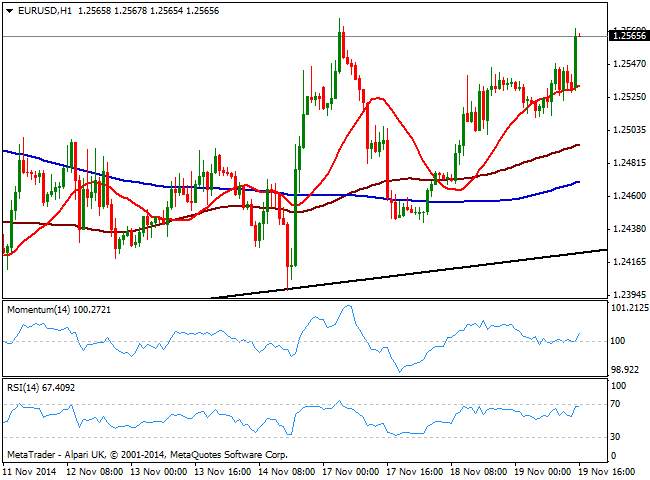

EUR/USD Current price: 1.2560

View Live Chart for the EUR/USD

The EUR/USD pair has shown little progress over these last two sessions, trading for most of the day around its early Asian opening and maintaining a short term neutral stance. Nevertheless, the pair accelerates higher early US session, approaching critical resistance area around 1.2570 also this week high. Technically, the 1 hour chart show indicators turned slightly higher above their midline as price extends above a flat 20 SMA. In the 4 hours chart price develops above a bullish 20 SMA but indicators stand in neutral territory, showing no actual directional strength. Later in the US afternoon, the FOMC will release its Minutes and is likely investors’ will wait until then before taking trading decisions.

Support levels: 1.2540 1.2500 1.2450

Resistance levels: 1.2570 1.2620 1.2660

GBP/USD Current price: 1.5687

View Live Chart for the GBP/USD

Pound surged against the greenback following the release of BOE’s Minutes, with votes unchanged at 7-2 and a slightly hawkish tone that surprised traders off guard: the pair was trading at a fresh year low of 1.5582 at the time, bouncing sharply afterwards. Technically, the 1 hour chart shows a mild positive tone, with price above a bullish 20 SMA and indicators aiming higher above their midlines. In the 4 hours chart price overcame its 20 SMA but indicators remain below their midlines, suggesting some further advances above current level are required to get some upward momentum towards 1.5770 tops.

Support levels: 1.5620 1.5585 1.5550

Resistance levels: 1.5700 1.5740 1.5770

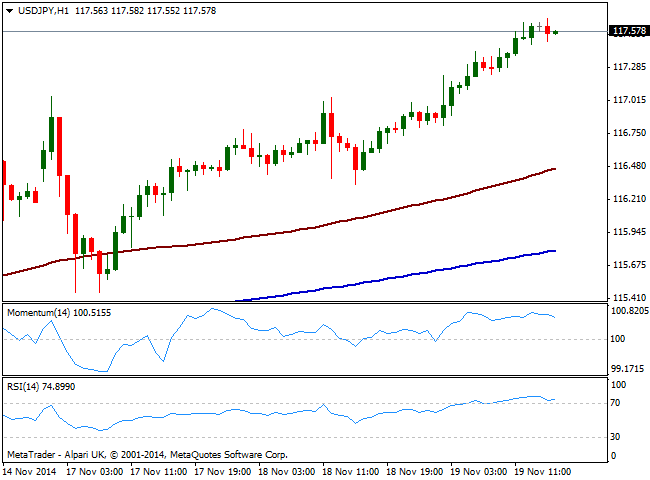

USD/JPY Current price: 117.57

View Live Chart for the USD/JPY

The USD/JPY advance extended up to 117.68, level not seen since October 2007, trading nearby early US session. The 1 hour chart shows indicators turning slightly lower from oversold levels, while moving averages head higher below current price. In the 4 hours chart indicators are also slightly exhausted to the upside, but there are no technical signs of a pullback or retracement against the dominant bullish trend.

Support levels: 117.45 117.05 116.60

Resistance levels: 117.85 118.20 118.60

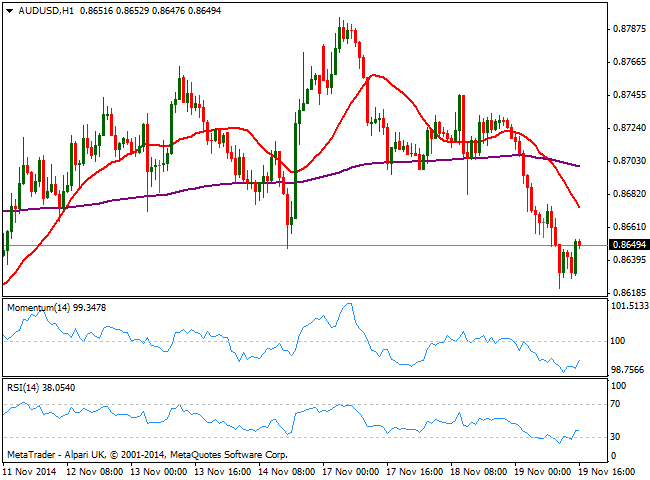

AUD/USD Current price: 0.8649

View Live Chart of the AUD/USD

The AUD/USD has been under selling pressure for most of the day, finally finding some short term buying interest at a daily low of 0.8621. The 1 hour chart shows price below a strongly bearish 20 SMA and indicators aiming higher from oversold levels, but still below their midlines, keeping the risk to the downside. In the 4 hours chart indicators gained bearish momentum and continue to head south into negative territory, whilst 20 SMA remains well above current price. Overall, the downside is favored, with a break below mentioned daily low exposing the 0.8550 price zone.

Support levels: 0.8620 0.8580 0.8550

Resistance levels: 0.8690 0.8740 0.8775

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.