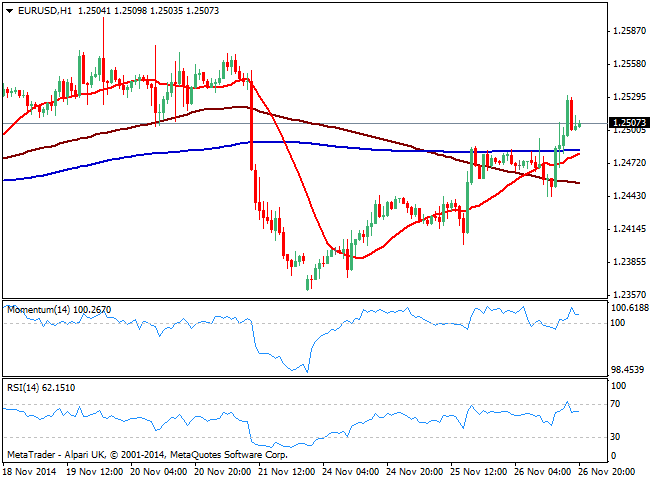

EUR/USD Current price: 1.2507

View Live Chart for the EUR/USD

A stack of US data ahead of the long Thanksgiving weekend ended up with a weaker greenback on Wednesday: Durable goods rose 0.4 percent in October, but the rise was largely supported by a jump in defense aircraft. Personal income increased less than expected, housing data was modest to be generous, and both Chicago PMI and Michigan consumer sentiment fell below previous month readings and expectations. But some profit taking in order to neat books may have also weighted in the forex board: summer vacations are around the corner and the big boys will start retreating.

In the meantime, the EUR/USD pair surged to a daily high of 1.2531, finding short term buyers on retracements towards the 1.2500 level. In its 1 hour chart, indicators aim higher after a limited downward correction above their midlines, while price extended above its moving averages. In the 4 hours chart indicators present a stronger upward momentum, whilst price stands once again above a mild bullish 20 SMA. Next line of sellers stands at 1.2550/60 so it will take a break above it to confirm a retest of the 1.2600 level over the upcoming sessions.

Support levels: 1.2485 1.2440 1.2400

Resistance levels: 1.2520 1.2555 1.2600

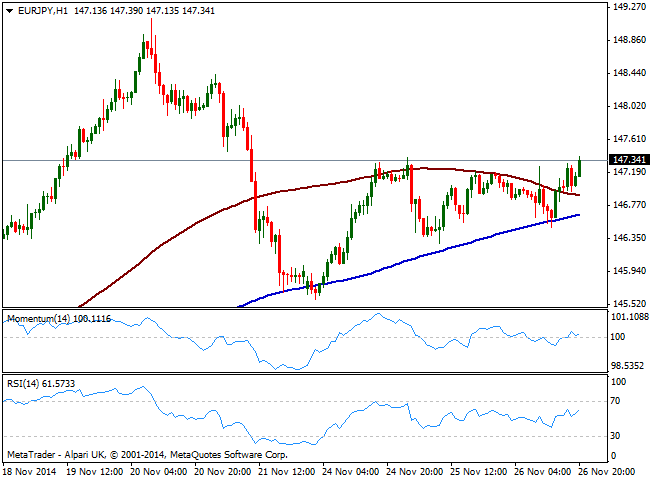

EUR/JPY Current price: 147.34

View Live Chart for the EUR/JPY

Yen’s BOJ-inspired slide may have reached a temporal bottom as lately, the enthusiasts sellers of the Japanese currency are missing in action. Nevertheless, the EUR/JPY cross has managed to post some intraday gains, dragged higher by EUR demand on speculation the ECB will remain on hold next week. Technically, the 1 hour chart shows price above 100 and 200 SMAs, both in a right 20 pips range, clear reflection of the latest lack of direction, while indicators aim higher above their midlines. In the 4 hours chart momentum has lost upward potential and turns lower above 100, while RSI remains strength less around 57. The overall tone is positive, yet pretending another round of strong advances seems out of the question for now, with 148.40/60 probably capping the upside over the next 48 hours.

