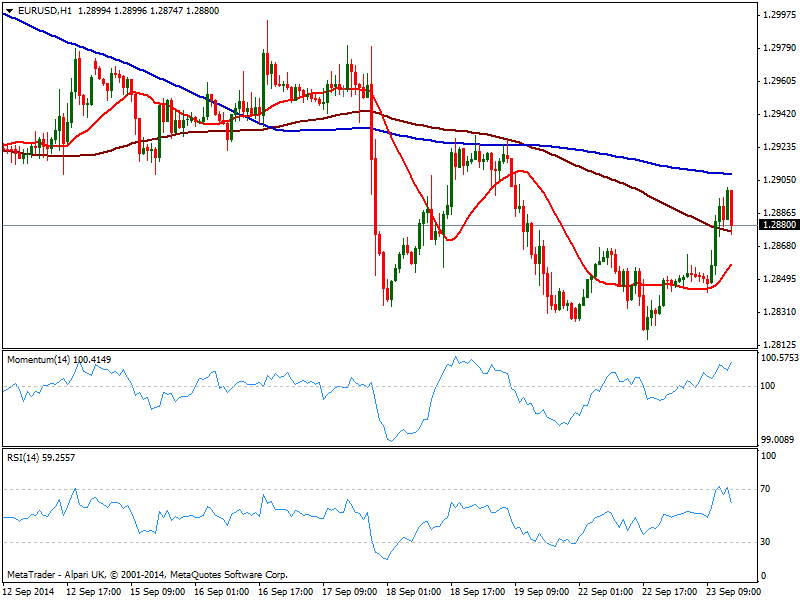

EUR/USD Current price: 1.2880

View Live Chart for the EUR/USD

Market is not in the mood of following the greenback this Tuesday, with US 10Y yields down to 2.54%, and US futures also extending their decline. European indexes trade in deep red, as headlines from Syria attacks boosted risk aversion. Funny, dollar is trading along with stocks, as it has become quite usual lately, with gold and yen as the preferred safe havens of the day. The EUR/USD flirted with the 1.2900 level from where its currently pulling down: the hourly chart shows price finding short term support around its 100 SMA, while momentum and 20 SMA continue to head higher. In the 4 hours chart current candle opened above a flat 20 SMA, standing now a few pips above it, while indicators hold below their midlines. The upside remains limited by 1.2920 strong static resistance level, and will take some gains above it to confirm further upward extensions in the pair.

Support levels: 1.2865 1.2810 1.2770

Resistance levels: 1.2920 1.2950 1.2990

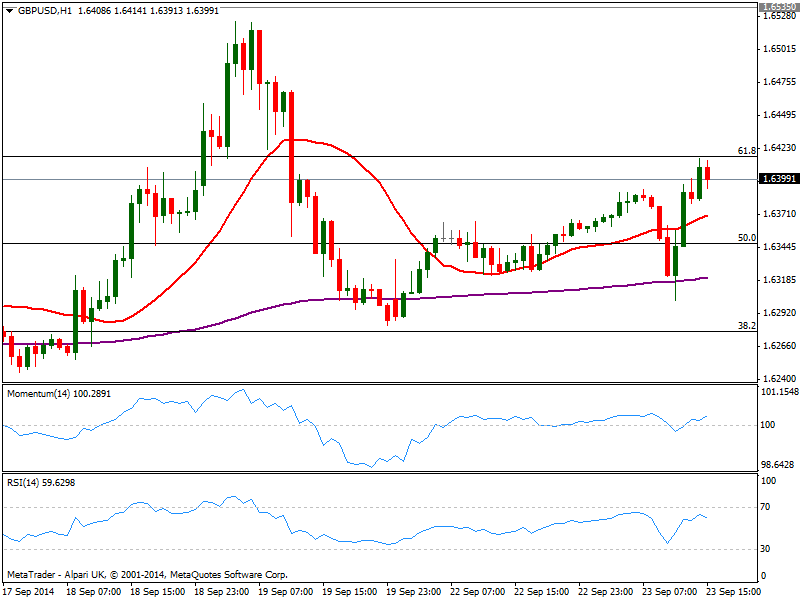

GBP/USD Current price: 1.6399

View Live Chart for the GBP/USD

The GBP/USD reached an intraday high of 1.6415, stalling at the 61.8% retracement of September slide, but maintaining most of its recent gains. The strong bounce from a daily low of 1.6302 suggests there’s room for further gains with the 1 hour chart showing price above a bullish 20 SMA and momentum presenting a mild positive tone. In the 4 hours chart price stands above its 20 SMA while indicators aim higher, albeit momentum holds below 100, showing a limited upward strength at the time being. Some follow through above mentioned resistance should lead to a continued advance, eyeing 1.6450/60 area as immediate target, ahead of recent highs at the 1.6530 price zone.

