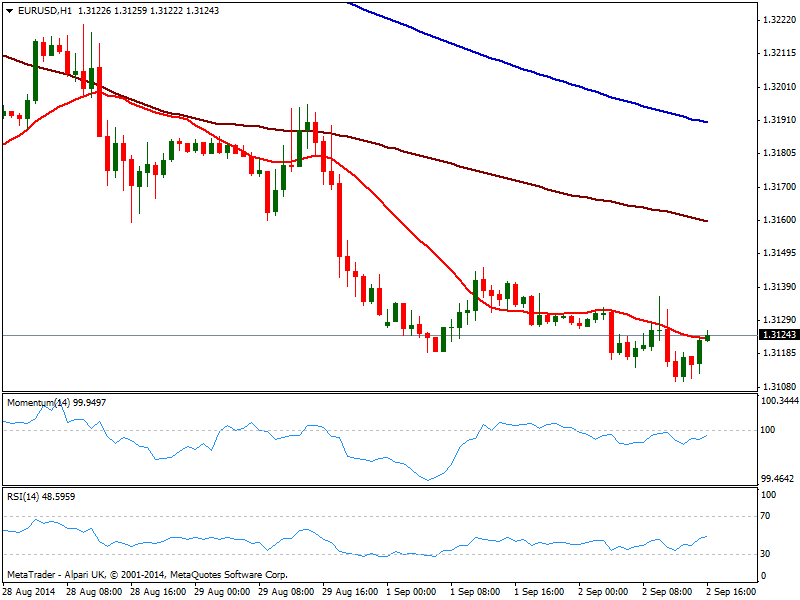

EUR/USD Current price: 1.3124

View Live Chart for the EUR/USD

Majors consolidate near their daily lows ahead of US data, with the greenback standing as the overall daily winner so far today. The EUR/USD bounced some from a daily low of 1.3109 but maintains the bearish tone, as per being capped by its 20 SMA in the 1 hour chart, while indicators stand in negative territory. In the 4 hours chart indicators aim higher from oversold levels, pointing for a limited upward correction while 20 SMA presents a strong bearish slope currently offering intraday resistance around 1.3150. Dollar strength could get a boost from US data to be released shortly, favoring then a break lower towards 1.3050.

Support levels: 1.3105 1.3080 1.3050

Resistance levels: 1.3150 1.3180 1.3215

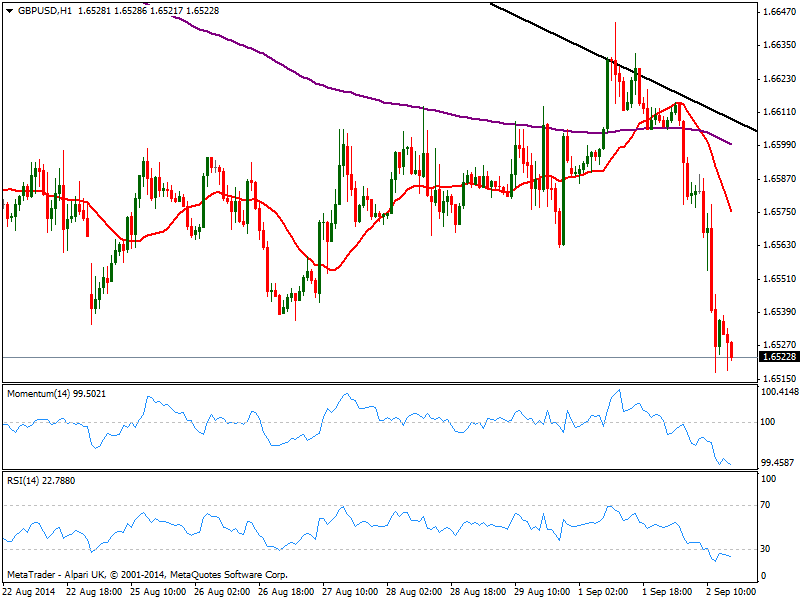

GBP/USD Current price: 1.6522

View Live Chart for the GBP/USD

Pound trades at fresh 6 month low against the greenback, having been unable to recover despite strong UK Construction PMI reading, up to 64. The pair pressures its daily low right below the 1.6520 figure, with the hourly chart showing a strong bearish momentum coming from indicators that continue heading south despite in oversold territory. In the 4 hours chart technical readings also present a bearish bias, pointing for further short term falls as long as sellers now surge on approaches to 1.6540/50 price zone.