Support levels: 146.90 146.40 145.90

Resistance levels: 147.65 148.10 148.50

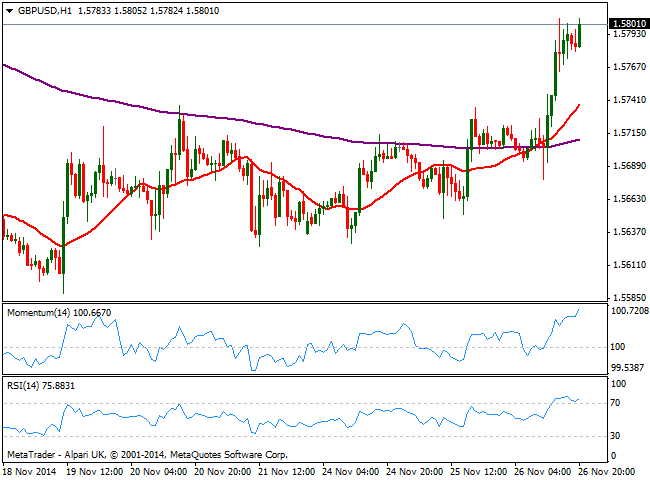

GBP/USD Current price: 1.5801

View Live Chart for the GBP/USD

Cable pressures its daily highs right above the 1.5800 figure, helped not only by dollar weakness, but by a pretty fair UK GDP revision to 3.0% as expected earlier on the day, unchanged from last month’s preliminary estimated. Business investment fall however in the 3rd quarter, suggesting confidence in the economic recovery of the kingdom has not picked up after latest months’ disappointments. The GPB/USD pair however managed to break above its recent range triggering short term stops and reaching a daily high of 1.5805. The 1 hour chart shows price extended above a bullish 20 SMA while indicators aim higher despite in overbought territory, supporting further advances. In the 4 hours chart indicators are losing recent strength also in overbought levels, while 200 EMA heads lower well above current price at 1.5890: that’s the line in the sand for the bearish tone seen over the last months, as price would need to extend above it to see a firmer midterm bullish potential.

Support levels: 1.5770 1.5740 1.5700

Resistance levels: 1.5825 1.5860 1.5890

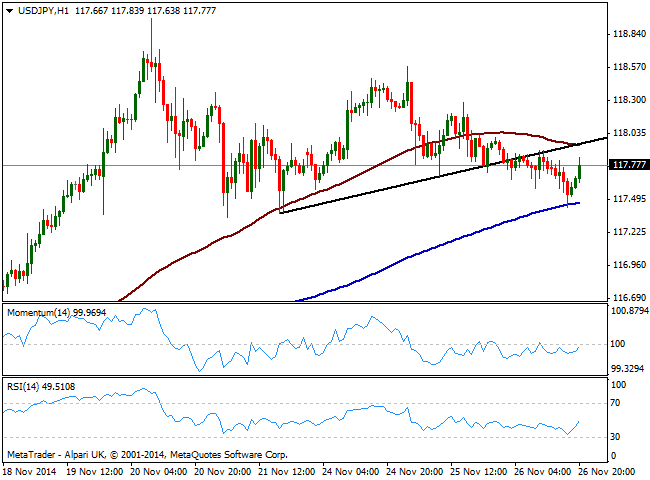

USD/JPY Current price: 117.77

View Live Chart for the USD/JPY

Little changed on the day, the yen has managed to advance against its American rival, with the USD/JPY however recovering from a daily low of 117.43. In the short term, the pair has broke below an ascendant trend line currently converging with 100 SMA at 117.95 and offering immediate intraday resistance, while indicators recovered up to their midlines turning now flat there. 200 SMA in the mentioned time frame, acted also as intraday support around the 117.30/40 area, level that holds the downside since 2 weeks ago. In the 4 hour chart the technical picture presents an increasing bearish potential, crossing their midlines to the downside albeit lacking momentum at the time being. A price acceleration below the level is now required to confirm further slides, eyeing then the 116.65 area as probable bearish target, while shy selling interest may begin to surge on approaches to 118.00.

Support levels: 117.35 117.00 116.65

Resistance levels: 117.95 118.40 118.90

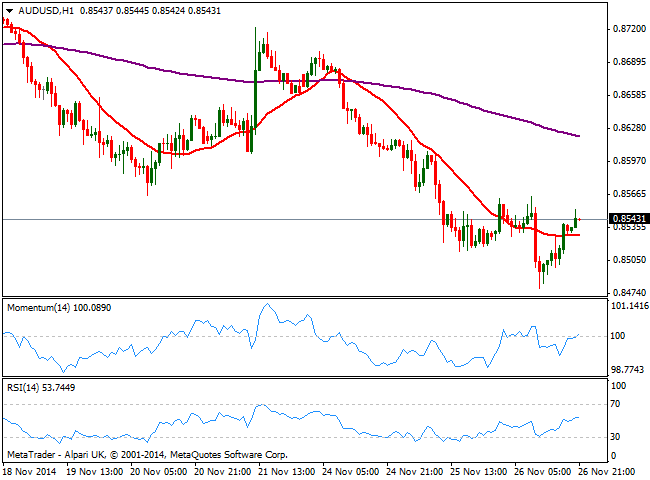

AUD/USD Current price: 0.8543

View Live Chart of the AUD/USD

Australian dollar fell down to 0.8479 against the greenback, albeit dollar weakness during US hours favored a recovery in the pair to current levels. Nevertheless, the movement was trend-drove, as the AUD/USD stands in a bear market. The 1 hour chart shows price now stands above a flat 20 SMA while indicators overcome their midlines showing no actual strength. In the 4 hours chart however, indicators barely bounced from extreme oversold levels and hold deep in the red, while 20 SMA maintains a strong bearish slope well above current price. Intraday rallies, if happen, will likely find sellers in the 0.8580/0.8610 price zone, while a short term slide below 0.8530 will likely anticipate further declines back towards the 4-year low posted this Wednesday.

Support levels: 0.8530 0.8500 0.8470

Resistance levels: 0.8580 0.8620 0.8645

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.