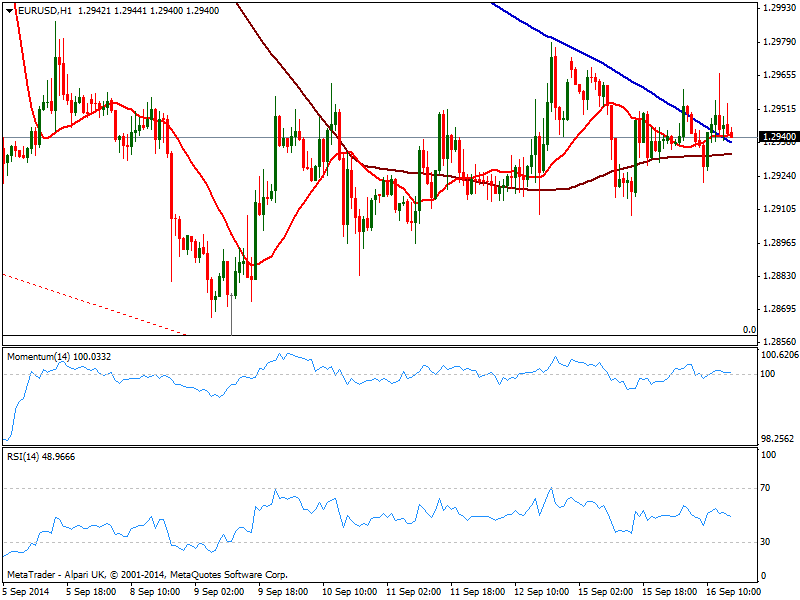

EUR/USD Current price: 1.2940

View Live Chart for the EUR/USD

The EUR/USD maintains the tight range, having been rejected from 1.2970 daily high. Trading in a 100 pips range for eighth day in a row, the hourly chart shows price hovering around 20, 100 and 200 SMAs, all together in a 10 pips range which reflects the total lack of directional strength, while indicators remain flat around their midlines. In the 4 hours chart price hovers around its 20 SMA while indicators stand in positive territory, also directionless. If something, FED meeting on Wednesday can be the trigger market is waiting for to decide whether to resume the trend or begin a recovery.

Support levels: 1.2910 1.2870 1.2835

Resistance levels: 1.2950 1.2990 1.3045

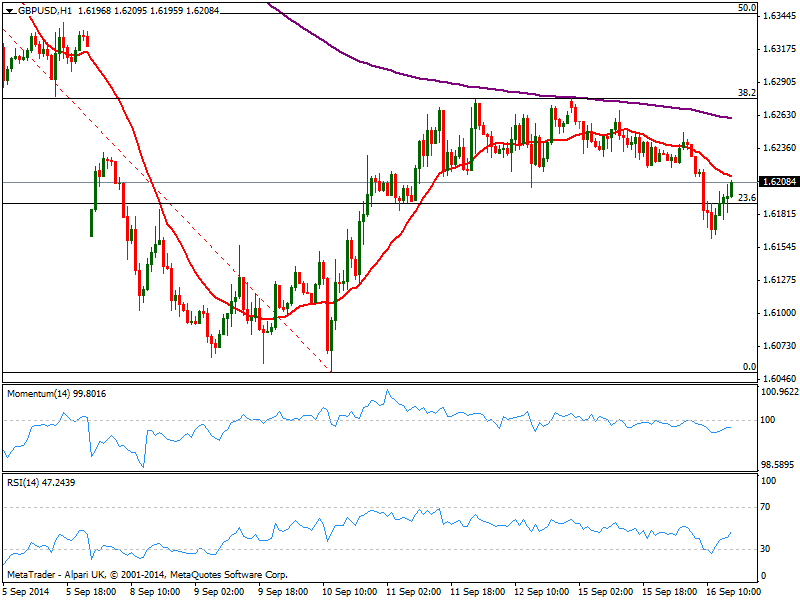

GBP/USD Current price: 1.6208

View Live Chart for the GBP/USD

The GBP/USD suffered an early kneejerk down to 1.6160, even before a weak UK CPI reading took of pressure over the BOE over a sooner rate hike. The pair however recovered some ground, trading now above 1.6190, 23.6% retracement of this month fall, with the hourly chart showing price pressuring 1.6200 area with 20 SMA right above it and indicators still in negative territory. In the 4 hours chart the overall bias is bearish according to technical readings, limiting chances of a stronger recovery.

