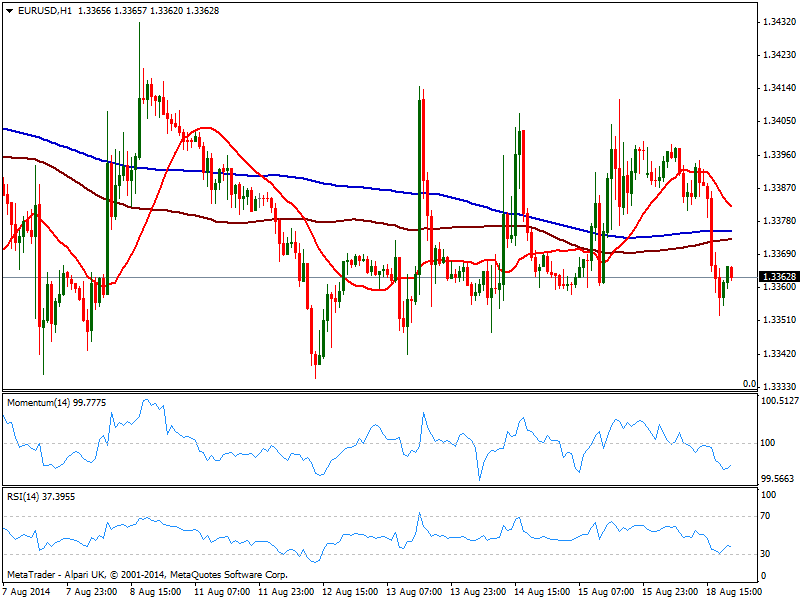

EUR/USD Current price: 1.3362

View Live Chart for the EUR/USD

The EUR/USD gave up further ground this Monday, down to a daily low of 1.3352, with the downside limited by a general positive move that drove stocks higher and thus kept high yielders on demand. But for the common currency, it was just enough to prevent fresh year lows, as the EUR remains in selling mode. Technically, the pair continued to move back and forth in its latest range, closer to the base set at 1.3332, entering Asian session with the hourly chart showing price below moving averages and indicators in oversold levels. In the 4 hours chart the technical picture is mild bearish but still neutral, situation that will extend as long as price maintains the 1.3330/1.3440 range.

