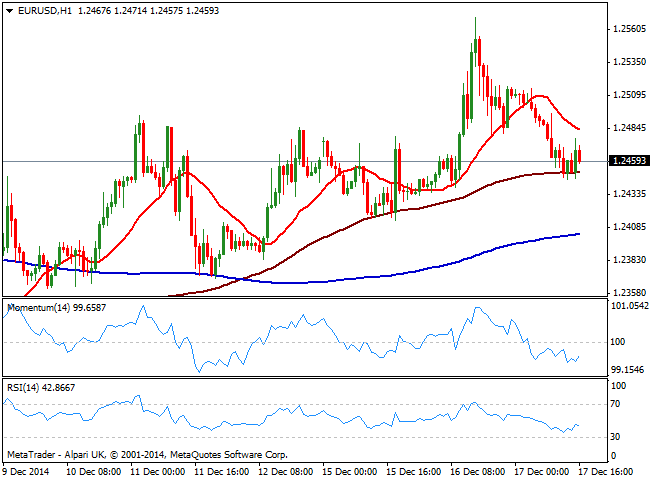

EUR/USD Current price: 1.2475

View Live Chart for the EUR/USD

The EUR/USD pair bounced from a daily low of 1.2445 following weaker than expected inflation readings in the US. CPI missed expectations, with the YoY reading at 1.3% and Nov figure at -0.3%, down on energy costs, no surprise considering oil lost 45% of its value in the last 6 months. However, things may not be as bad as the headline suggest, as according to latest NFP data, hourly wages increased meaning real wages actually increased as a result. The 1 hour chart shows however that the price remains limited to the upside by a bearish 20 SMA around 1.2485 while indicators diverge from each other but remain in negative territory. In the 4 hours chart price continues to struggle around its 20 SMA whilst indicators rest directionless in neutral territory. At this point is all about the FED and the wording of its statement, and a break below 1.2400 or above 1.2485 will likely set the tone after the news.

Support levels: 1.2440 1.2400 1.2360

Resistance levels: 1.2485 1.2530 1.2570

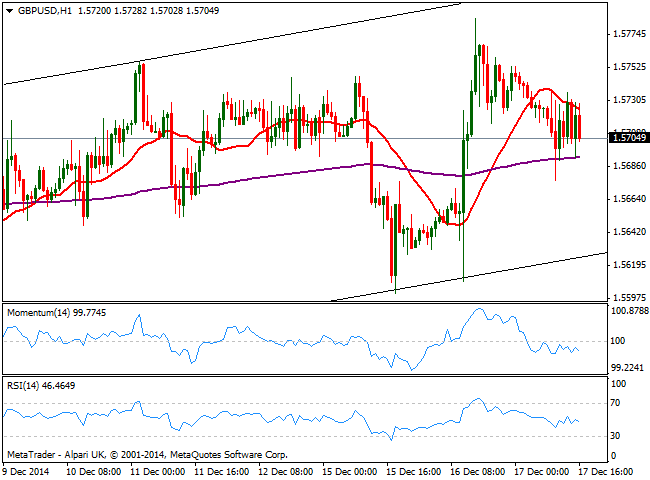

GBP/USD Current price: 1.5704

View Live Chart for the GBP/USD

The GBP/USD pair trades in a quiet range ever since the European opening, having found little support in rising wages and steady unemployment. The pair seems attached to the 1.5700 level, with the 1 hour chart showing the price unable to advance above a bullish 20 SMA and indicators heading lower below their midlines, keeping the pressure to the downside. In the 4 hours chart technical readings present a neutral stance, with 20 SMA flat and indicators turning lower around their midlines. The pair develops inside an ascendant channel which base stands now at 1.5630, critical support to follow during the upcoming hours, as a break below should increase the downward pressure.

Support levels: 1.5670 1.5630 1.5590

Resistance levels: 1.5740 1.5785 1.5825

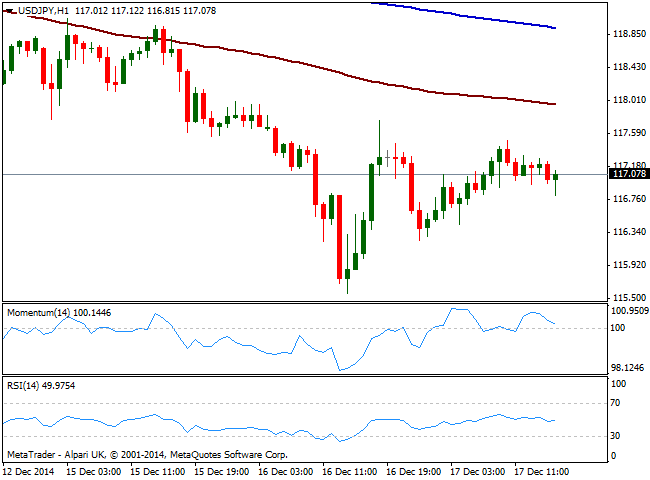

USD/JPY Current price: 117.04

View Live Chart for the USD/JPY

The USD/JPY pair consolidates around the 117.00 figure, steady as stocks halt these last days bleeding, but unable to run. The 1 hour chart shows that the price remains below its 100 and 200 SMAs, both with a clear bearish slope, while momentum turned lower but remains above 100. In the 4 hours chart indicators corrected oversold readings and stand flat below their midlines, reflecting current lack of direction in the price.

Support levels: 116.90 116.60 116.25

Resistance levels: 117.30 117.75 118.20

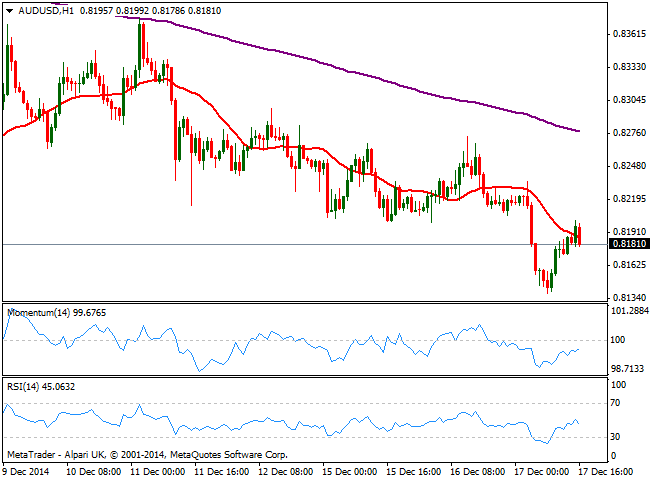

AUD/USD Current price: 0.8181

View Live Chart of the AUD/USD

The AUD/USD pair fell to a fresh multi-year low of 0.8138 during Asian hours, with no actual catalyst behind the slide but the strong ongoing bearish trend. Technically, the 1 hour chart shows the upward corrective movement following the mentioned low, found sellers around the 0.8200 figure, now immediate resistance. Indicators had corrected oversold readings but remain weak in negative territory as price hovers around its 20 SMA. In the 4 hours chart technical readings are biased lower, favoring further declines in the longer term regardless whatever happens with the FOMC today.

Support levels: 0.8140 0.8110 0.8075

Resistance levels: 0.8200 0.8230 0.8270

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.