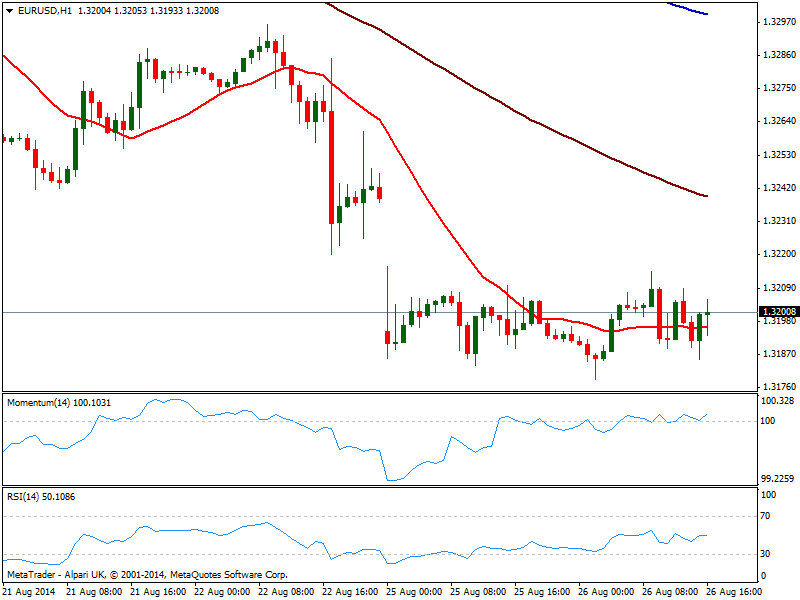

EUR/USD Current price: 1.3200

View Live Chart for the EUR/USD

US Durable Goods Orders jumped to 22.6%, yet the ex-transportation number resulted quite negative down to -0.8%: that means that despite the now confirmed rumor of strong gains due to unusually large aircraft orders, the rest of the sectors had been pretty lousy. Dollar is generally down against most majors, exception made again by the EUR/USD that remains unable to pickup beyond the 1.3200 level. Technically, the pair maintains a neutral short term stance, as the hourly chart shows indicators flat around their midlines, and 20 SMA horizontal. In the 4 hours chart 20 SMA stands now around 1.3240 converging with the unfilled gap and offering dynamic resistance, with indicators also directionless in negative territory.

Support levels: 1.3185 1.3150 1.3120

Resistance levels: 1.3215 1.3250 1.3270

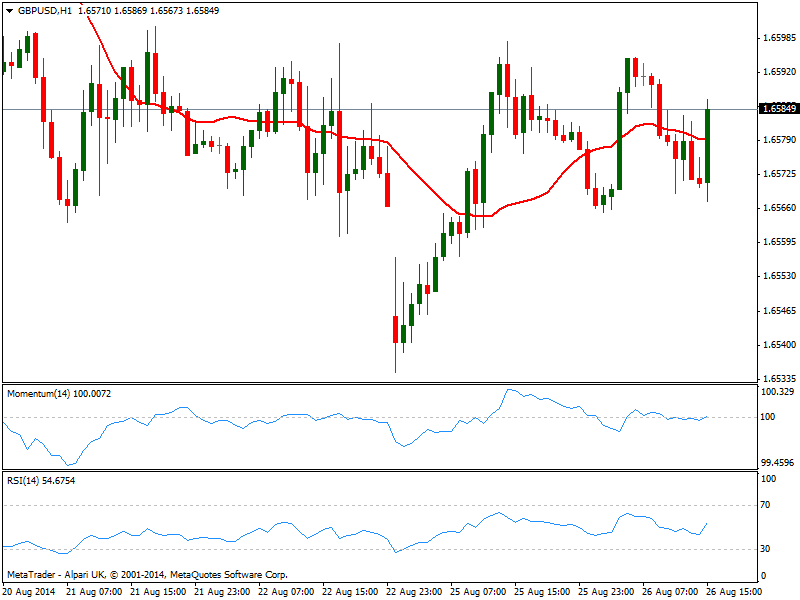

GBP/USD Current price: 1.6584

View Live Chart for the GBP/USD

The GBP/USD trades uneventfully bellow 1.6600, having been confined to a tight range for most of the last 24 hours. The hourly chart shows price moving back and forth around a flat 20 SMA as indicators rest horizontal around their midlines, giving no clues on upcoming direction. In the 4 hours chart the picture is quite alike, and only a steady recovery above 1.6600 can anticipate some advances, with a daily descendant trend line at 1.6660 as possible selling level if reached.

