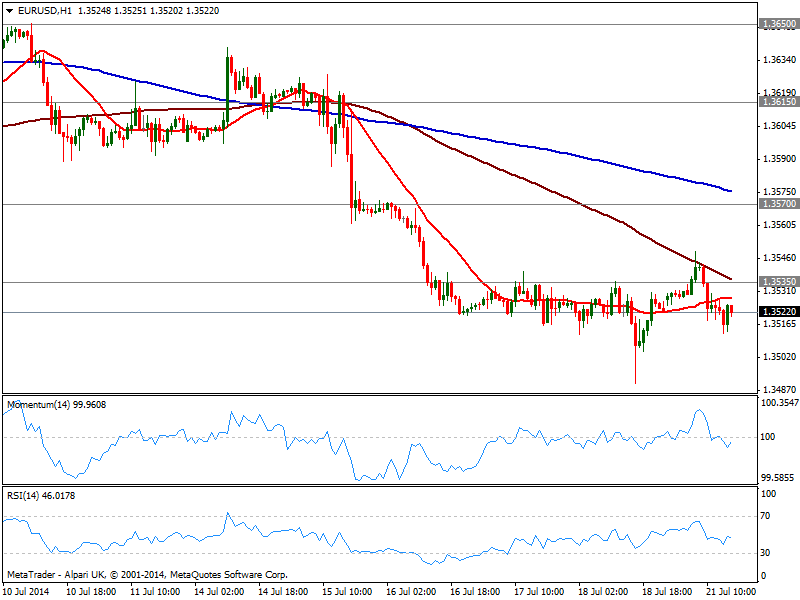

EUR/USD Current price: 1.3522

View Live Chart for the EUR/USD

Summer doldrums are felling strongly this Monday, with Japan off on holidays during Asian session, and little data early Europe. The EUR/USD saw a shy spike up to 1.3548 with the opening, but quickly pulled back, trading steady in the 1.3520 price zone early US session. Stocks are down in Europe along with US futures, which favors some safe havens, but US yields are also giving up ground, which should keep dollar gain limited. For the most, the EUR/USD still looks heavy considering it trades a handful of pips above the year low of 1.3476, but the short term outlook remains neutral, with the hourly chart showing price below a flat 20 SMA and indicators horizontal in neutral territory.

Support levels: 1.3510 1.3476 1.3440

Resistance levels: 1.3535 1.3570 1.3620

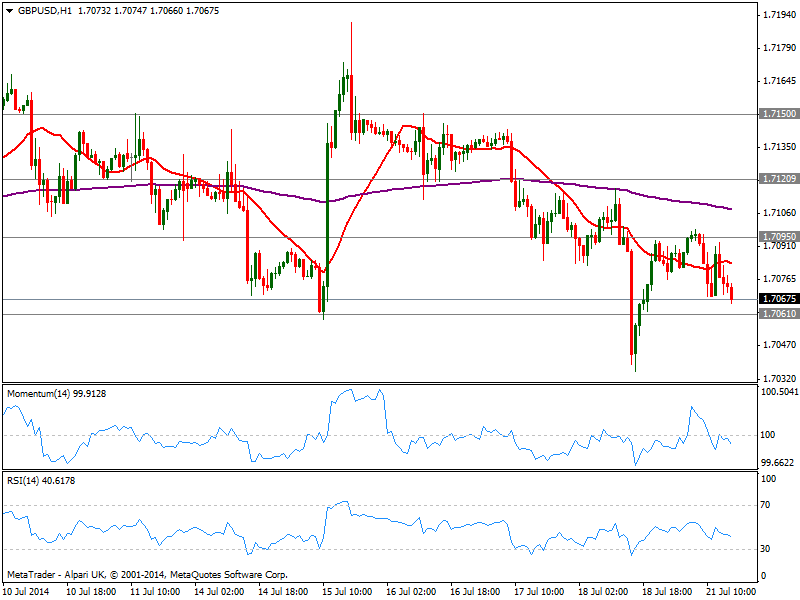

GBP/USD Current price: 1.7067

View Live Chart for the GBP/USD

The GBP/USD eases towards 1.7060 support, having failed to regain the 1.7100 level earlier today. The hourly chart shows price extending below its 20 SMA while indicators turn south below their midlines, supporting some downward extension in the short term. In the 4 hours chart technical readings also present a bearish tone, with a break below mentioned support exposing the 1.7020/30 price zone.