Support levels: 1.6190 1.6150 1.6115

Resistance levels: 1.6250 1.6280 1.6320

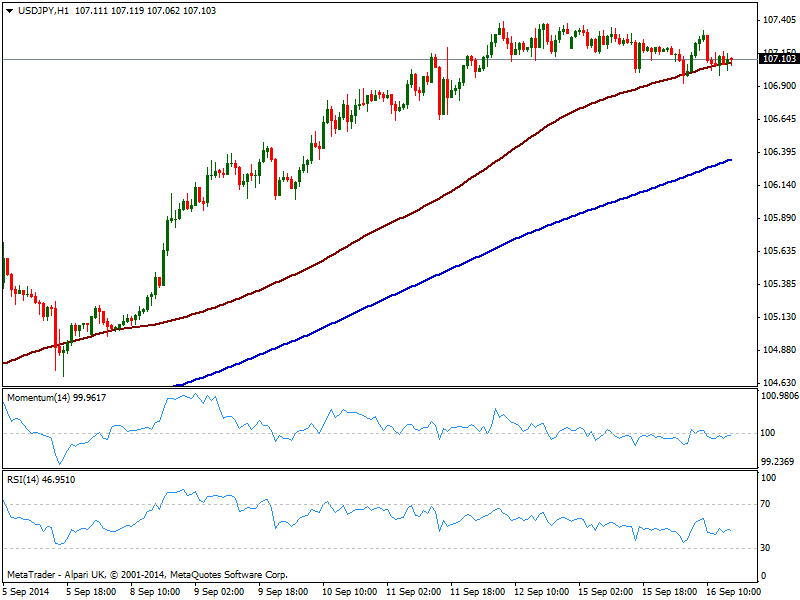

USD/JPY Current price: 107.10

View Live Chart for the USD/JPY

The USD/JPY presents a mild bearish tone, with the pair pressuring 107.00 support area, yet with indicators showing no actual strength at the time being. Price in this last time frame, struggles around its 100 SMA so far providing some weak support as price is being unable to pick up from it. In the 4 hours chart indicators turned lower with momentum entering negative territory, adding some to the bearish pressure, yet as long as 106.80 holds, the downside seems limited.

Support levels: 106.80 106.50 106.10

Resistance levels: 107.40 107.90 108.20

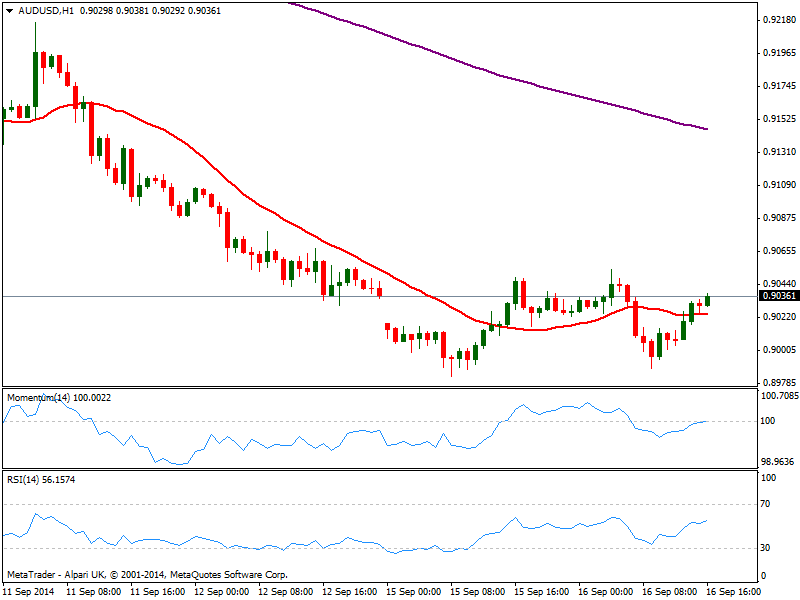

AUD/USD Current price: 0.9036

View Live Chart of the AUD/USD

The AUD/USD advances within range, with a daily high set at 0.9052 early Asia, and a low at 0.8988 early Europe. The 1 hour chart shows price a few pips above a flat 20 SMA and momentum around 100, showing no actual strength. In the 4 hours chart indicators correct from oversold levels yet remain in negative territory, while 20 SMA maintains a strong bearish slope above current price, which helps keep the upside limited.

Support levels: 0.8990 0.8960 0.8920

Resistance levels: 0.9050 0.9075 0.9110

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.