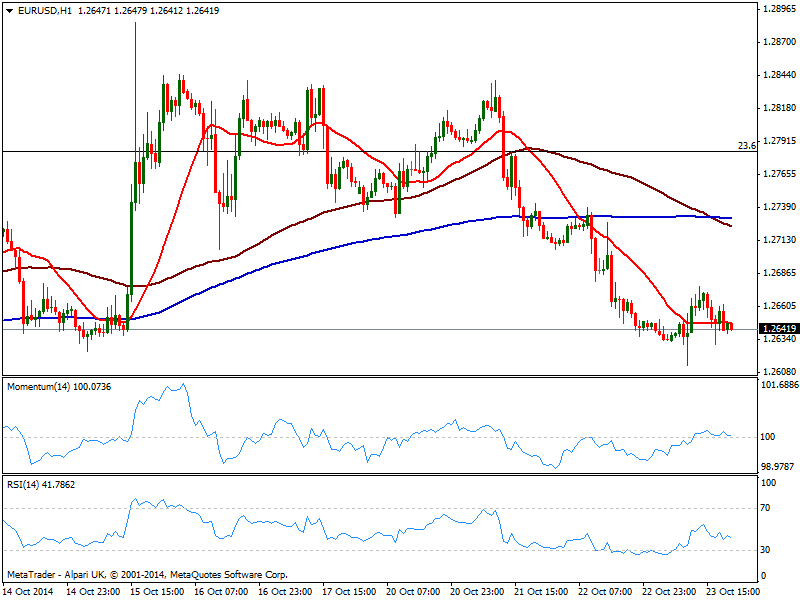

EUR/USD Current price: 1.2641

View Live Chart for the EUR/USD

Solid gains amongst American indexes supported a mild advance in the greenback this Thursday that in some cases managed to extend to new week highs. In Europe, German and EZ PMIs came out better than expected, giving the common currency a short term boost up to 1.2676 against the greenback, yet the pair reverted most of such gains during early US hours. In the US, data was far from encouraging, pretty much in line with expected of even a couple ticks below, probably the only reason why dollar demand remained limited.

Nevertheless the EUR/USD maintains its weak tone, with the 1 hour chart showing price moving back and forth around a flat 20 SMA and indicators with a mild bearish slope in neutral territory, and the 4 hours chart presenting a strong bearish bias in its technical readings. The pair has been facing some buying interest in the 1.2610/20 price zone lately, so once those bulls give up, the downside will be exposed to a quick slide towards 1.2570 price zone. To the upside, the immediate short term resistance comes at 1.2660, with a break above it pointing for a retest of the 1.2700 figure as probable top for next Friday.

