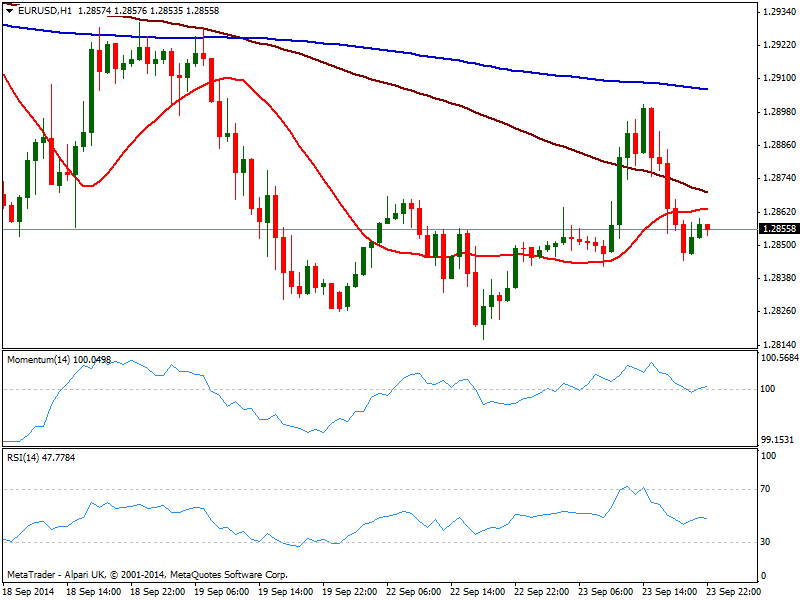

EUR/USD Current price: 1.2856

View Live Chart for the EUR/USD

Dollar suffered a setback early Europe, with air strikes to Syria triggering demand of safe haven yen and dollar, and pushing investors to dump the greenback, that eased against most of its rivals. Commodity currencies have been however unable to pick up suffering from self weakness all day long. Among stocks, European indexes closed in the red, while American indexes also suffered, erasing most of last week gains by Tuesday close.

As for the EUR/USD the pair corrected higher, reaching 1.2900 from where the selling resumed: the pair closes the day a couple pips above its daily opening, around its 1.2850 latest comfort zone. PMIs in Europe showed the slowdown continues in the area, doing little to support the rally. Technically, the hourly chart shows price below moving averages, and indicators aiming higher but in neutral territory, keeping the risk to the downside. In the 4 hours chart technical readings maintain the bearish tone, supporting the shorter term view, albeit a break below 1.2810 is required to confirm a new leg lower.

