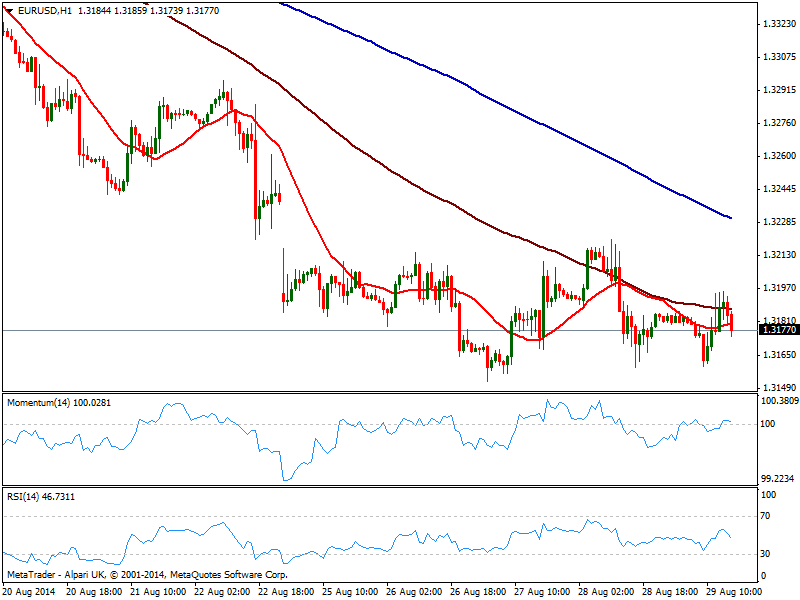

EUR/USD Current price: 1.3184

View Live Chart for the EUR/USD

Back and forth with fundamental news, the pair has once again lacked direction over the past session, trading uneventfully below the 1.3200 level, maintaining a bearish technical stance as per trading a few pips above its year low. Inflation in Europe matched expectations of 0.3% nothing really positive considering it puts the economy one step closer to deflation. Nevertheless, market will probably wait until upcoming ECB meeting on Thursday before taking any serious decision on the pair. At this point, the short term picture is mild bearish, with indicators turning lower around their midlines and price moving below its 20 SMA in the hourly chart. In the 4 hours one price is capped below a flat 20 SMA while momentum grinds higher in positive territory and RSI stands flat below its midline. Unless a price acceleration below 1.3150, the pair will likely maintain its weekly range for the rest of the day.

Support levels: 1.3150 1.3120 1.3090

Resistance levels: 1.3215 1.3240 1.3280

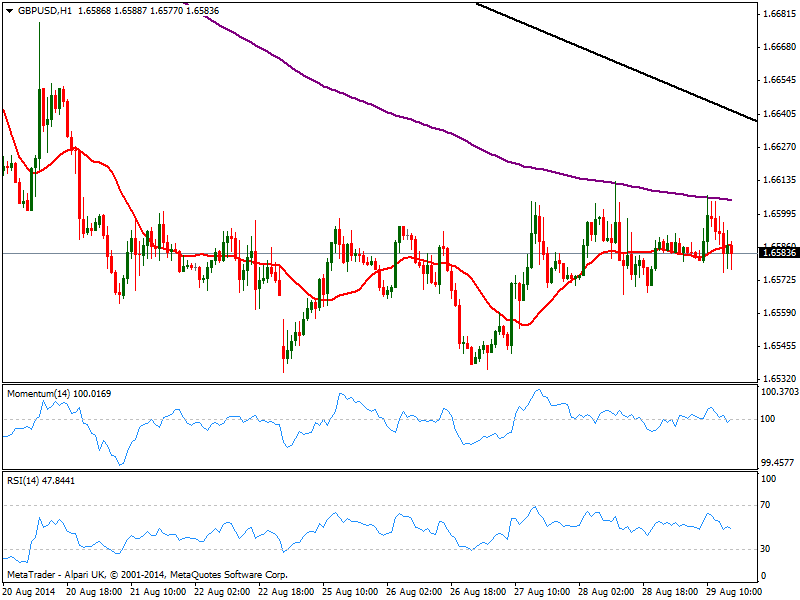

GBP/USD Current price: 1.6583

View Live Chart for the GBP/USD

The GBP/USD pressured the 1.6600 level early Europe, but failed once again to move beyond it, trading in a 30 pips range since early Asian opening right below the level. The technical picture in the short term remains neutral, with price hovering around a flat 20 SMA and indicators steady around their midlines, while the 4 hours chart presents the same technical stance. A daily descendant trend line coming from this year high offers resistance around 1.6650 today in case of a shocking advance, while a break below 1.6540 is required to confirm a new leg down.