Support levels: 1.2620 1.2580 1.2550

Resistance levels: 1.2660 1.2700 1.2740

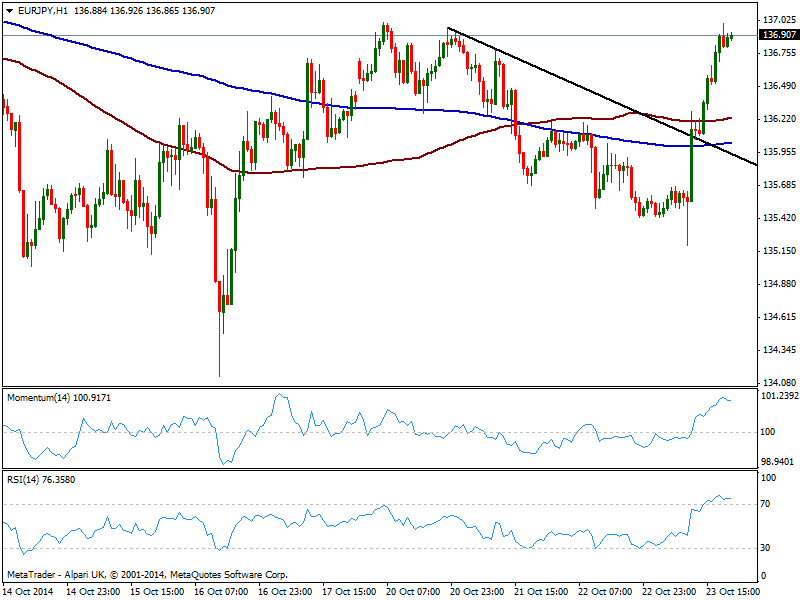

EUR/JPY Current price: 136.90

View Live Chart for the EUR/JPY

Yen was subject of a massive selloff against most rivals, with the EUR/JPY triggering stops and accelerating north several times on the day, and hardly looking back. DJIA added over 300 points on the day and the S&P added near 1.8%, while US 10Y notes yields tick higher, up to 2.29%: the perfect scenario for yen losses. The pair has broke above a short term descendant trend line, currently around 135.70, and the hourly chart shows price well above moving averages, both flat a handful of pips above and below the 136.00 figure, while indicators begin to give signs of exhaustion in overbought territory. In the 4 hours chart technical readings are biased higher barely crossing their midlines, with immediate support now in the 136.40 price zone: if the level holds on corrections, an upward acceleration should see the pair extending near 138.00 over this upcoming Friday.

Support levels: 136.40 136.00 135.35

Resistance levels: 137.05 137.55 138.00

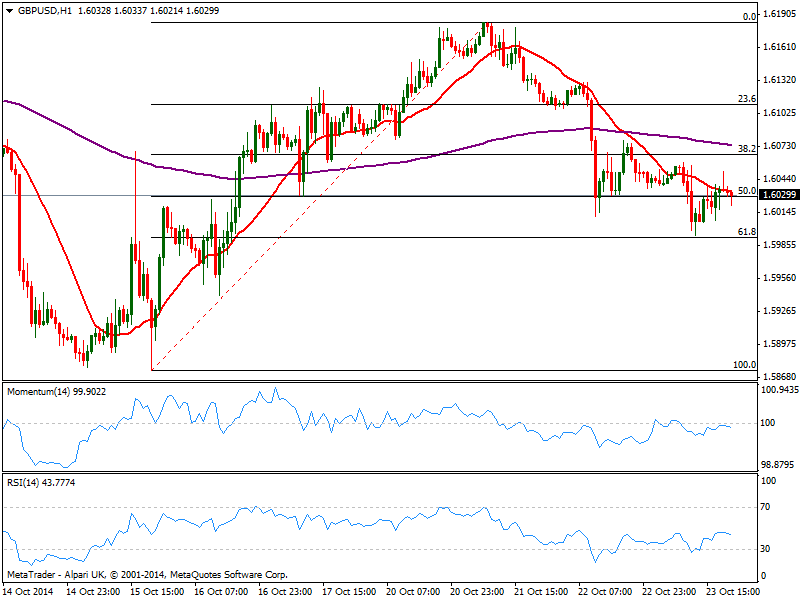

GBP/USD Current price: 1.6029

View Live Chart for the GBP/USD

The GBP/USD flirted with the 1.6000 level after the release of weak UK Retail Sales, a confirmation the speed of economic growth suspected earlier on the year is not enough to anticipate a sooner rate hike. The pair however, found some buying interest around the critical figure, enough to make the pair bounce around 40 pips. Currently trading at the 50% retracement of its latest bullish run from 1.5874 to 1.6171, the hourly chart shows a bearish 20 SMA also around the Fibonacci level at 1.6030, while indicators present a mild negative tone below their midlines. In the 4 hours chart indicators remain well into negative territory, but losing the bearish strength seen earlier on the day, while 20 SMA maintains a strong bearish slope above current price. As long as below 1.6100, the risk to the downside is big with a break below 1.5995 pointing to a quick slide towards the 1.5940/50 price zone.