Support levels: 1.2810 1.2775 1.2740

Resistance levels: 1.2865 1.2920 1.2950

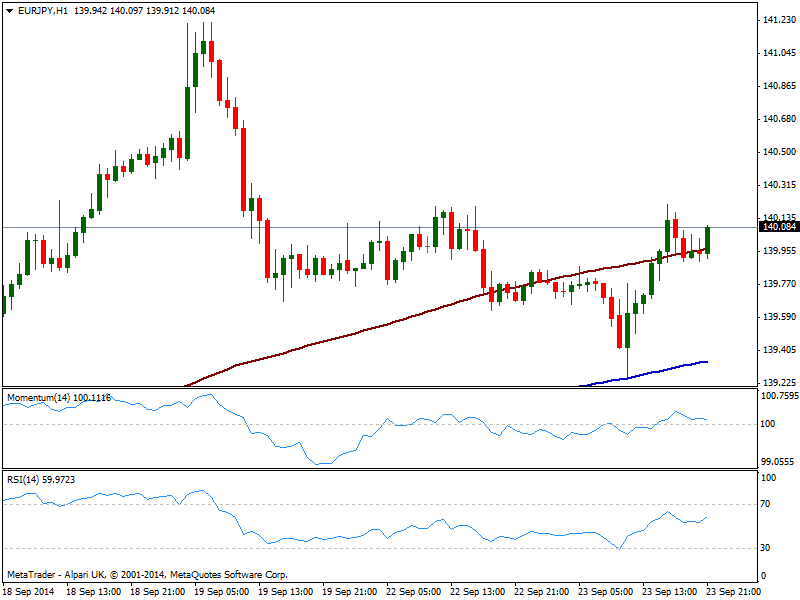

EUR/JPY Current price: 140.07

View Live Chart for the EUR/JPY

Yen temporal strength was seen as a buying opportunity by investors, as the EUR/JPY bounced nicely from 139.26, daily low, aiming now to establish above the 140.00 figure. The 1 hour chart shows price barely above 100 SMA, while 200 one provided support at mentioned daily low; indicators in the same time frame aim slightly higher above their midlines, showing a limited upward strength at the time being. In the 4 hours chart however, indicators stand in neutral territory, also lacking upward strength: some steady consolidation above mentioned 140.00 figure followed by an acceleration through 140.40 immediate resistance should confirm the bullish intraday tone and see an approach up to 141.00 price zone.

Support levels: 140.00 139.50 139.20

Resistance levels: 140.40 140.80 141.20

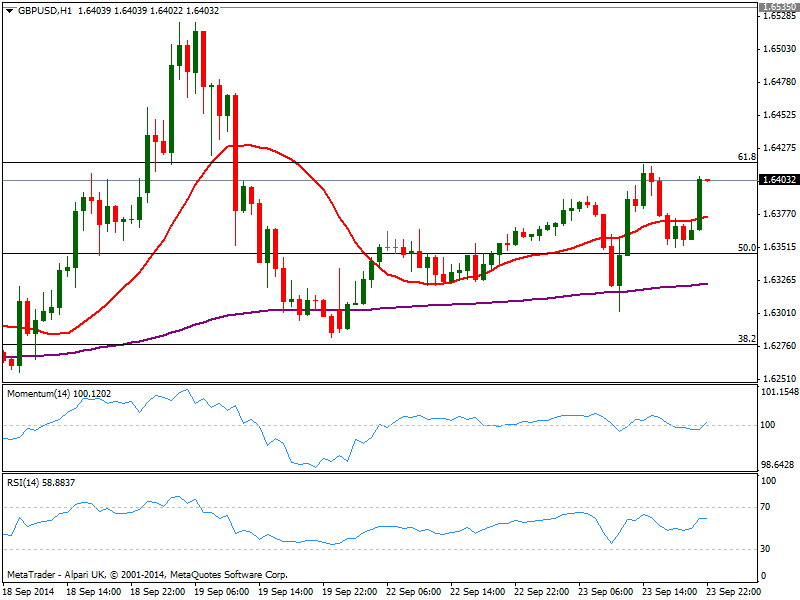

GBP/USD Current price: 1.6400

View Live Chart for the GBP/USD

The GBP/USD is slowly regaining its bullish tone, having extended up to 1.6415 intraday with the pair holding nearby as the US session comes to an end. The 1 hour chart shows price holding below a key Fibonacci level, with a mild positive tone coming from technical readings, while the 4 hours chart shows price above a bullish 20 SMA yet indicators also lacking upward strength, as per holding in neutral territory. For the most, the upward tone seems ready to resume, with the upside now favored on a break above mentioned Fibonacci level, eyeing a short term advance up to 1.6460.