Support levels: 1.6510 1.6470 1.6435

Resistance levels: 1.6540 1.6585 1.6620

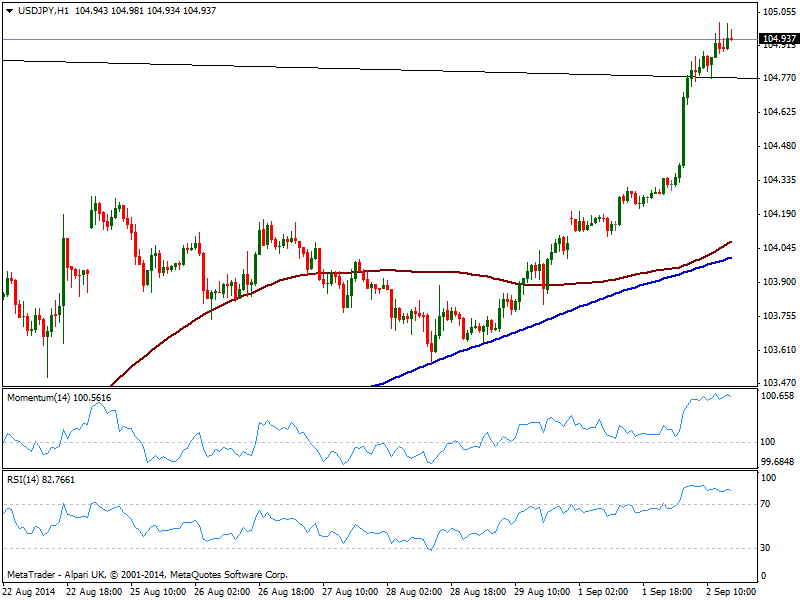

USD/JPY Current price: 104.93

View Live Chart for the USD/JPY

The USD/JPY flirts with the 105.00 level, trading around a long term descendant trend line coming back from 1998. The hourly chart shows indicators barely retracing from extreme overbought readings, but price holding near the highs, suggesting the downward corrective movement will remain limited. In the 4 hours chart moving averages had gained further bullish slope well below current price, while indicators also look exhausted to the upside in extreme overbought levels. Nevertheless, a break above 105.10 should deny the possibility of a downward correction and see the pair extending up to 105.43, this year high.

Support levels: 104.80 104.30 104.00

Resistance levels: 105.10 105.45 105.90

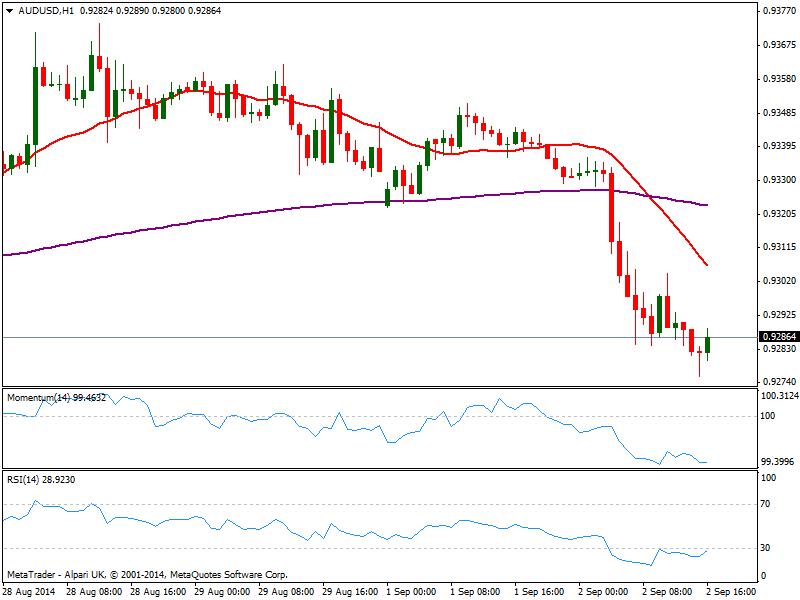

AUD/USD Current price: 0.9286

View Live Chart of the AUD/USD

Aussie lost the 0.9300 level against the dollar, with the pair now steady near its daily low of 0.9275. The hourly chart shows price well below a bearish 20 SMA while indicators stand in oversold territory, far from suggesting a recovery. In the 4 hours chart the technical picture is also bearish, with a break now below 0.9260 required to confirm a new leg down.

Support levels: 0.9260 0.9220 0.9170

Resistance levels: 0.9300 0.9330 0.9370

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.