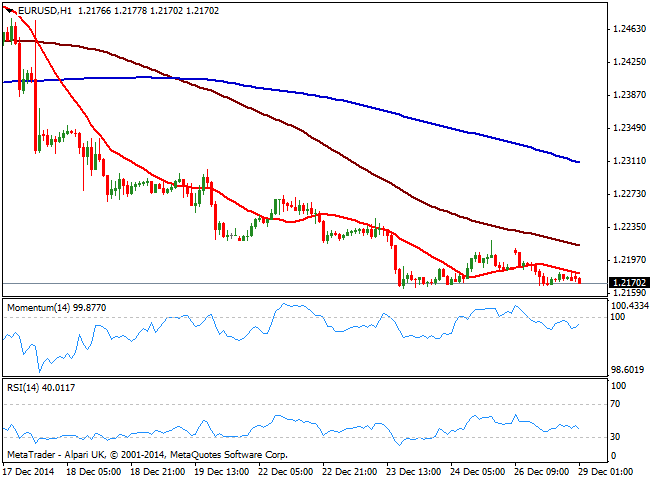

EUR/USD Current price: 1.2170

View Live Chart for the EUR/USD

The EUR/USD pair maintains the negative tone after the long holiday weekend, and is set to face another abbreviated week, with the New Year’s holiday keeping markets closed on Wednesday and Thursday once again. The main risk event for this Monday in Europe is the Greek ballot that if lost by current PM Antonis Samaras, would result in a snap election that could bring anti-austerity party Syriza into power and trigger the euro zone into a new crisis.

Trading within a tight range near the year low established at 1.2164 the 1 hour chart shows price extending below its 20 SMA whilst indicators head south below their midlines. In the 4 hours chart, an attempt of recovery was contained by a bearish 20 SMA, currently around 1.2200, whilst indicators maintain a mild negative tone, supporting further declines.

Support levels: 1.2165 1.2120 1.2085

Resistance levels: 1.2200 1.2240 1.2275

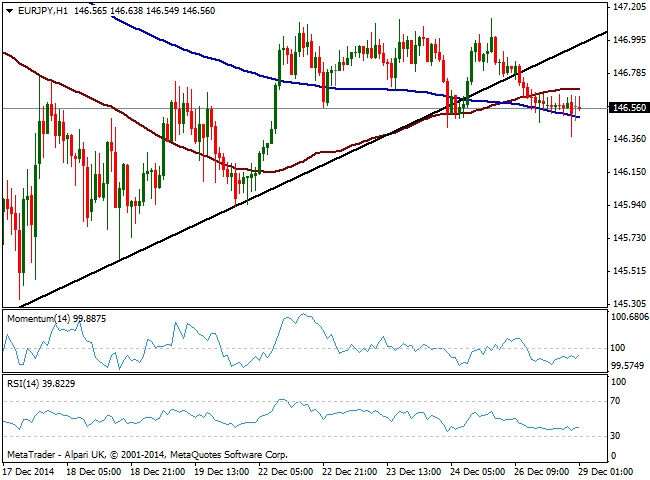

EUR/JPY Current price: 146.55

View Live Chart for the EUR/JPY

The EUR/JPY trades lower in range, with the pair stuck to a tight 20 pips range for most of the last tradable 24 hours. Weighted by EUR weakness, the cross has broke below a short term ascendant trend line, and the 1 hour chart shows that the price stands below its 100 SMA and ready to break below the 200 SMA, whilst indicators stand in the red, keeping the pressure to the downside. In the 4 hours chart indicators are also biased lower around their midlines, whilst price hovers around flat moving averages, all of which reflects the ongoing lack of volatility across the forex market.

