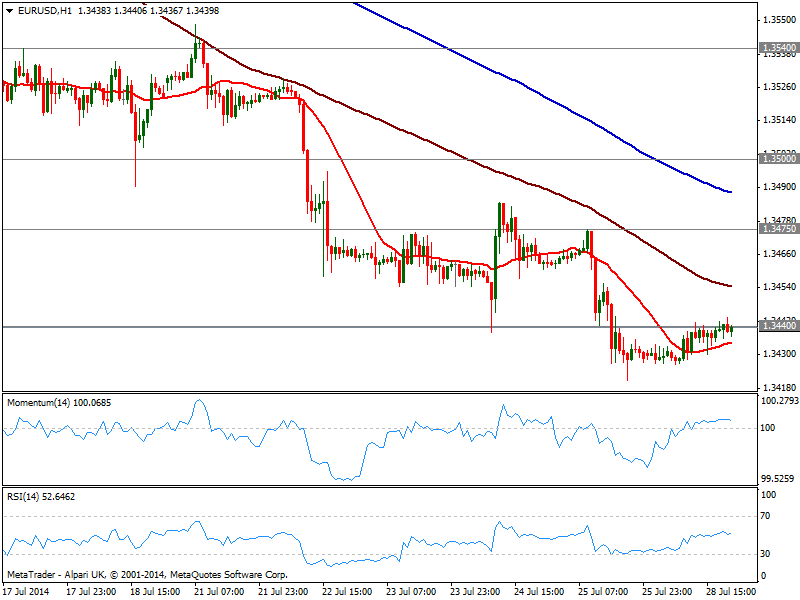

EUR/USD Current price: 1.3440

View Live Chart for the EUR/USD

Market has, as expected, been ultra thin this Monday, with majors mostly confined in 20/30 pips ranges: there were no major news coming from Europe, and in the US disappointing data was not enough to affect investors, that wait for the deluge of economic reports coming from the US starting on Wednesday. The big focus will be FOMC meeting albeit chances of a surprise there are limited: the only way the FED can rock markets is by announcing a sooner than expected rate hike, something pretty unlikely coming from ultra dovish Yellen.

Anyway and from a technical point of view, the EUR/USD held near its year lows, advancing some of US negative fundamental readings, but clearly unable to advance beyond 1.3440 static resistance level. The hourly chart shows a mild positive tone coming from technical readings, neutral for the most, while the 4 hours chart maintains the bearish tone as per price developing below moving averages and momentum heading south below its midline. An upward correction can’t be ruled out, yet sellers are probably waiting in the 1.3475 area, preventing the pair from advancing further.