Support levels: 1.5995 1.5950 1.5910

Resistance levels: 1.6065 1.6090 1.6125

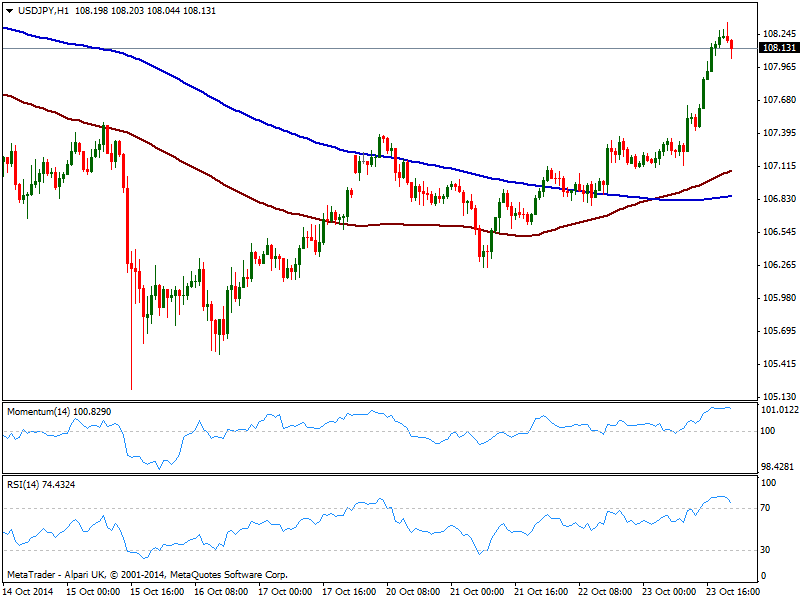

USD/JPY Current price: 108.14

View Live Chart for the USD/JPY

The USD/JPY surged up to 108.35, breaking through a couple of intraday resistances, now supports, without looking back. As in the case of EUR/JPY, stocks and yields advancing in the US was the main support for the pair now stable above 108.00. Short term, the 1 hour chart shows price well above 100 and 200 SMAs, with the shortest above the largest, and indicators turning lower in extreme overbought territory, not yet signaling a probable bearish correction. In the 4 hours chart technical readings are also losing upward strength in overbought territory, with 107.60 as the level to watch to add buys in case of retracements.

Support levels: 108.00 107.60 107.35

Resistance levels: 108.50 108.90 109.30

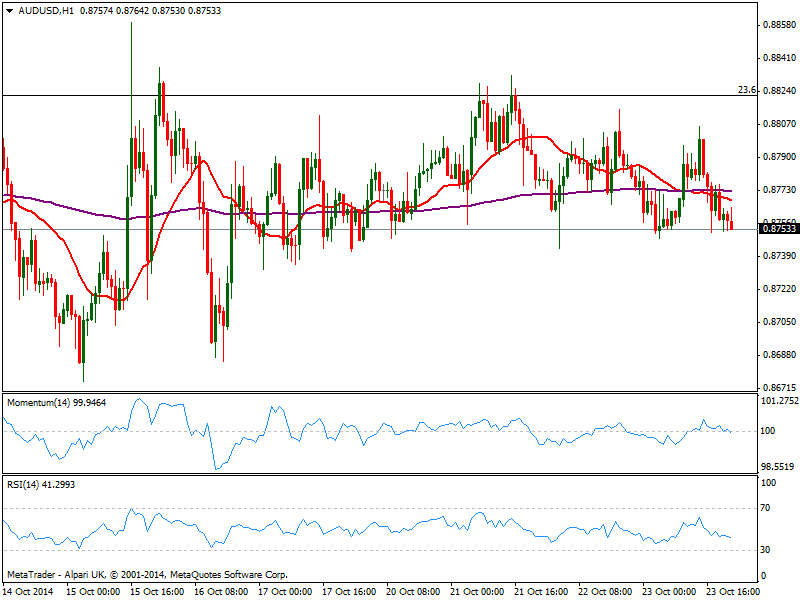

AUD/USD Current price: 0.8753

View Live Chart of the AUD/USD

The AUD/USD trades near its daily low by US close, without nothing new to add to these last days view: the pair continues to trade in a limited range, albeit the 1 hour chart shows an increasing bearish potential, yet to be confirmed with a break below 0.8730 immediate support: price stands below a mild bearish 20 SMA as indicators turn lower around their midlines. In the 4 hours chart the picture is pretty much the same, with price hovering right below a flat 20 SMA and indicators gaining bearish slope below their midlines. Below mentioned support, the bearish movement may accelerate, with further slides below 0.8690 pointing to a test of 0.8640, base of the widest range.

Support levels: 0.8730 0.8690 0.8640

Resistance levels: 0.8770 0.8820 0.8860

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD clings to small gains above 1.2550

Following Friday's volatile action, GBP/USD edges highs and trades in the green above 1.2550. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold price rebounds on downbeat NFP data, eyes on Fedspeak

Gold price (XAU/USD) snaps the two-day losing streak during the European session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Fed.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.