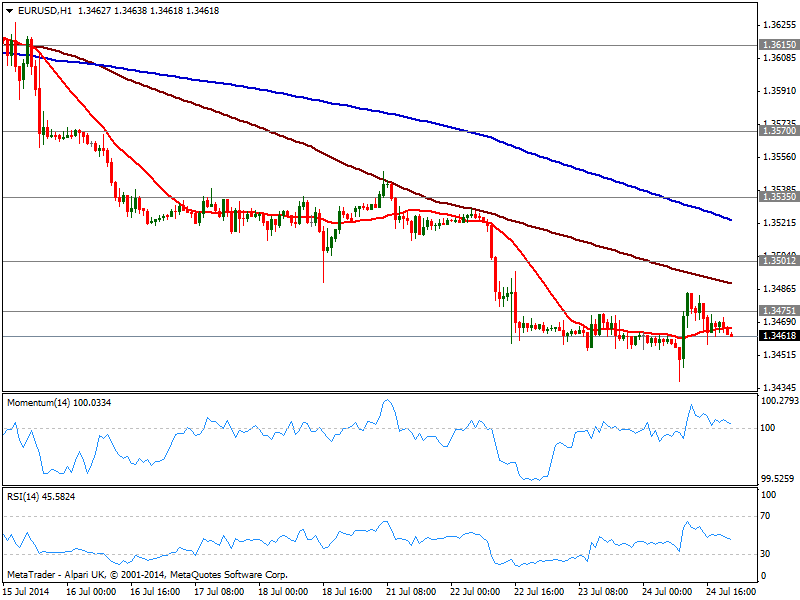

EUR/USD Current price: 1.3462

View Live Chart for the EUR/USD

A higher high, and a lower low were posted in the EUR/USD, but the daily range did not overcame 50 pips. In fact, the daily candle is almost a doji, with almost no body to show. For the first time in the week, there was interesting data with European one surprising to the upside: local PMIs resulted stronger than expected, main reason beyond the daily high of 1.3485, while US figures were for the most disappointing, with US manufacturing PMIs down to 56.3 and New Home sales also missing expectations. However, dollar edged higher against most rivals, supported by a bounce on US 10Ynotes yields.

Technically, there are no much directional signs for the EUR/USD with the recovery shy of 1.3500; the hourly chart presents a mild negative tone, with momentum heading lower near its midline and price steady around a flat 20 SMA. In the 4 hours chart 20 SMA capped the upside, offering now dynamic resistance in the 1.3475 area, while momentum aims higher still below its midline. A corrective movement may surge on steady gains above 1.3500, thus approaches to 1.3570 should been seen as selling opportunities following the dominant trend.