Support levels: 1.6345 1.6300 1.6275

Resistance levels: 1.6415 1.6460 1.6500

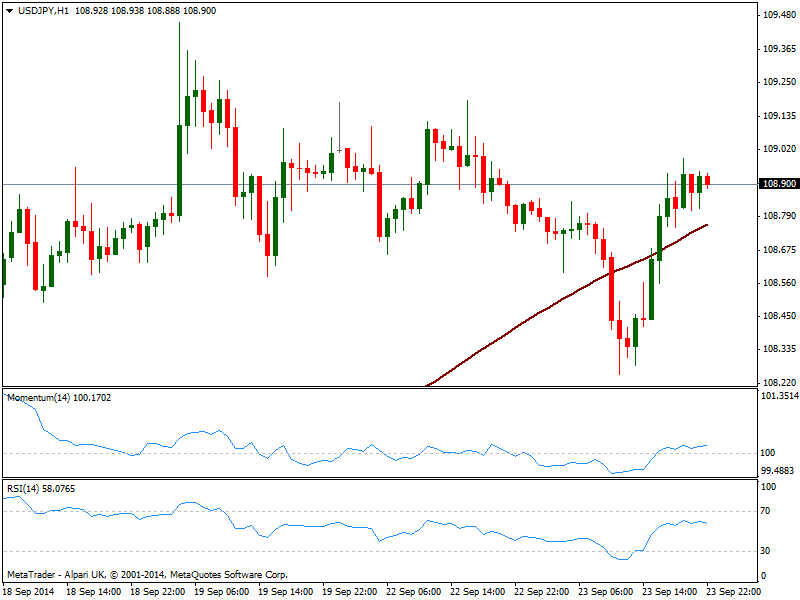

USD/JPY Current price: 108.90

View Live Chart for the USD/JPY

The bullish trend in the USD/JPY has proved strong, as the pair bounced from a daily low of 108.25 back to the 109.00 price zone, despite the strong slide in stocks markets on risk sentiment. The 1 chart shows price consolidating above a still bullish 100 SMA while indicators present a mild positive tone above their midlines. In the 4 hours chart technical readings recovered above 100 with momentum heading north and RSI mostly flat around 60, all of which limits the downside at the time being. To confirm a move higher however, price needs to accelerate beyond 109.45, last week high and critical resistance.

Support levels: 108.65 108.10 107.70

Resistance levels: 109.45 109.80 110.10

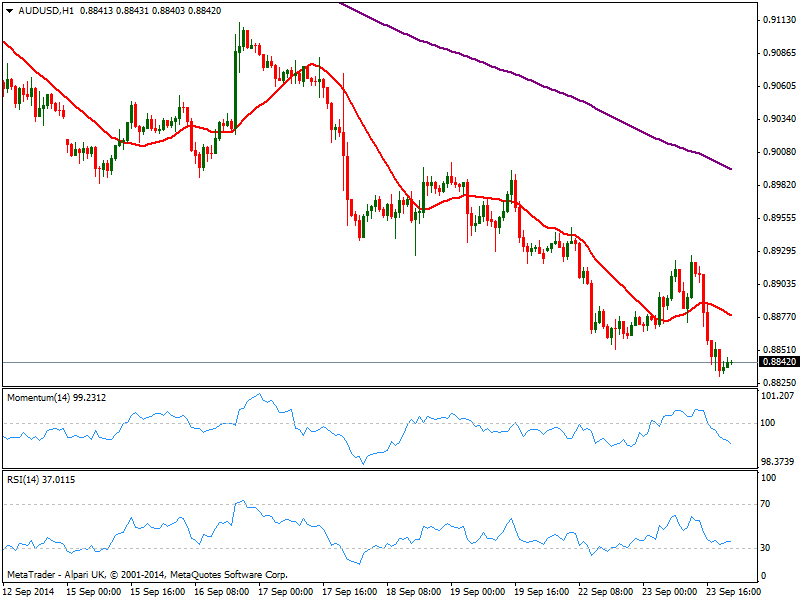

AUD/USD Current price: 0.8842

View Live Chart of the AUD/USD

The AUD/USD saw a temporal relieve during Asian hours, with a tick up in Chinese PMI sending the pair up to 0.8920, but the pair was unable to hold to its gains, and resumed its decline to a new monthly low of 0.8830. Trading a few pips above this last, the 1 hour chart shows price below a bearish 20 SMA and momentum heading strongly south below its midline, while the 4 hours chart shows also a strong bearish momentum, all of which support further falls: short term, price may extend down to 0.8770 on a break below mentioned daily low, but eyeing an extension down to 0.8600 area for the upcoming days.

Support levels: 0.8830 0.8800 0.8770

Resistance levels: 0.8865 0.8920 0.8950

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY crashes nearly 450 pips to 155.50 on likely Japanese intervention

Having briefly recaptured 160.00, USD/JPY came under intense selling to test 155.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.