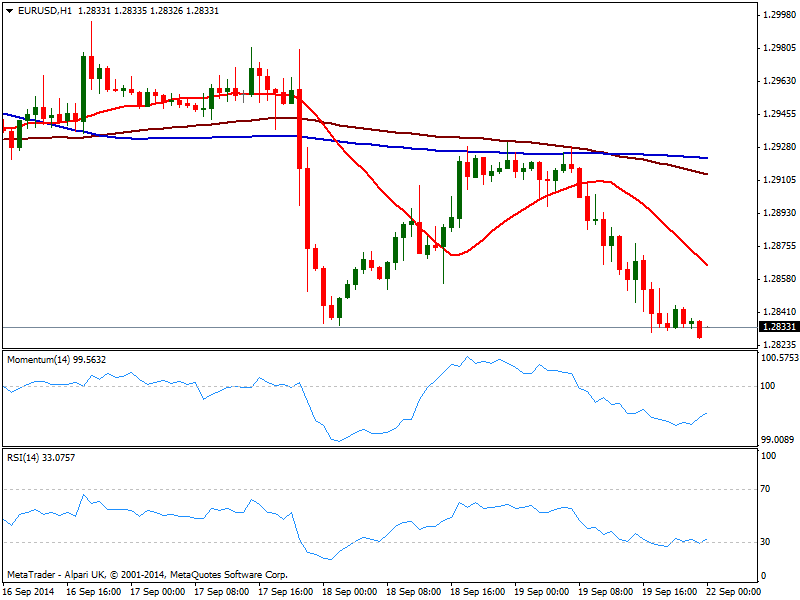

EUR/USD Current price: 1.2831

View Live Chart for the EUR/USD

The EUR/USD trades effectively unchanged from Friday’s close, at a fresh year low set by New York closing bell. The week ahead, despite a much lighter calendar, will include Draghi’s testimony on monetary policy before the European Parliament's Economic and Monetary Committee, in Brussels mid European morning this Monday, which may imprint some intraday volatility to the pair. But beyond that, the dominant bearish trend remains firm in place despite oversold readings short and longer term.

Technically, the hourly chart shows price well below a bearish 20 SMA, currently around 1.2865 with indicators barely bouncing from oversold levels. In the 4 hours chart momentum continues to head south into negative territory, as RSI stands at 33 giving no signs of a probable recovery. Ahead of mentioned Draghi’s speech, the pair can remain range bound, with a price acceleration below 1.2810 however, opening doors for a slide down to 1.2740 price zone, strong long term static support.