Support levels: 1.3445 1.3410 1.3380

Resistance levels: 1.3475 1.3500 1.3535

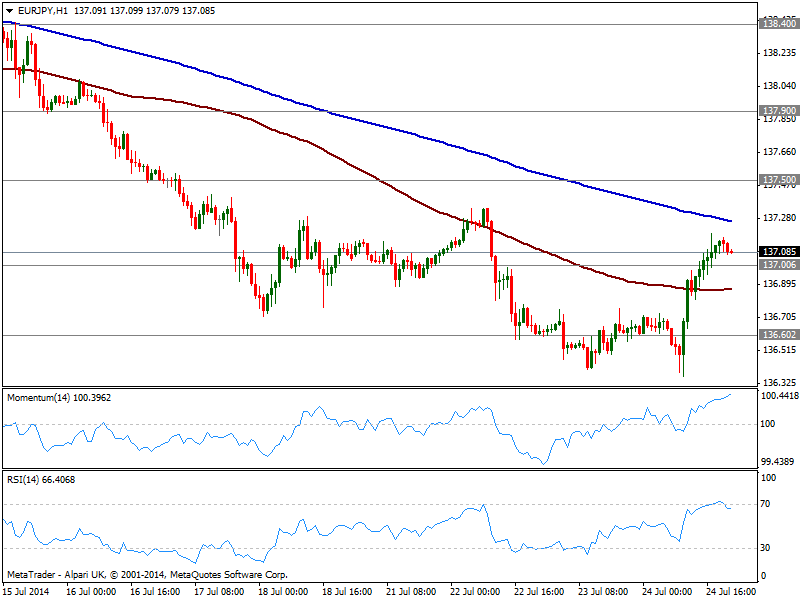

EUR/JPY Current price: 137.08

View Live Chart for the EUR/JPY

Yen weaned against its rivals, with the EUR/JPY recovering above the 137.00 mid US afternoon, and holding ground early Asian session. The hourly chart shows RSI turning lower and pointing for a downward correction, but momentum maintains the bullish tone while price trades between 100 and 200 SMAs, this last a few pips above current price. In the 4 hours chart a mild positive tone prevails albeit below 136.90 chances will turn back towards the downside.

Support levels: 136.90 136.60 136.20

Resistance levels: 137.50 137.90 138.40

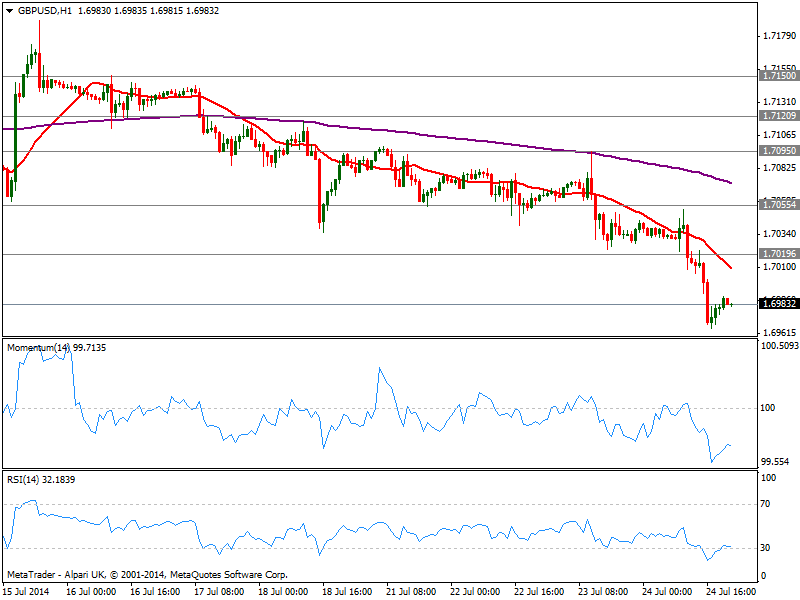

GBP/USD Current price: 1.6983

View Live Chart for the GBP/USD

Retail Sales in the UK weighted on Pound crosses, with the GBP/USD pointing to close the day below the 1.70 figure, first time in a month. The hourly chart shows indicators corrected oversold readings but turned back south well into negative territory, while 20 SMA extended its decline and stands now around 1.7010. In the 4 hours chart indicators present a clear bearish tone with price extending below its 200 EMA, all of which supports further downward moves.

