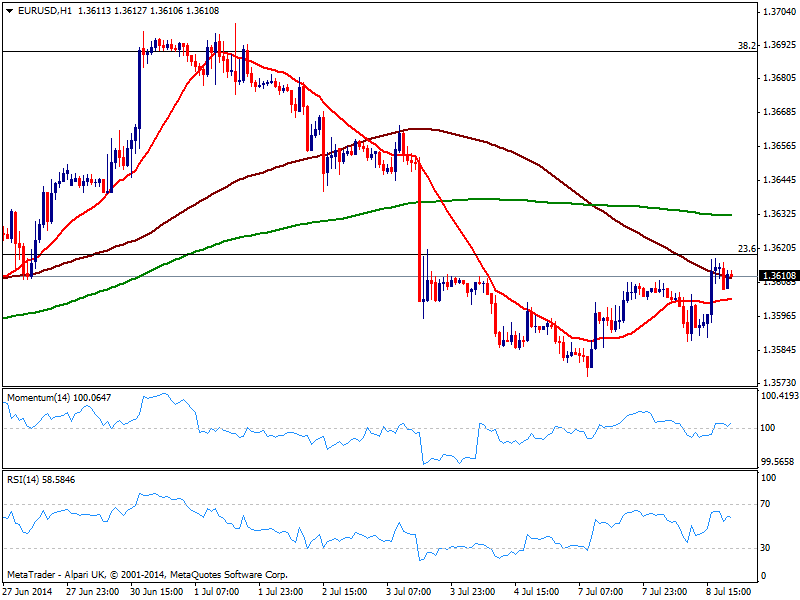

EUR/USD Current price: 1.3611

View Live Chart for the EUR/USD

The EUR/USD finally saw some air early US opening, managing to advance some pips above former weekly high, albeit stalling right below 1.3620, 23.6% retracement of the 1.40/1.35 slide, still the key level to overcome to see a bit more constructive trend in there. In the meantime, the lack of data both shores of the Atlantic, helped the pair to remain in its usual comatose state. Technically, the hourly chart shows a mild positive tone, while the 4 hours chart also presents a bullish technical stance, albeit price is stuck around moving averages also, with 20, 100 and 200 all together in a 10 pips range, reflecting latest range. Some gains above mentioned 1.3620 may see the pair extending its advance up to 1.3660/80 area, while stops continue to grow below 1.3570 and if triggered, may finally see a bearish movement developing, eyeing 1.3476 this year low.