Support levels: 1.6540 1.6490 1.6465

Resistance levels: 1.6600 1.6630 1.6650

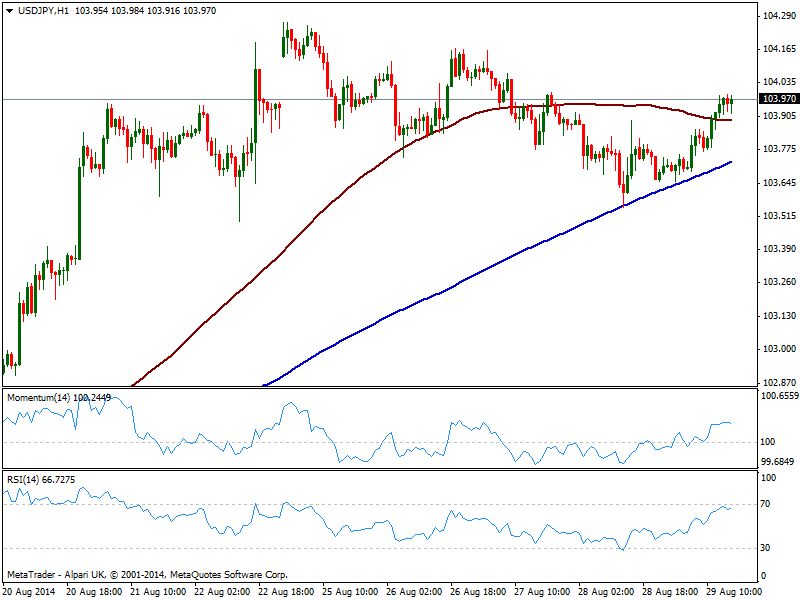

USD/JPY Current price: 103.97

View Live Chart for the USD/JPY

Flirting with the 104.00 figure, the USD/JPY got a boost from negative Japanese data coming from employment and industrial sectors. The pair has managed to add some, but remains capped below its weekly high posted on Monday, with the hourly chart showing price above its 100 SMA and indicators in positive territory, albeit losing early upward strength. In the 4 hours chart indicators head higher around their midlines, not yet suggesting a stronger rise but at least limiting the possibility of a short term decline.

Support levels: 103.55 103.20 102.85

Resistance levels: 104.20 104.50 104.80

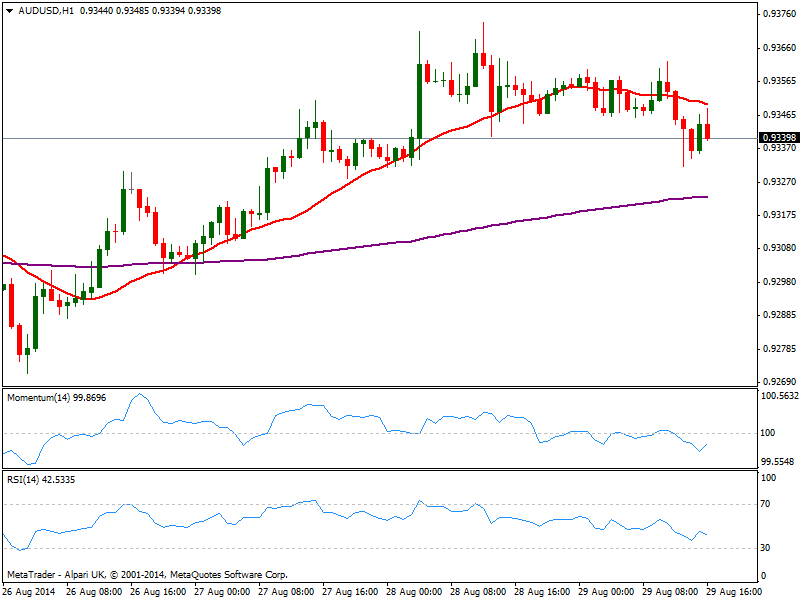

AUD/USD Current price: 0.9340

View Live Chart of the AUD/USD

The AUD/USD eased some further from its recent highs near 0.9370, yet holds so far above 0.9330 with the hourly chart showing price extending below its 20 SMA and indicators in negative territory but diverging between each other. In the 4 hours chart current candle extends below its 20 SMA while indicators turned south but remain above their midlines, pointing at least for a bearish correction towards 0.9300. A weekly close below this last however, will increase the downward potential, exposing 0.9260 price zone.

Support levels: 0.9330 0.9300 0.9260

Resistance levels: 0.9370 0.9410 0.9450

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.