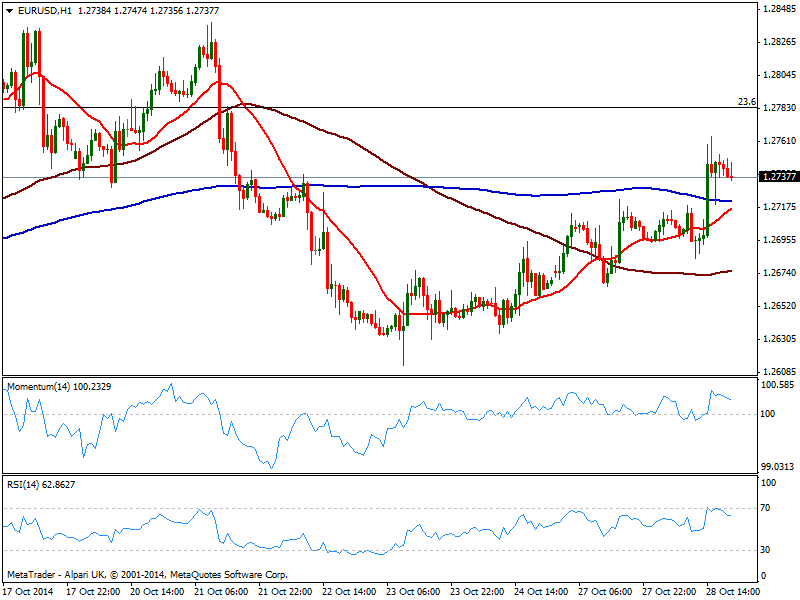

EUR/USD Current price: 1.2737

View Live Chart for the EUR/USD

Dollar ends lower across the board, particularly hit against commodity currencies since early European session, with both CAD and AUD surging to fresh multi week highs. As for European ones, the early session was extremely quiet ahead of US data, which ended up being quite mixed: first strong reading saw Durable Goods Orders missing expectations by far printing a whopping -1.3% for September, and triggering a dollar sell off across the board. 1 hour later US consumer confidence soared to a seven year high of 94.5, yet market players decided it was enough: there was almost no reaction across the forex board to this latest news, except a mild advance in USD/JPY. All eyes turned now to the FED monetary policy decision upcoming Wednesday, expected to trim the last $15B of QE and keep the wording unchanged.

As for the EUR/USD, the 1 hour chart shows indicators turning lower towards their midlines, with price holding above its moving averages: 20 SMA heads higher with a nice bullish slope, currently around 1.2710 acting as dynamic short term support. In the 4 hours chart indicators has lost the upward strength but remain in positive territory and far from suggesting a retracement. A critical resistance stands now in the 1.2780/90 price zone where the pair stalled several times over this October, and will probably keep the upside limited until the news.