Support levels: 1.6950 1.6920 1.6870

Resistance levels: 1.7020 1.7055 1.7095

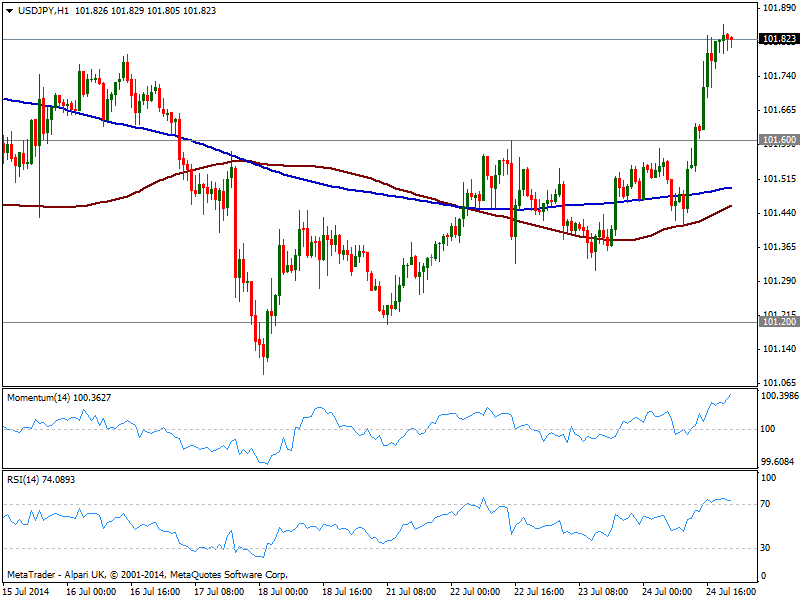

USD/JPY Current price: 101.82

View Live Chart for the USD/JPY

The UD/JPY finally managed to overcome the 101.60 level, accelerating higher once stops got out of the way. The pair stalled a few pips below critical resistance around 101.95, 200 DMA. In the short term, the hourly chart shows a strong upward momentum despite RSI stands in overbought territory. Price stands well above moving averages, but 200 one stands above 100 one, which fails to confirm the upward potential. In the 4 hours chart indicators are slightly exhausted to the upside but still in positive territory. Some follow through above 101.95, may see the pair extending the upside up to 102.80 next strong midterm resistance.

Support levels: 101.60 101.20 101.05

Resistance levels: 101.95 102.35 102.80

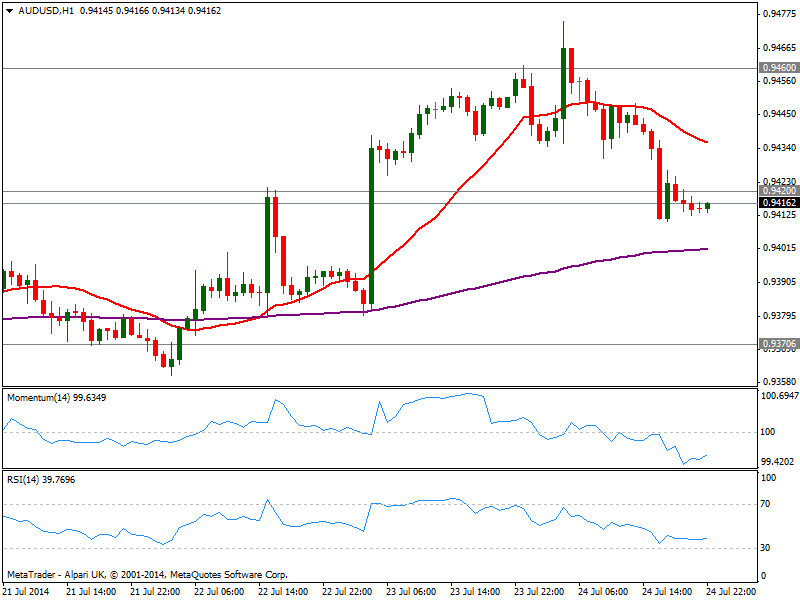

AUD/USD Current price: 0.9416

View Live Chart for the AUD/USD

The AUD/USD retreated from a multi-week high of 0.9475 reached over Asian session following RBNZ decision to shift its economic policy to neutral after rising rates for another 0.25% up to 3.50%. Aussie demand eased however as the pair approached to the year high of 0.9500, and trades now below 0.9420 static resistance level. The hourly chart shows a mild bearish tone, with indicators flat in negative territory and price below its 20 SMA, while the 4 hours chart shows price finding now support at 0.9410, 20 SMA as indicators turn lower from overbought readings. Still not clear, some recovery above 0.9420 should see price returning towards recent highs, while below mentioned 20 SMA, price will likely look for a test of 0.9370 in the short term.

Support levels: 0.9370 0.9330 0.9300

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

USD/JPY crashes toward 156.00, Japanese intervention in play?

Having briefly recaptured 160.00, USD/JPY came under intense selling and sank toward 156.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD rallies toward 0.6600 on risk flows, hawkish RBA expectations

AUD/USD extends gains toward 0.6600 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.