Support levels: 1.6345 1.6300 1.6275

Resistance levels: 1.6415 1.6460 1.6500

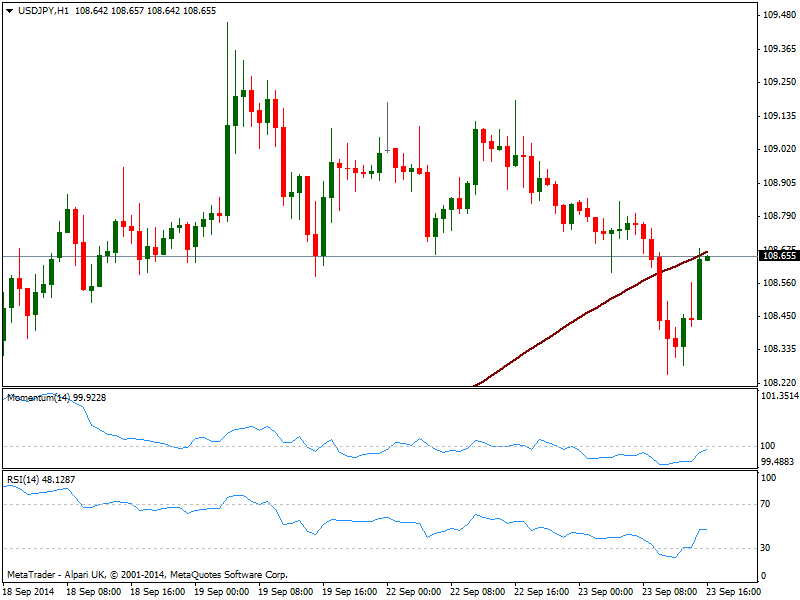

USD/JPY Current price: 108.65

View Live Chart for the USD/JPY

The USD/JPY slip down to 108.25 before recovering some, struggling now around former support of 100 SMA in the hourly chart around 108.60; indicators in the same time frame show indicators corrected some but remain in negative territory, while the 4 hours chart shows a mild bearish tone coming from technical readings. Further falls below 108.10 should lead to an extension of the short term negative tone, yet some advances above mentioned 100 SMA will likely see the pair back near 109.00 price zone.

Support levels: 108.10 107.70 107.35

Resistance levels: 108.65 109.00 109.45

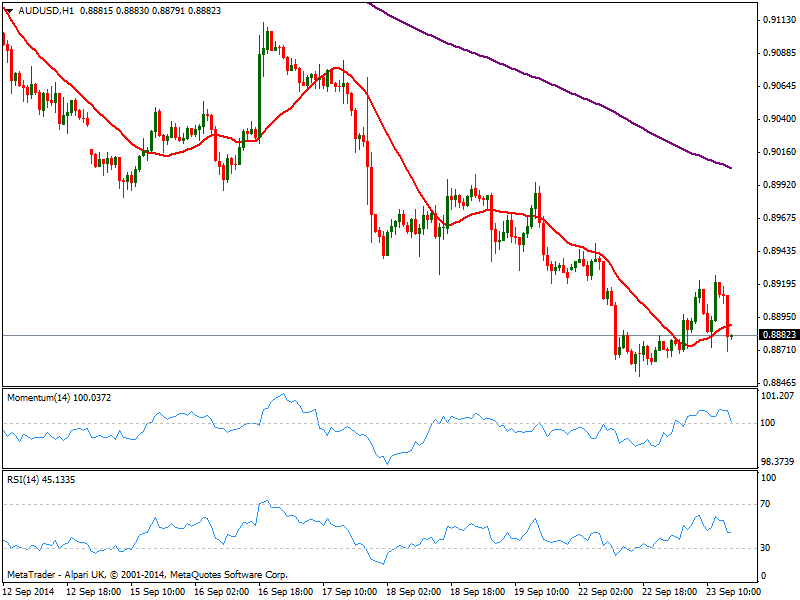

AUD/USD Current price: 0.8826

View Live Chart of the AUD/USD

The AUD/USD found some support over Asian hours, on a better than expected Chinese PMI that anyway failed to signal a strong local recovery. The pair advanced up to 0.8920 but was unable to sustain gains above the key figure, trading down near its daily opening. The 1 hour chart shows price below its 20 SMA and indicators turning lower in positive territory approaching their midlines, while the 4 hours chart price stalled at a bearish 20 SMA while indicators maintain the negative tone below their midlines.

Support levels: 0.8860 0.8830 0.8800

Resistance levels: 0.8920 0.8950 0.8990

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD trades on a stronger note 1.2530, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The United States Employment report will be released by the Bureau of Labor Statistics at 12:30 GMT. The US Dollar looks to employment data after the Fed signaled its intention to hold rates higher for longer on Wednesday.