Support levels: 1.3570 1.3530 1.3500

Resistance levels: 1.3620 1.3675 1.3700

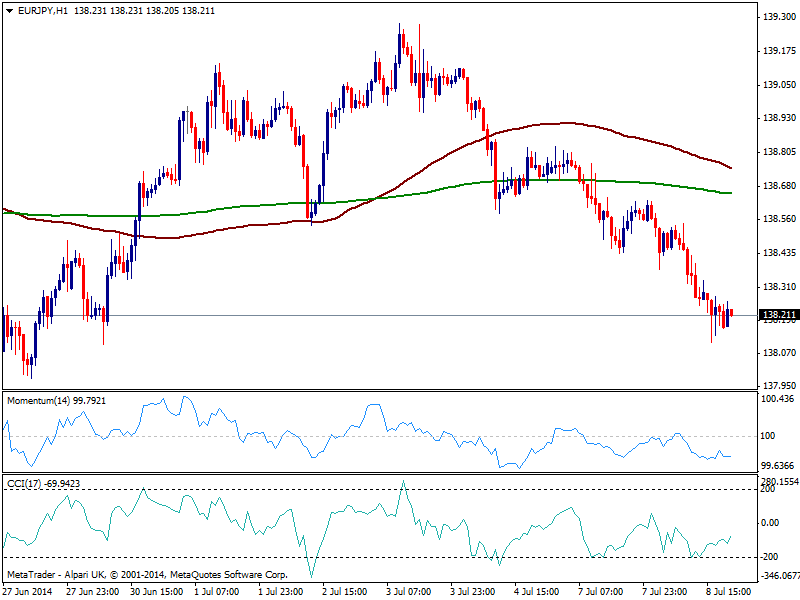

EUR/JPY Current price: 138.20

View Live Chart for the EUR/JPY

The EUR/JPY extended its decline on US yields slide, down on the day 6bps. Stocks also had a bad day, with all of US indexes strongly down as earning season quick started with some major disappointments coming from techs. The pair maintains a strong bearish tone early Asia, with price nearing critical 137.90 support, and developing well below its moving averages, while indicators maintain a bearish slope. In the 4 hours chart technical readings are also favoring the downside, with a break below mentioned level supporting a stronger downward continuation with 136.80 coming then at sight. Approaches to 139.00 are now seen as selling opportunities rather than reversals of current bearish trend.

Support levels: 137.90 137.40 136.80

Resistance levels: 138.40 138.90 139.35

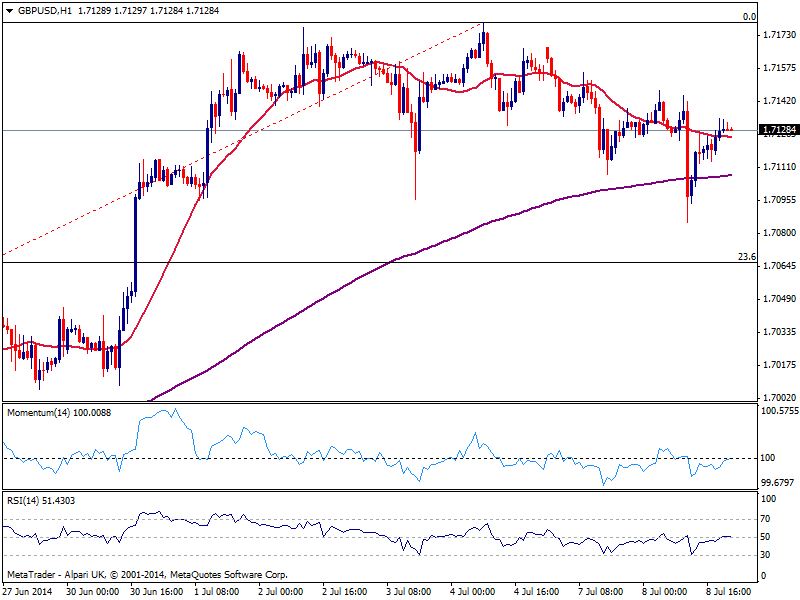

GBP/USD Current price: 1.7128

View Live Chart for the GBP/USD

The GBP/USD ends the day unchanged, after posting a 6-day low of 1.7084 on the back of disappointing manufacturing and industrial production data in the UK early Europe. Nevertheless, bulls shown they are still in charge, seizing their chances and quickly pushing price back above 1.7100. The hourly chart still lacks upward strength, as per price barely above a still bearish 20 SMA and indicators flat around their midlines. In the 4 hours chart price failed to overcome 20 SMA currently around 1.7140 an immediate resistance, while indicators turned higher but remain below their midlines. A steady advance beyond 1.7140 is then required to confirm at least a retest of 1.7180 this year high, while risk to the downside will likely increase on a break below 1.7060, 23.6% retracement of the latest daily run.