Support levels: 146.30 145.90 145.50

Resistance levels: 147.30 147.80 148.20

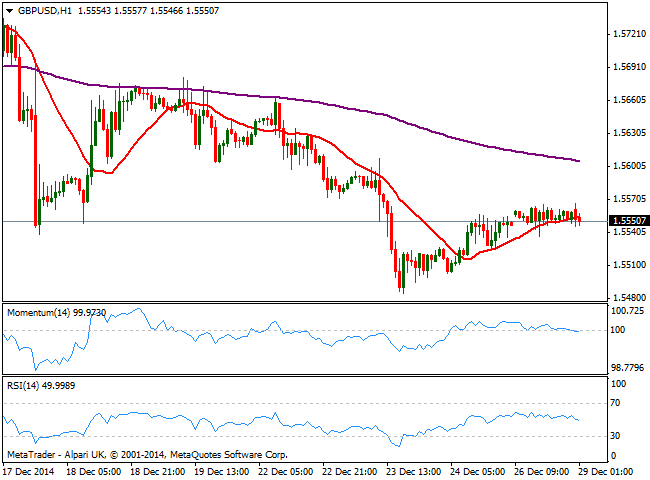

GBP/USD Current price: 1.5550

View Live Chart for the GBP/USD

The GBP/USD pair firmed up into the close, trading around the 1.5550 level and with some intraday highs around 1.5570 from these last few days acting as immediate intraday resistance. The 1 hour chart shows price holding above a bullish 20 MSA whilst indicators hold in positive territory, albeit showing no strength. In the 4 hours chart however, price is being capped by a bearish 20 SMA whilst indicators aim higher but remain below their midlines, limiting chances of an upward recovery. The pair has established its year low at 1.5485 which means a break below the level is required to deny chances of a short term recovery for these upcoming sessions.

Support levels: 1.5540 1.5515 1.5485

Resistance levels: 1.5570 1.5615 1.5650

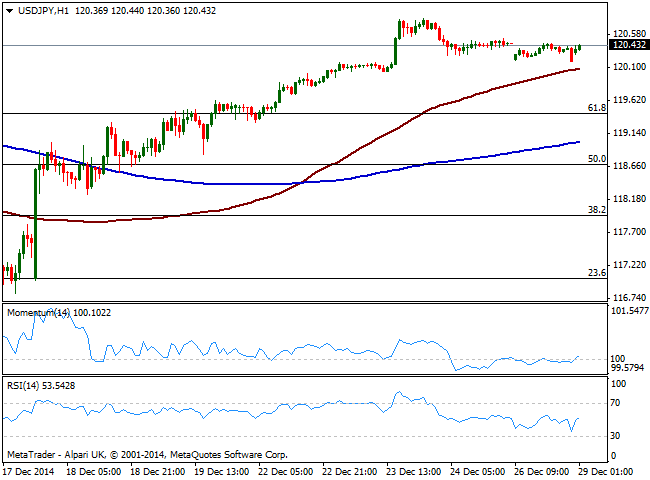

USD/JPY Current price: 120.43

View Live Chart for the USD/JPY

Spot USD/JPY lost some ground on Friday closing the day around 120.19. The pair opens the week with a positive tone, following news released on Saturday that the Japanese government approved a stimulus package worth $29 billion, intended to increase economic activity in the weaker regions of the country, injecting further liquidity into the system.

The pair trades around 120.40, and the 1 hour chart shows that the price is holding above a bullish 100 SMA currently around 120.05, the immediate support. In the same chart however, momentum indicator stands flat around 100, reflecting latest lack of activity while RSI is biased higher but remains below the 50 level. In the 4 hours chart RSI retreated from overbought levels whist momentum heads lower near 100, showing no actual strength. The dominant trend is still bullish, although some downward corrective movement should not be dismissed if the 120.00 level gives up.

Support levels: 120.00 119.65 119.30

Resistance levels: 120.85 121.10 121.55

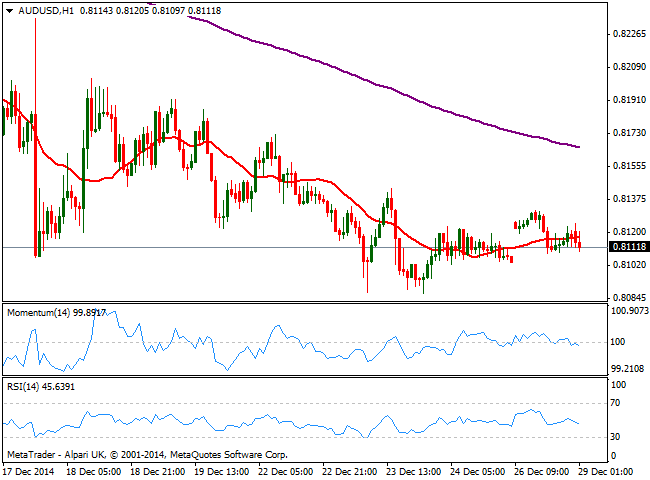

AUD/USD Current price: 0.8118

View Live Chart of the AUD/USD

The AUD/USD maintains the flat stance since on previous updates, consolidating around the 0.8100 level after having established a year low at 0.8087 last week. The pair has been trading in a tight 100 pips range last week and will likely remain limited also during the upcoming days, albeit the dominant bearish trend will likely prevail. Short term, the 1 hour chart shows a neutral stance, whilst the 4 hours chart shows the price below a bearish 20 SMA and indicators heading lower below their midlines, supporting the dominant bearish trend.

Support levels: 0.8085 0.8060 0.8025

Resistance levels: 0.8135 0.8170 0.8200

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.