Support levels: 1.3410 1.3380 1.3335

Resistance levels: 1.3440 1.3475 1.3500

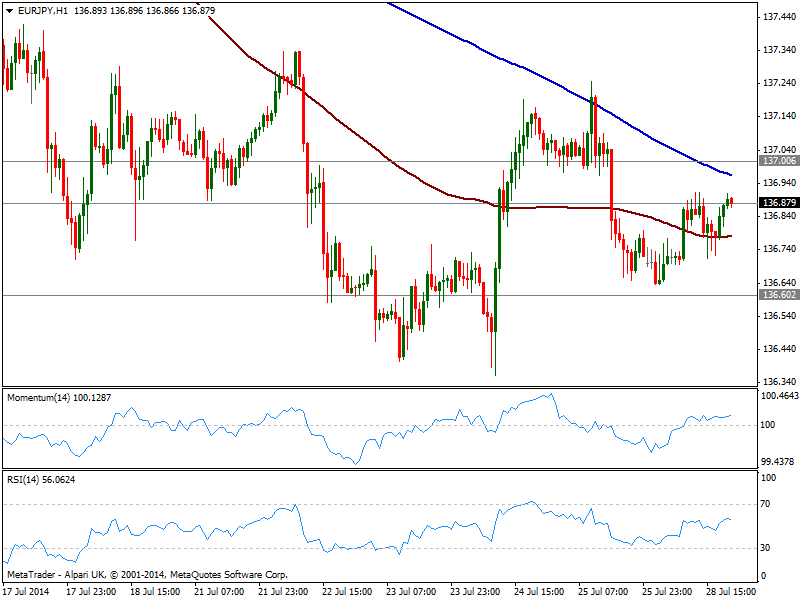

EUR/JPY Current price: 136.87

View Live Chart for the EUR/JPY

US 10y yields stand around the daily high of 2.49% by the end of the American session, putting yen under some mild bearish pressure against most rivals. Stocks point to close unchanged, giving little clues for upcoming Asian session from that front, but some Japanese data in the form of housing data may shed some light. Short term, the hourly chart shows price advanced a few pips, trading between 100 and 200 SMAs, both with a bearish slope, as indicators stand flat in positive territory. In the 4 hours chart technical readings present a neutral stance, as indicators hover around their midlines directionless. The downside remains favored, with a price acceleration below 136.60 leading to a quick test of 136.20 critical support zone.

Support levels: 136.90 136.60 136.20

Resistance levels: 137.50 137.90 138.40

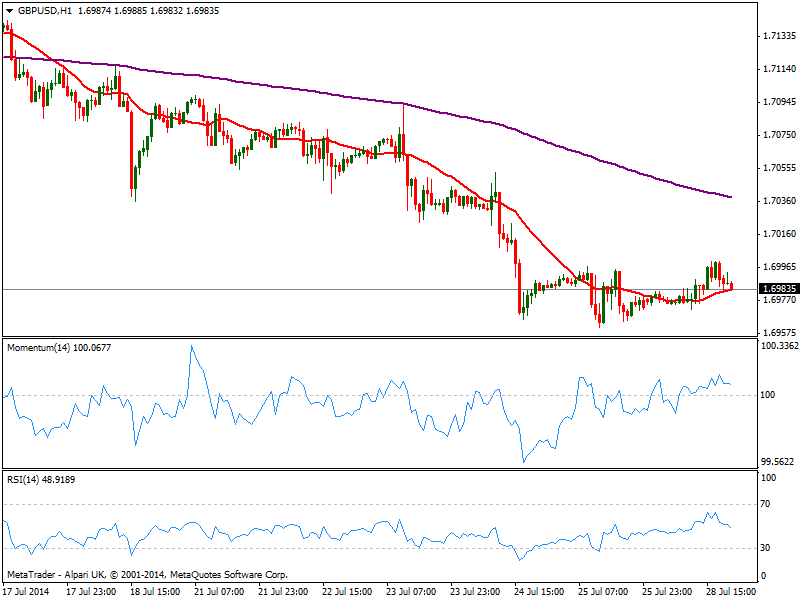

GBP/USD Current price: 1.6983

View Live Chart for the GBP/USD

The GBP/USD tested 1.7000 early US session, but also traded in a tight limited range for most of the day which left the hourly chart with little clues on upcoming direction. Indicators in the mentioned time frame turned slightly lower but stand above their midlines, while price hovers around a flat 20 SMA. In the 4 hours chart 20 SMA contained the upside, offering dynamic resistance around mentioned daily high, while indicators hold below their midlines, still keeping the pressure to the downside. Nevertheless, a break below 1.6950 is required to confirm a new leg down towards the 1.6900/10 price zone.