Support levels: 1.2810 1.2770 1.2840

Resistance levels: 1.2865 1.2910 1.2950

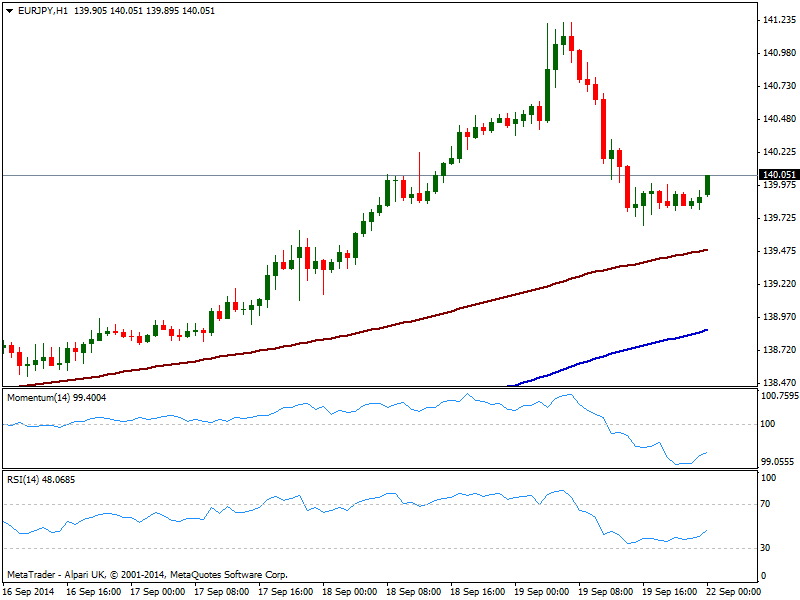

EUR/JPY Current price: 140.05

View Live Chart for the EUR/JPY

The EUR/JPY retraced from a 4-month high of 141.21, consolidating now around the 140.00 level. Yen weakness has been largely welcomed by BOJ Governor Kuroda who pledged to provide more stimulus if needed, a bit of jawboning to fuel markets. As a new week starts, the hourly chart shows price advancing above the 140.00 mark with indicators recovering from oversold territory, still below their midlines, and 100 SMA acting as intraday support in case of a decline around 139.50. In the 4 hours chart indicators corrected overbought conditions and slowly turn back north well into positive territory, suggesting latest retracement has been just corrective. Nevertheless the critical resistance stands at 140.40, and a recovery above it should support a steadier advance towards mentioned highs.

Support levels: 139.50 139.10 138.60

Resistance levels: 140.40 140.80 141.20

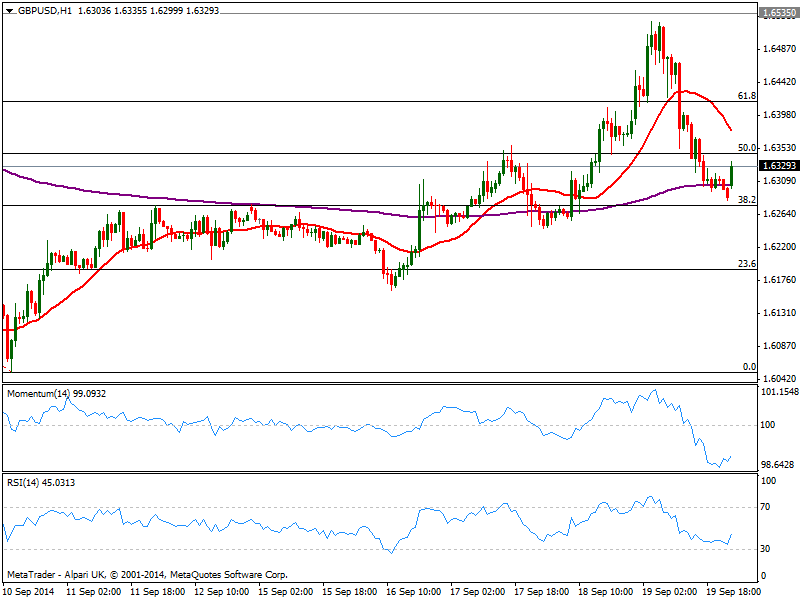

GBP/USD Current price: 1.6329

View Live Chart for the GBP/USD

The GBP/USD has gave back all of the ground added on a discounted “NO” win before it actually happened, with investors profiting from latest rally to 1.6530 price zone. Trading around pre Scottish referendum fever levels, the hourly chart shows price firming up from the 38.2% retracement of this September fall from 1.6643 to 1.6051 at 1.6275, with indicators advancing some from oversold levels and 20 SMA heading strongly south well above current price. In the 4 hours chart 20 SMA converges with the 50% retracement of the same rally at 1.6345, offering immediate resistance, while indicators head south right below their midlines: some steady gains above the level should favor further intraday recoveries yet below 1.6270, risk turns to the downside, eyeing 1.6160 price zone.

