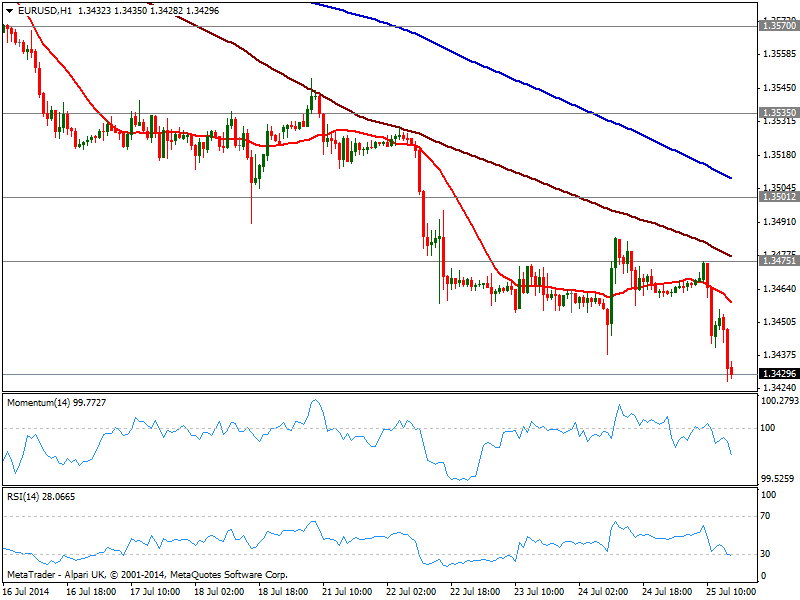

EUR/USD Current price: 1.3429

View Live Chart for the EUR/USD

The EUR/USD trades at its lowest level of the year, having accelerated south after the release of US Durable Goods Orders above expected. Having found sellers in the 1.3475 static resistance level, the pair is poised to continue falling, with the hourly chart showing a strong downward momentum and moving averages gaining bearish slope well above current price. In the 4 hours chart technical readings also present a clear bearish tone, supporting a test of the 1.3400/10 price zone in the short term. A break below the level, should trigger stops and therefore anticipate more losses for the day.

Support levels: 1.3410 1.3380 1.3335

Resistance levels: 1.3475 1.3500 1.3535

GBP/USD Current price: 1.6980

View Live Chart for the GBP/USD

Pound was immune to a good UK GDP number, as second quarter reading matched expectations of 0.8% growth. The GBP/USD however, extended its slide to 1.6960 and trades in a tight range below the 1.7000 mark. The hourly chart presents a neutral technical stance, as per indicators flat around their midlines and price stuck around an also flat 20 SMA, while the 4 hours chart shows a steady bearish tone coming from indicators. Immediate support stands at 1.6950, May 26th daily low and if broken, the slide can extend quickly towards the 1.6900/20 price zone.

Support levels: 1.6950 1.6920 1.6870

Resistance levels: 1.7020 1.7055 1.7095

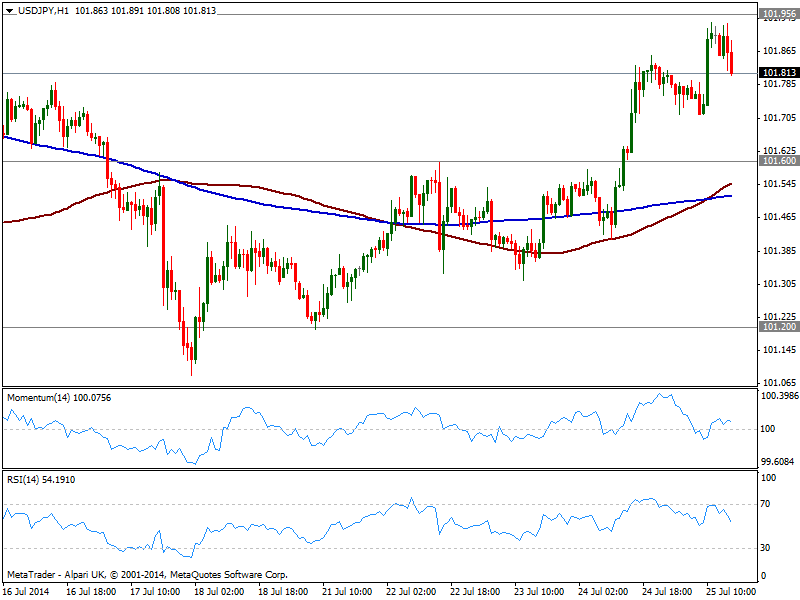

USD/JPY Current price: 101.81

View Live Chart for the USD/JPY

The USD/JPY has been rejected from 101.92, 200 DMA and turns lower despite general dollar strength. The hourly chart however, suggest current movement is corrective, as 100 SMA cross over 200 one both in the 101.50 price zone, while indicators head lower but hold in positive ground. In the 4 hours chart technical readings maintain a positive tone as momentum heads higher above its midline, with buyers probably surging on approaches to 101.60 price zone.

Support levels: 101.60 101.20 101.05

Resistance levels: 101.95 102.35 102.80

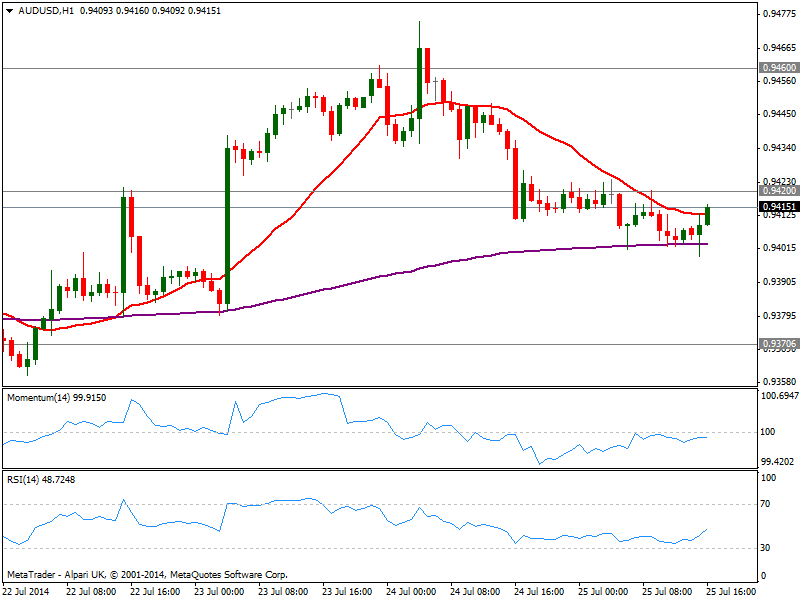

AUD/USD Current price: 0.9415

View Live Chart for the AUD/USD

AUD/USD saw a kneejerk below the 0.9400 figure, but quickly bounced standing now a few pips below 0.9420 strong static resistance level. The hourly chart shows price aiming to advance above its 20 SMA while indicators stand around their midlines, directionless. In the 4 hours chart a mild bearish tone prevails, with indicators heading lower in negative territory and 20 SMA above current price.

Support levels: 0.9370 0.9330 0.9300

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.