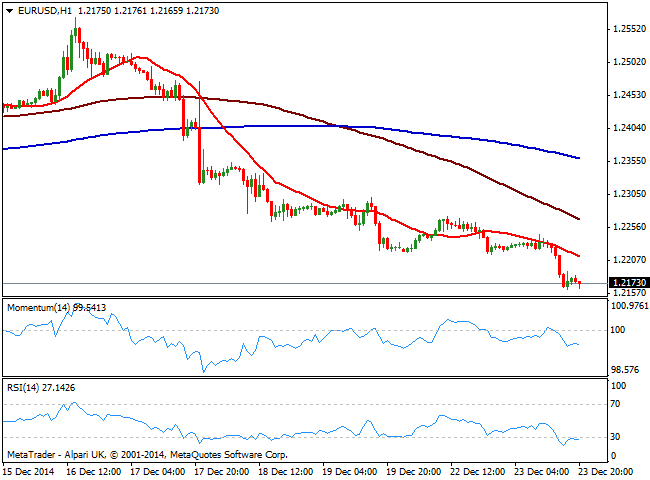

EUR/USD Current price: 1.2172

View Live Chart for the EUR/USD

The American dollar advanced once again this Tuesday, reaching fresh year highs against most of its major rivals. The catalyst for the advance was the Q3 GDP reading which final revision reached a whopping 5%, the highest in 11 years. Market ignored weaker Durable Goods Orders released alongside with GDP figures, while an hour later, another hurdle of US data resulted in growing Consumer Confidence and Personal Spending, but less New Home Sales than expected. Nevertheless, investors embraced the dollar and equities, as these lasts surged to all time highs in the US.

The EUR/USD pair fell down to 1.2164 and intraday bounces were rejected around 1.2190 now immediate resistance. The technical picture in the short term remains bearish, as the price accelerated below its 20 SMA whist indicators continue to head lower despite in oversold levels. In the 4 hours chart indicators resumed their slides after limited upward corrections early Monday, with RSI heading south around 24. Markets will close earlier on Wednesday and remain closed on Thursday, which means little action should be expected across the forex board.

Support levels: 1.2150 1.2120 1.2085

Resistance levels: 1.2190 1.2225 1.2250

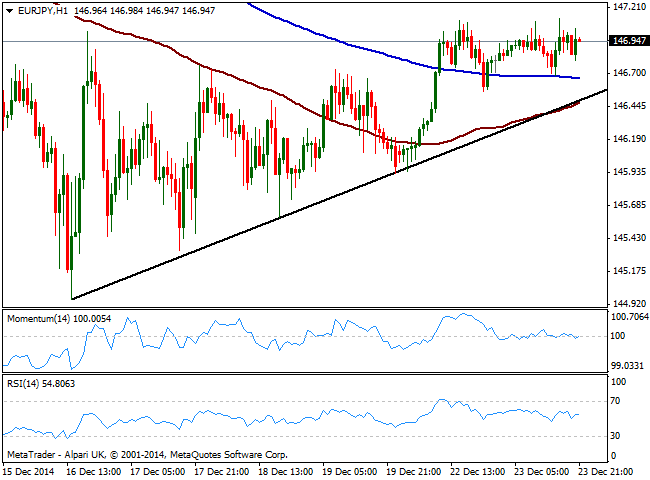

EUR/JPY Current price: 146.94

View Live Chart for the EUR/JPY

The Japanese Yen edged lower across the board, weighted by rising stocks and improving US fundamental data, albeit the EUR/JPY cross remained subdued on EUR weakness. The pair has advanced up to a daily high of 147.13 in a short lived spike, but quickly retraced back sub 147.00 where it stands. The 1 hour chart shows that the price held above its 200 SMA but indicators were unable to move away from their midlines, maintaining a neutral stance. In the 4 hours chart the technical picture is also neutral with some follow through above 147.30 required to see the pair gaining some bullish track.

Support levels: 146.60 146.30 145.90

Resistance levels: 147.30 147.80 148.20

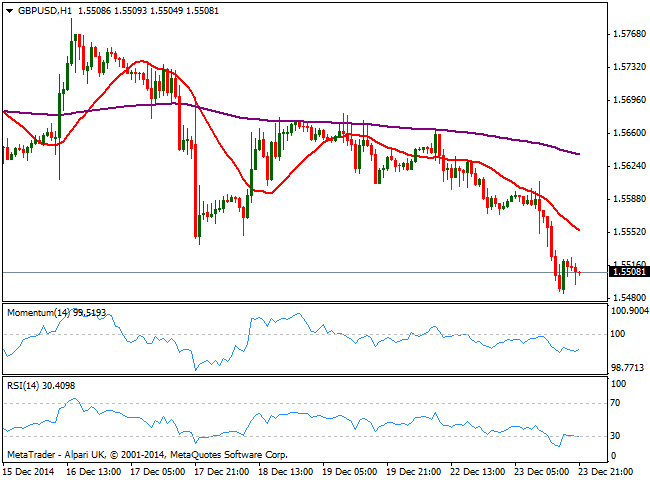

GBP/USD Current price: 1.5508

View Live Chart for the GBP/USD

The GBP/USD pair nosedived to a fresh year low of 1.5485, weighted by GDP readings both sides of the Atlantic: in the UK, Q3 GDP came out at 0.7%, dragging the YoY reading down to 2.6%, below estimates of a 3.0%. Better-than-expected US readings highlighted the imbalance between both economies, being the final trigger for the pairs’ slump. As the US session comes to an end, the GBP/USD 1 hour chart shows that the price is developing well below its 20 SMA, whilst RSI reached 18 before correcting some, now again turning lower in oversold levels. In the 4 hours chart technical indicators maintain a strong bearish momentum well into negative territory, all of which supports further declines.