Support levels: 1.6950 1.6920 1.6870

Resistance levels: 1.7010 1.7055 1.7095

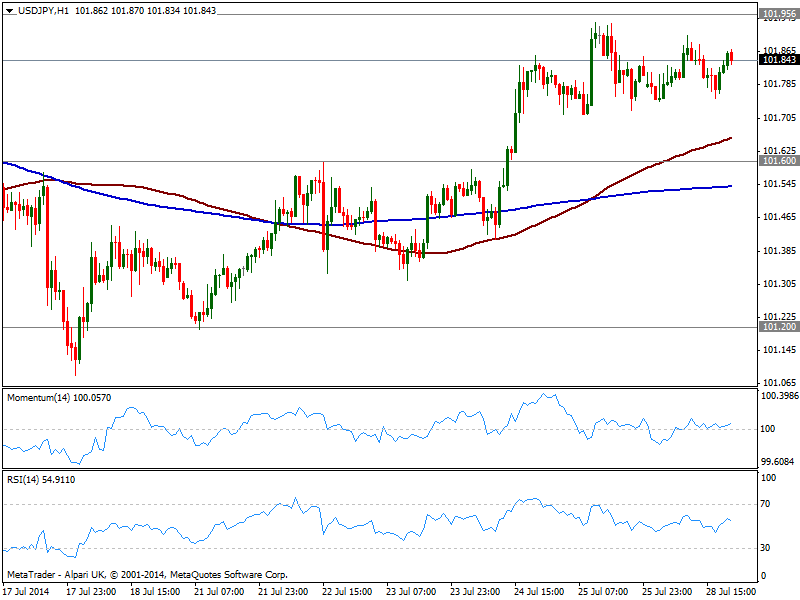

USD/JPY Current price: 101.84

View Live Chart for the USD/JPY

The USD/JPY has been no exception, and traded uneventfully below 101.90, with the hourly chart now showing a mild positive tone, as per price developing above moving averages and indicators standing in positive territory. In the 4 hours chart indicators stand in positive territory but turning lower, while moving averages maintain a bearish slope albeit below current price. Risk to the downside will likely increase on a break below 101.60, but bulls may take their chances on an advance beyond the 102.00 mark.

Support levels: 101.60 101.20 101.05

Resistance levels: 101.95 102.35 102.80

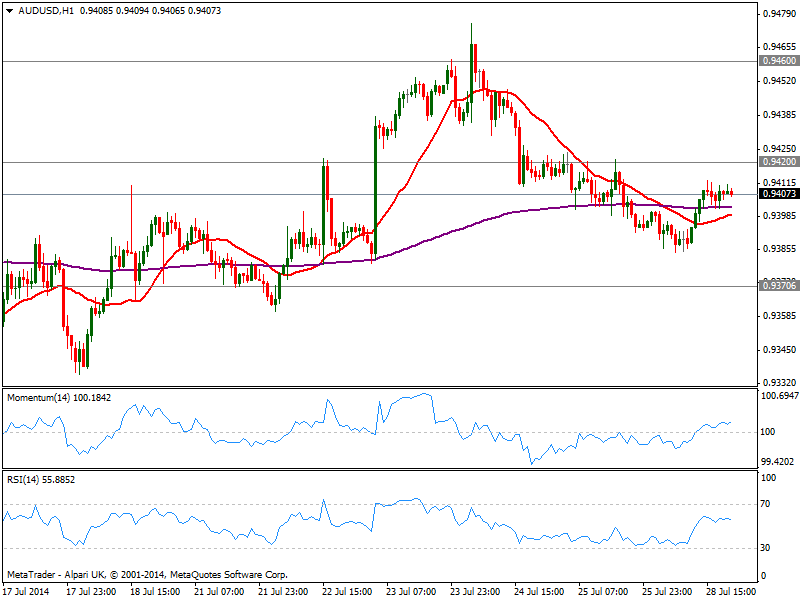

AUD/USD Current price: 0.9407

View Live Chart for the AUD/USD

The AUD/USD traded below the 0.9420 mark, presenting however a mild positive short term tone, as per the hourly chart showing indicators aiming higher in positive territory and price above moving averages. In the 4 hours however, the bearish tone prevails as 20 SMA heads lower around mentioned 0.9420 strong static resistance level, while indicators stand below their midlines, directionless. Local housing data can affect the pair temporarily over Asian hours, yet with little expectation of triggering wide moves, ahead of major events later on the week.

Support levels: 0.9370 0.9330 0.9300

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.