Support levels: 1.3370 1.3330 1.3295

Resistance levels: 1.3405 1.3440 1.3485

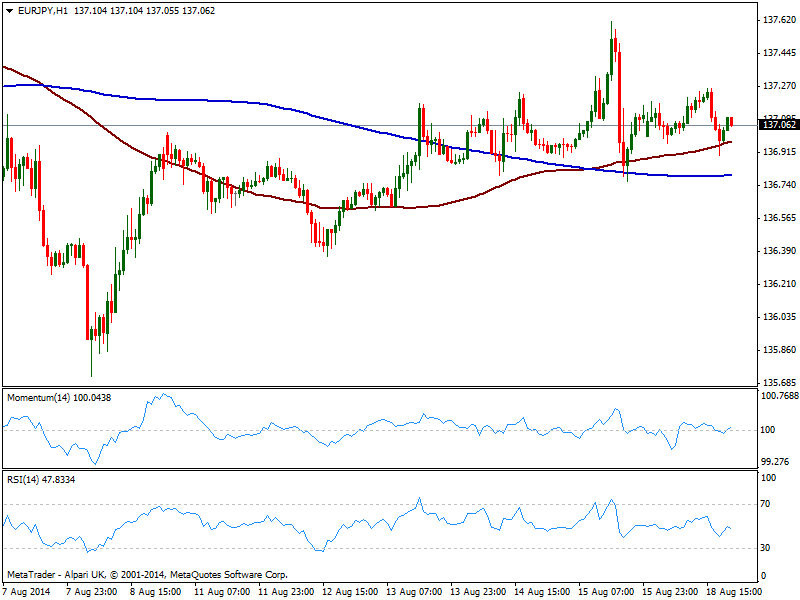

EUR/JPY Current price: 137.06

View Live Chart for the EUR/JPY

The EUR/JPY enters Tuesday unchanged from the weekly opening, having held above the 137.00 level for most of the day. Unchanged since previous update, the hourly chart shows price holding above a bullish 100 SMA and 200 one now around 136.80, acting as intraday support while indicators hover around their midlines. In the 4 hours chart indicators stand flat around their midlines, showing no directional strength. The ruling trend however is still bearish longer term, with some sustained gains beyond 138.00 required to start considering an interim bottom in place.

Support levels: 136.80 136.40 135.90

Resistance levels: 137.30 137.60 138.00

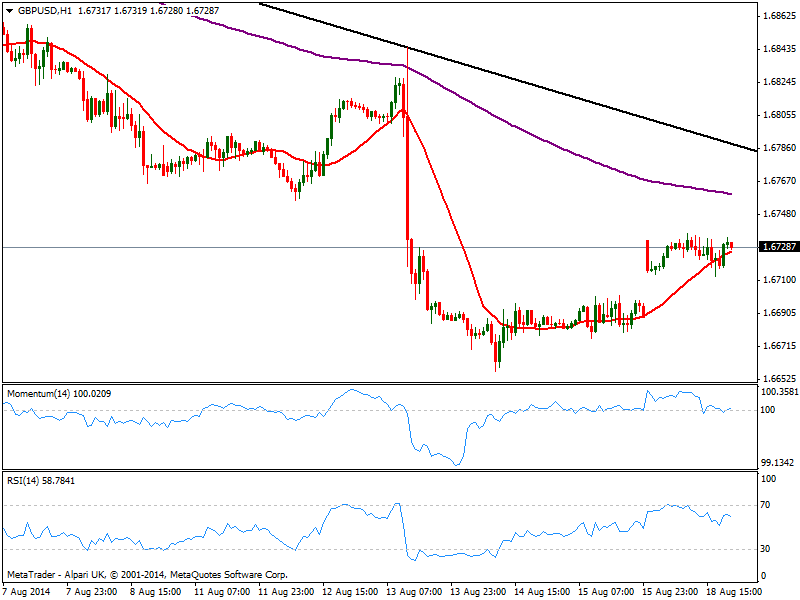

GBP/USD Current price: 1.6728

View Live Chart for the GBP/USD

Despite the initial advance of GBP/USD past Asian session, the pair remained unable to move for the rest of the day, confined to a 20 pips range. Upcoming Wednesday, the UK will publish it monthly inflation report and BOE’s Minutes, so it won’t be a surprise if the pair continues static on Tuesday. Besides, latest recovery is far from enough as price remains well below a daily descendant trend line coming from this year high, currently around 1.6785, critical resistance to break to confirm the return of the bulls. In the meantime and for the short term, the hourly chart shows price hovering around a flat 20 SMA and indicators in neutral territory, while the 4 hours chart presents a mild positive tone. Nevertheless, a break above mentioned level is required to see the pair regaining the upside, while downward risk increases on a break below 1.6680, where the pair still has an unfilled weekly opening gap.