Support levels: 1.2710 1.2670 1.2630

Resistance levels: 1.2790 1.2840 1.2885

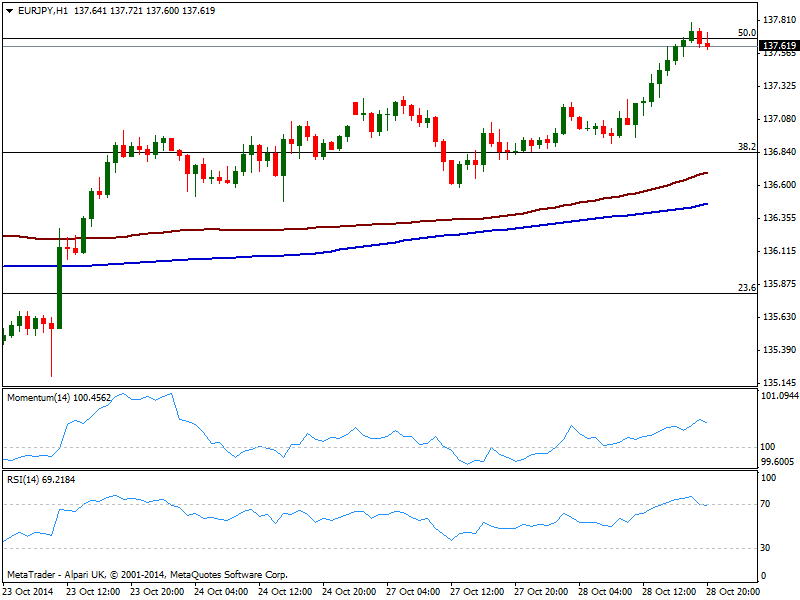

EUR/JPY Current price: 137.62

View Live Chart for the EUR/JPY

Yen extended its early week decline on the back of another good day among stocks, with indexes edging higher both in Europe and the US. Euro advanced favored an EUR/JPY jump up to current levels, stalling around a critical resistance: 100 DMA stands a couple pips above current price, alongside with the 50% retracement of the 141.21/134.13 slide. Having seen practically no retracements after reaching 137.79, risk has turned towards further gains. Technically, the 1 hour chart shows indicators turning flat in overbought territory, while 100 and 200 SMAs finally start to move, gaining some bullish slope well below current price. In the 4 hours chart the bias is also higher, with some further advances beyond 137.90 now required to confirm more intraday gains.

Support levels: 137.40 137.00 136.60

Resistance levels: 137.90 138.40 138.85

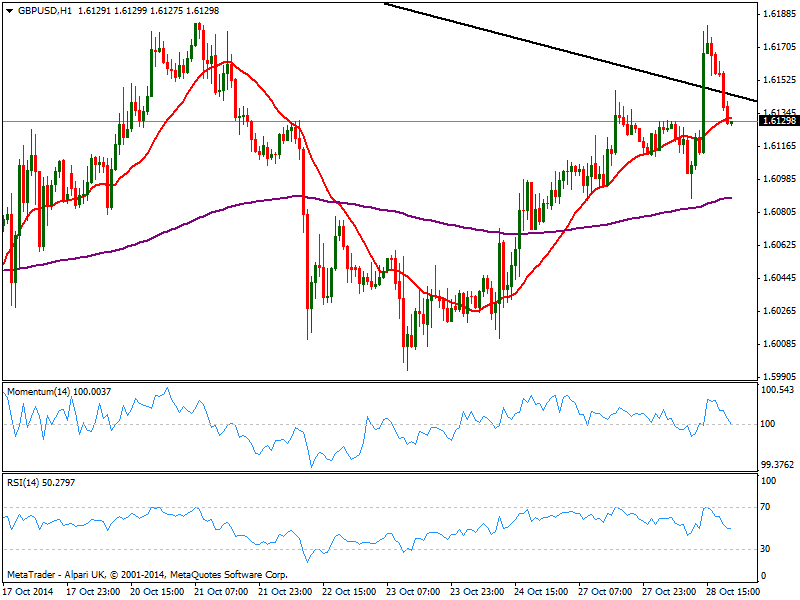

GBP/USD Current price: 1.6129

View Live Chart for the GBP/USD

Having posted a daily high of 1.6182, the GBP/USD finally pulled back below the daily ascendant trend line coming form 1.7190, leaving a bitter taste on bull’s mouth. The slow but steady slide over American hours, sees the pair entering Asian ones with a bearish short term tone, as per current candle opening below its 20 SMA and indicators about to cross their midlines to the downside with a strong bearish slope. In the 4 hours chart indicators also turned lower but remain well above their midlines, while 20 SMA now offers immediate intraday support at 1.6090. Furthermore in this last time frame, 200 EMA capped the upside around mentioned daily high quite significant in the longer run, as further declines will point for a return of the bearish trend.