Support levels: 1.6540 1.6490 1.6465

Resistance levels: 1.6600 1.6630 1.6660

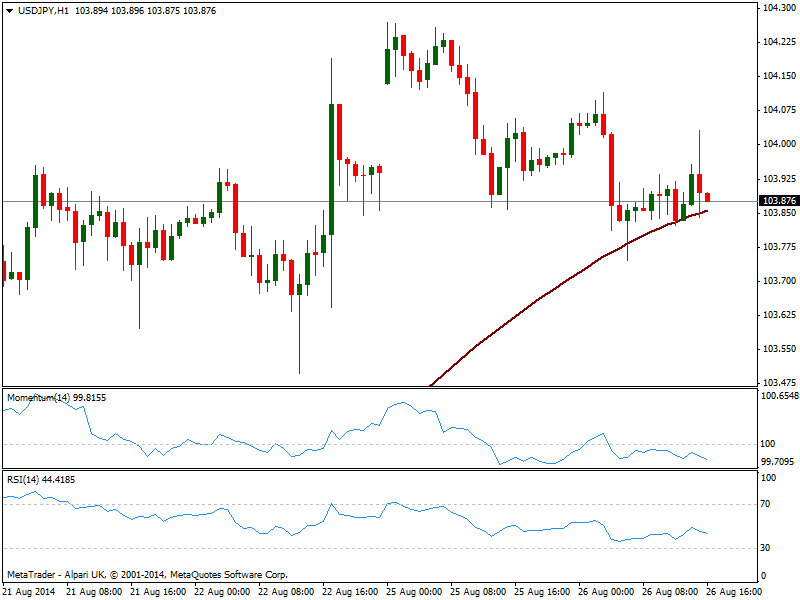

USD/JPY Current price: 103.99

View Live Chart for the USD/JPY

The USD/JPY eased towards 103.75 over Asian hours, having however found short term support in its 100 SMA, with the pair holding right above it for most of the day. The hourly chart shows indicators heading south below their midlines, yet as long as above 103.70, the downside seems limited. In the 4 hours chart indicators lost downward strength and turned flat above their midlines, supporting the shorter term view. Stocks strength seems to be the cause of the limited downward potential, and unless a reversal there, the pair will likely remain range bound.

Support levels: 103.70 103.20 102.85

Resistance levels: 104.10 104.45 104.80

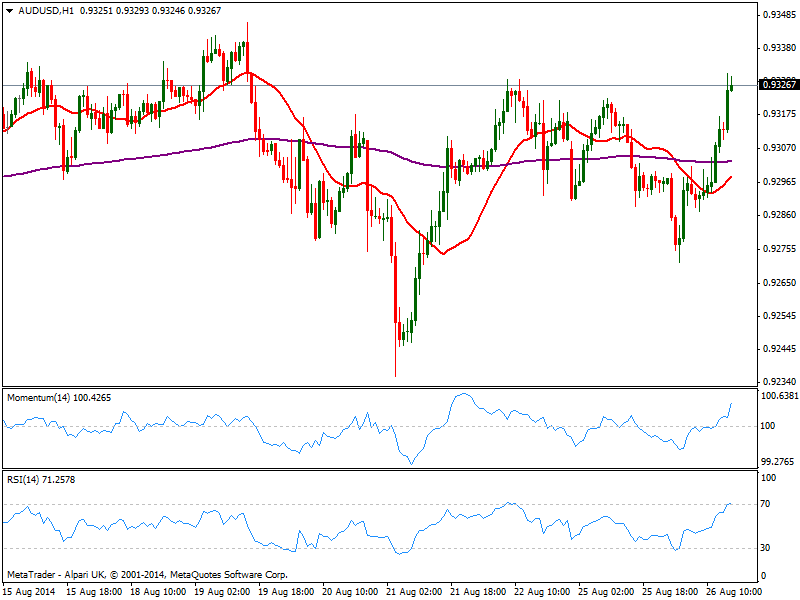

AUD/USD Current price: 0.9326

View Live Chart for the AUD/USD

Aussie strengthened against the greenback early European session, helped by rising gold and rumors off a Chinese requirement ratio cut. Approaching 0.9330 the hourly chart presents a strong upward momentum early US session, with price accelerating well above its 20 SMA. In the 4 hours chart technical readings present a mild positive tone, with price now pressuring 200 EMA, usually a strong static resistance. A price acceleration above 0.9330 should trigger stops and therefore help the pair advance up to 0.9370 price zone.

Support levels: 0.9260 0.9220 0.9180

Resistance levels: 0.9330 0.9370 0.9410

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.