Support levels: 1.5485 1.5440 1.5410

Resistance levels: 1.5540 1.5570 1.5615

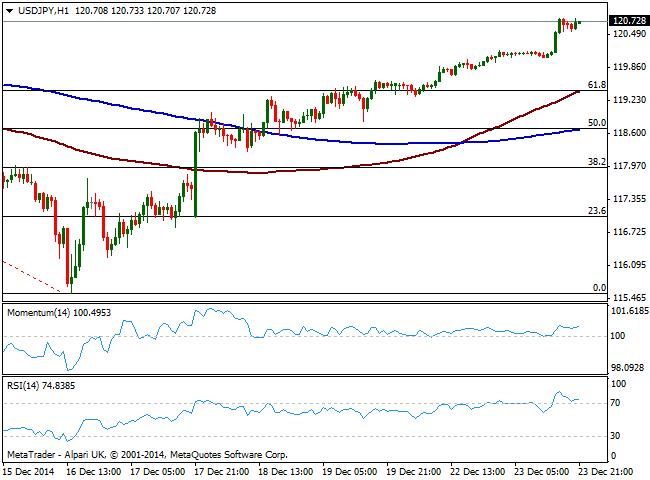

USD/JPY Current price: 120.72

View Live Chart for the USD/JPY

The USD/JPY pair advanced sharply above the 120.00 level, consolidating by the end of the day near its fresh 2-week high of 120.80. There will be no fundamental data released during Asian hours, and for Wednesday the US weekly unemployment claims will be the most relevant data of the day, nothing that usually shocks the markets. From a technical perspective, the pair has resumed its bullish set up, with speculators now looking at least for a retest of the multiyear low posted early December at 121.84. In the short term, the 1 hour chart shows 100 SMA extended up to 119.40, converging now with the 61.8% retracement of the latest daily decline, while momentum stands flat above its midline. In the same time frame, RSI settled above 70 after an early spike not yet confirming any sort of downward correction. In the 4 hours chart however, indicators maintain the upward strength, pointing out for an advance beyond, the 121.00 mark.

Support levels: 120.45 120.00 119.65

Resistance levels: 120.85 121.10 121.40

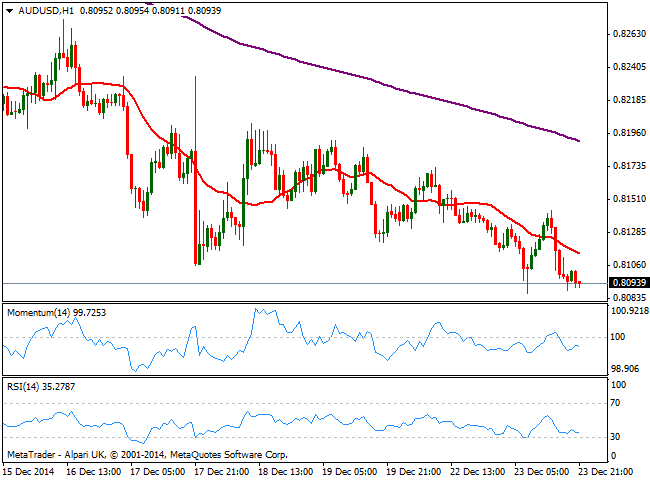

AUD/USD Current price: 0.8093

View Live Chart of the AUD/USD

The Australian dollar extended its decline against its American rival to a fresh 4-year low of 0.8087, influenced by iron ore losses early Tuesday, and former bounces were contained by 0.8140 immediate resistance level, from where the pair resumed its slide. It has been a tough year for Aussie against the greenback, but at the same time, the AUD is set for its first annual gain versus its major peers in three years as it outperforms the euro and the yen, frustrating RBA’s measures to stimulate the local economy. That means the Central Bank may be closer than expected to another rate cut which should result in further AUD/USD slides into 2015. Anyway and in the short term, the pair is expect to maintain a neutral-bearish stance, with the 1 hour chart now showing price below a bearish 20 SMA and indicators heading south below their midlines, keeping the risk to the downside. In the 4 hours chart 20 SMA continues to act as dynamic resistance currently around 0.8135, whist indicators head south in negative territory, supporting the dominant bearish trend.

Support levels: 0.8090 0.8060 0.8025

Resistance levels: 0.8135 0.8170 0.8200

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

The EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 on Monday during the early Asian trading hours. The softer US Dollar provides some support to the major pair.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.