Support levels: 1.6275 1.6220 1.6160

Resistance levels: 1.6345 1.6410 1.6470

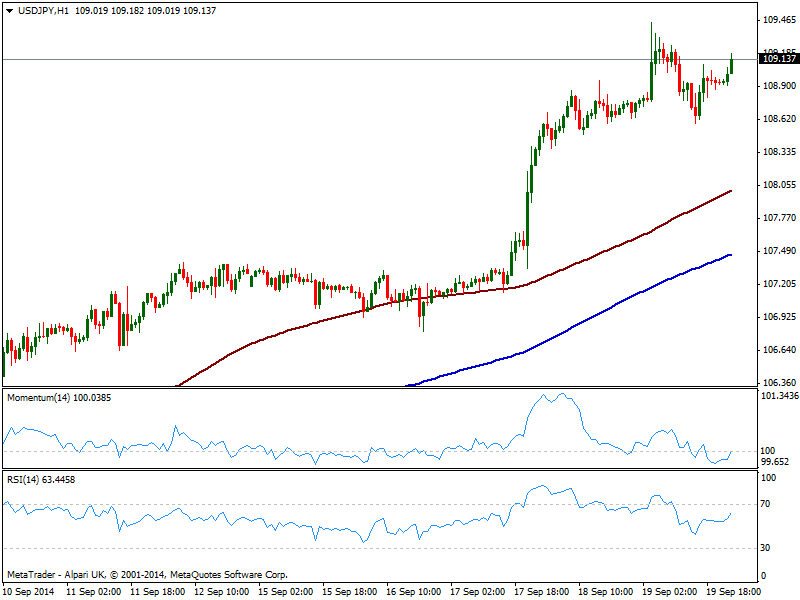

USD/JPY Current price: 109.13

View Live Chart for the USD/JPY

The USD/JPY holds above the 109.00 level, with yen unable to sustain modest advances against the greenback: latest retracement has found buyers in the 108.50/60 price zone, now immediate support, with 1 hour indicators aiming higher around their midlines, and moving averages maintaining their bullish slopes well below current price. In the 4 hours chart, indicators head higher in overbought territory after a limited downward correction, supporting the dominant bullish trend. Retracements down to mentioned price zone will likely attract buyers again while a break above 109.45 exposes the pair to an advance up to 110.00 critical figure.

Support levels: 108.95 108.55 108.10

Resistance levels: 109.45 109.75 110.20

AUD/USD Current price: 0.8921

View Live Chart of the AUD/USD

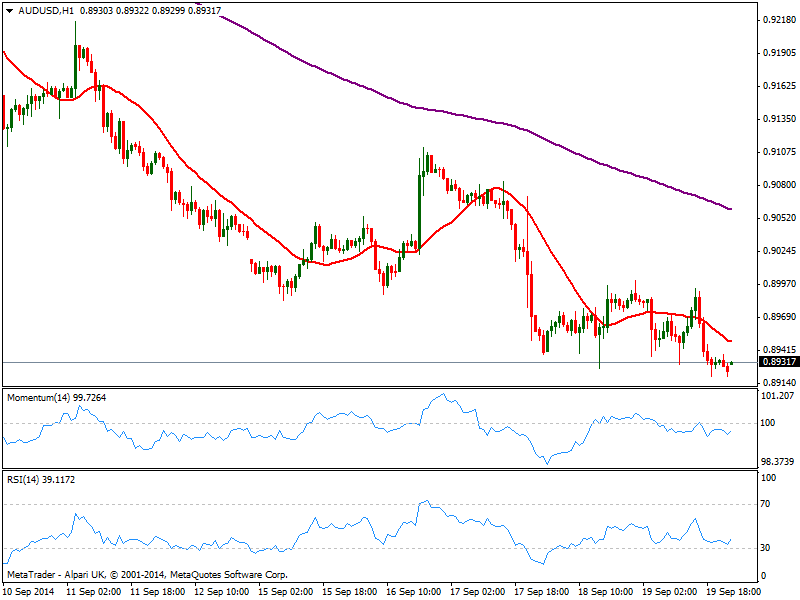

Having lost almost 5 cents since the month started the AUD/USD trades near 0.8900, levels not seen since March this year. The 1 hour chart shows price below a bearish territory, but indicators directionless below their midlines, showing no actual strength. In the 4 hours chart indicators present a mild bearish tone well into negative territory, with 20 SMA presenting a strong bearish slope now around 0.8990 acting as intraday resistance.

Support levels: 0.8910 0.8880 0.8830

Resistance levels: 0.8950 0.8990 0.8940

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.