Support levels: 1.6090 1.6050 1.6010

Resistance levels: 1.6145 1.6185 1.6220

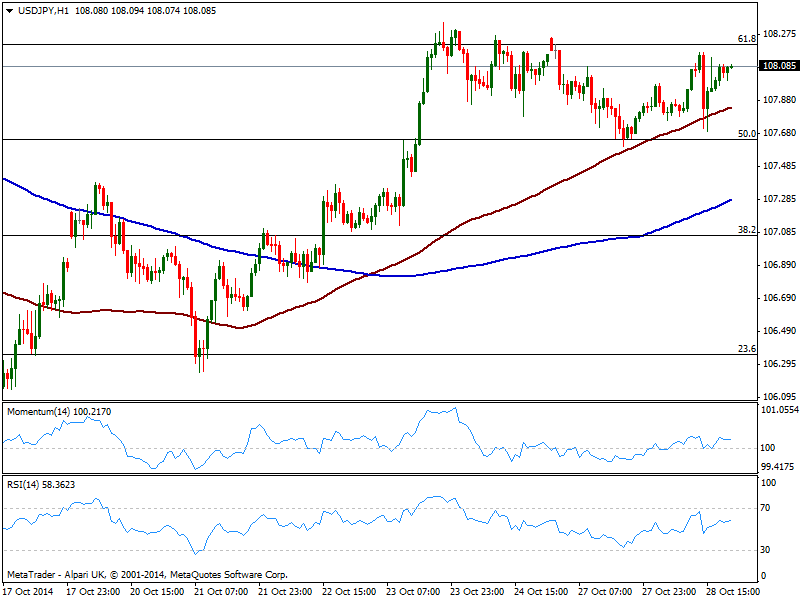

USD/JPY Current price: 108.80

View Live Chart for the USD/JPY

The USD/JPY has made little progress this Tuesday, confined to the range set by Fibonacci levels, in between 107.60 and 108.20: those represent the 50% and the 61.8% retracements of the latest bearish run from 110.08/105.19. The 1 hour chart maintains a mild positive tone, with indicators flat above their midlines, but 100 SMA maintaining a strong upward tone and still advancing well above 200 one. In the 4 hours chart, technical readings are quite neutral, which means a clear break of mentioned extremes is required to see the pair setting a more directional bias.

Support levels: 107.55 107.10 106.70

Resistance levels: 108.20 108.50 108.90

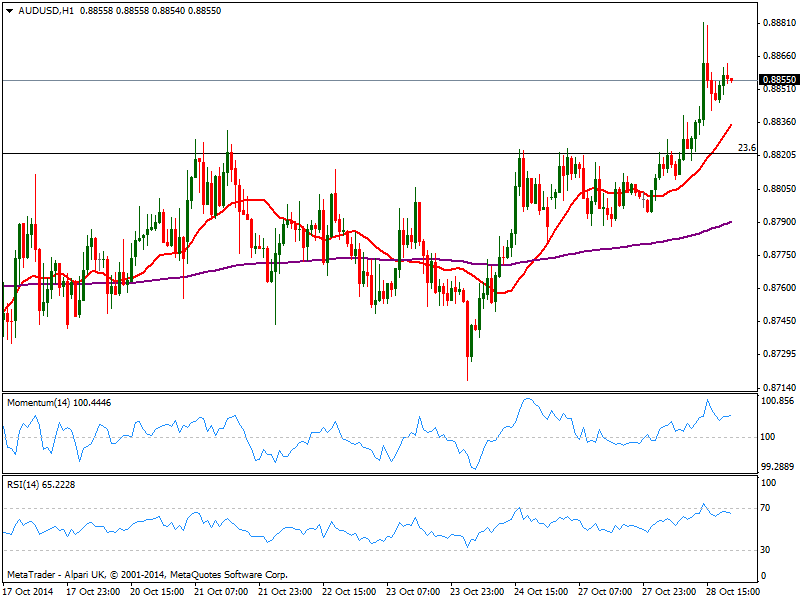

AUD/USD Current price: 0.8855

View Live Chart of the AUD/USD

Aussie finally woke up, reaching 0.8881 against the greenback, and holding now well above the 0.8820 support as a new day starts. The latest slide may have to do partially with gold late slump, as the metal gave up most of its intraday gains in the latest hours. Nevertheless, the pair maintains a bullish tone as per the breakout of its latest range. Technically the 1 hour chart shows a positive tone with indicators now flat above their midlines and a strong bullish 20 SMA well below current price. In the 4 hours chart the picture is quite similar, with price above a flat 20 SMA and indicators now lacking strength in positive territory.

Support levels: 0.8820 0.8770 0.8730

Resistance levels: 0.8890 0.8930 0.8970

Recommended Content

Editors’ Picks

AUD/USD holds positive ground above 0.6500 on weaker US Dollar

The AUD/USD pair extends recovery around 0.6525 during the early Asian session on Thursday. The Federal Reserve held its interest rates steady at 5.25–5.50% at its meeting on Wednesday, citing a “lack of further progress” in getting inflation back down to its 2% target.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.