Support levels: 1.6715 1.6680 1.6650

Resistance levels: 1.6740 1.6785 1.6810

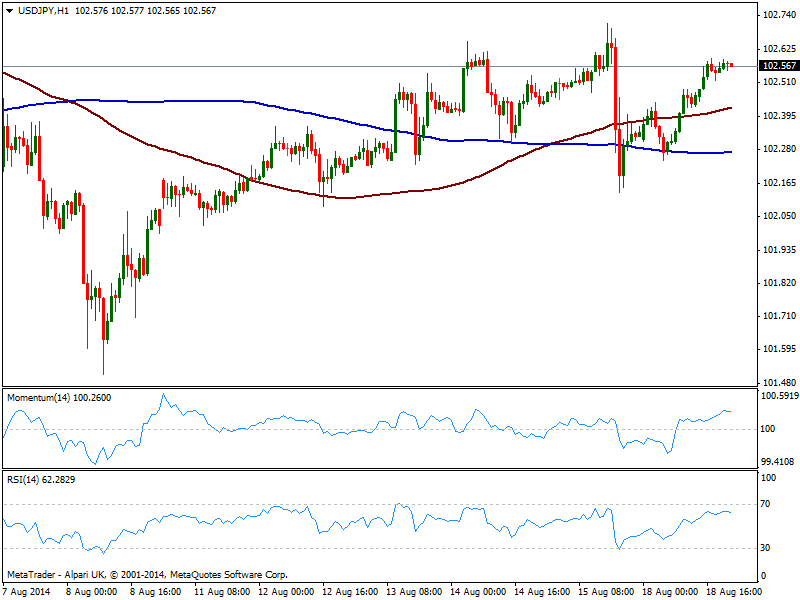

USD/JPY Current price: 102.56

View Live Chart for the USD/JPY

The USD/JPY added a few pips on Monday, trading steady near 102.59 daily high, for most of the US session. The advance however remained shy of 102.80 resistance area, where the pair has several daily highs from the past few weeks, and a daily descendant trend line coming from this year high of 105.43 which reinforces the strength of the level. The hourly chart shows indicators losing upward strength in positive territory, but price above its moving averages, maintaining a positive tone. In the 4 hours chart, indicators aim higher around their midlines while price held above moving averages, supporting the shorter term view.

Support levels: 102.35 101.95 101.60

Resistance levels: 102.80 103.10 103.45

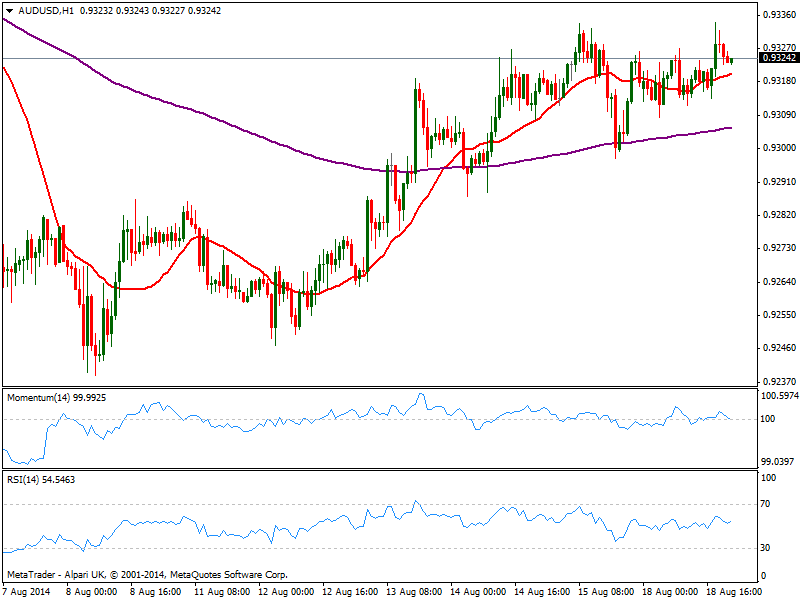

AUD/USD Current price: 0.9324

View Live Chart for the AUD/USD

The AUD/USD awaits RBA latest Minutes to wake up, with the pair trading uneventfully between 0.9300 and 0.9330 for most of this Monday. As commented on previous updates, Governor Stevens is expected to down talk Aussie, stating the currency remains overvalued, meaning expectations are limited for an AUD rally. Would be a surprise if he stands with a hawkish stance, and therefore the pair may break higher. Showing no directional strength in intraday charts, the key support stands at 0.9260, and it will take a break below it to see the downward momentum accelerate.

Support levels: 0.9300 0.9260 0.9220

Resistance levels: 0.9330 0.9370 0.9410

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.