair saw a limited advance up to 0.7974 before easing back towards its daily opening level. Aussie will have to face local inflation data to be release during the upcoming Asian session, expected to have shrink to 1.8% in the last quarter of 2014, against previous quarter reading of 2.3%. A reading below expected should keep the pair in bearish mode, while strong selling interest still stands around the 0.7965 price zone. The 1 hour chart shows that price broke below its 20 SMA while indicators head lower below their midlines, pointing for some further declines in the short term. In the 4 hours chart price struggles around a strongly bearish 20 SMA, while indicators hovers around their midlines, diverging from each other and therefore not giving a clear directional bias.

Support levels: 0.7900 0.7860 0.7820

Resistance levels: 0.7965 0.8000 0.8040

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.