Support levels: 1.7060 1.7025 1.6985

Resistance levels: 1.7095 1.7120 1.7150

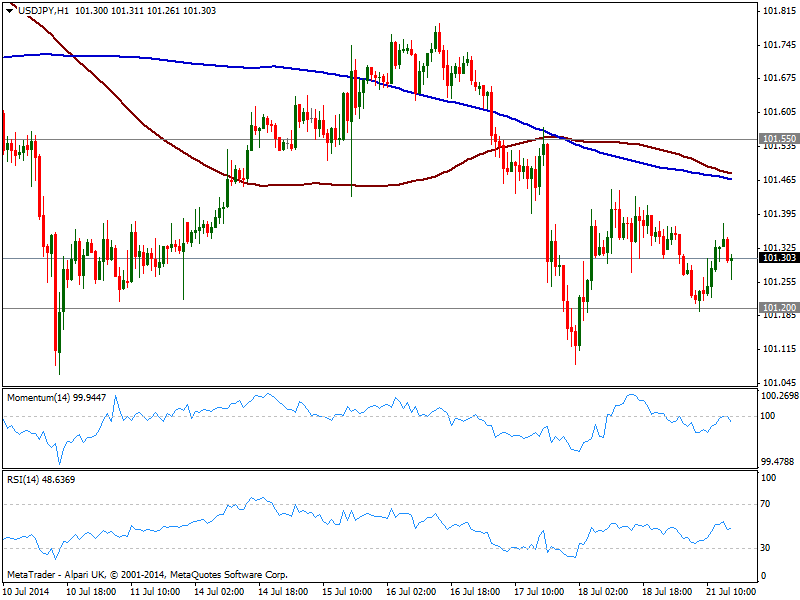

USD/JPY Current price: 101.30

View Live Chart for the USD/JPY

The USD/JPY bounced from a daily low of 101.20 immediate short term support, maintaining the overall negative tone seen on previous updates. The hourly chart shows indicators retracing from their midlines, while 100 and 200 SMA’s converge around 101.50, offering now immediate resistance. In the 4 hours chart indicators stand in negative territory but directionless, while price develops below moving averages, all of which keeps the pressure to the downside.

Support levels: 101.20 101.05 100.70

Resistance levels: 101.55 101.95 102.35

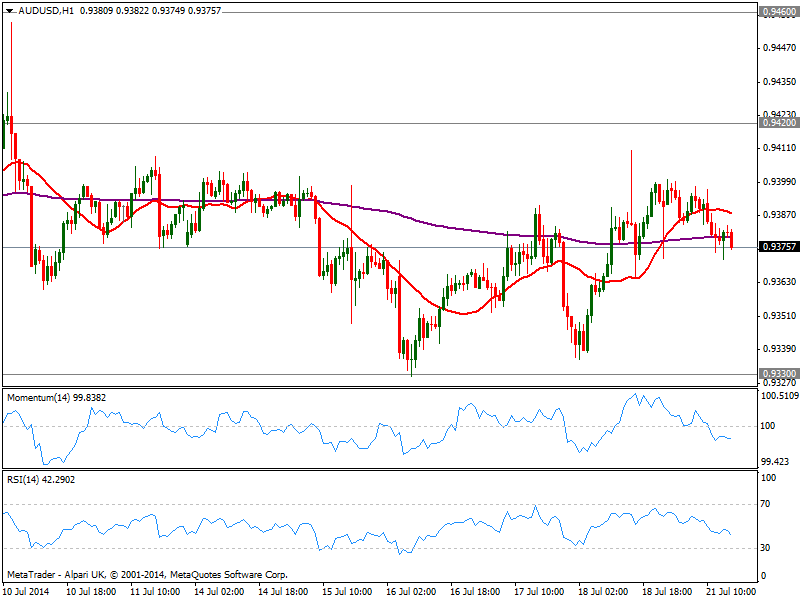

AUD/USD Current price: 0.9375

View Live Chart for the AUD/USD

Aussie eased against the dollar, with the pair now holding right above 0.9370 static support zone and the hourly chart showing 20 SMA turning south above current price and indicators heading lower below their midlines, suggesting some further slides ahead. In the 4 hours chart price stands right above moving averages, while indicators approach their midlines, still in positive territory.

Support levels: 0.9370 0.9330 0.9300

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY extends recovery after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.