Support levels: 1.7095 1.7060 1.7020

Resistance levels: 1.7140 1.7180 1.7220

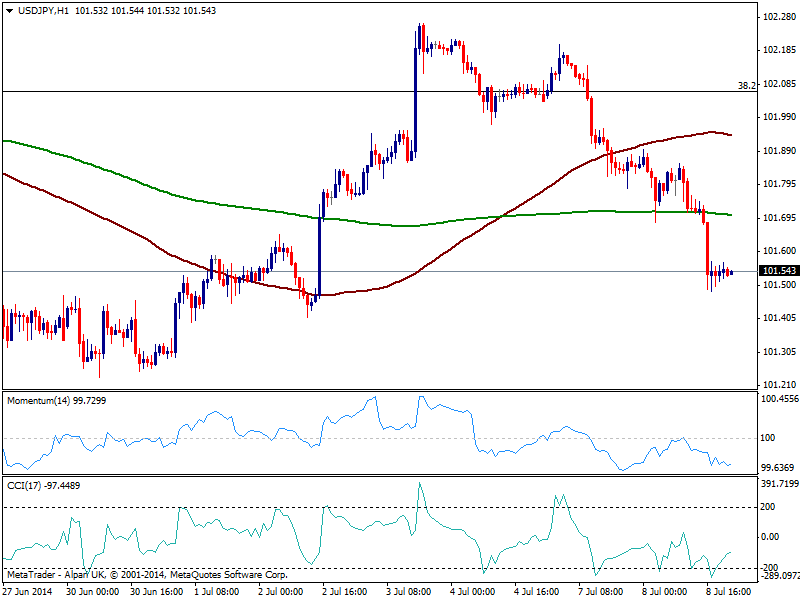

USD/JPY Current price: 101.54

View Live Chart for the USD/JPY

The USD/JPY trades around its daily low set at 101.48, also weighted by US yields and stocks. The post US employment data rally was short lived and for what price shows, not enough to revert yen latest strength: risk to the downside in the midterm has increased with this break lower towards 100.70 this year lows. In the short term, the hourly chart shows price extending below 100 and 200 SMAs, while momentum maintains a clear bearish tone, supporting more slides ahead. In the 4 hours chart technical readings present a strong bearish momentum, also favoring lower lows for the day.

Support levels: 101.20 100.70 100.35

Resistance levels: 101.60 101.95 102.35

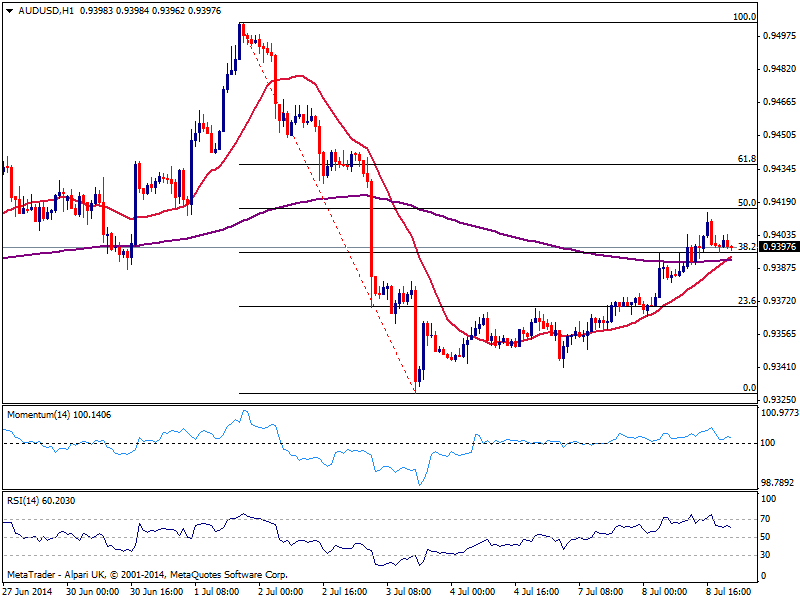

AUD/USD Current price: 0.9397

View Live Chart for the AUD/USD

Australian dollar posted a daily high of 0.9414 against the greenback before retreating some, still holding some decent daily gains. The pair stands above the 38.2% retracement of the latest bearish run, with a mild positive tone in the short term as the hourly chart shows price above 20 SMA and indicators flat above their midlines. In the 4 hours chart indicators are losing their upward potential but hold in positive territory, while moving averages hold well below current price: either an advance above 0.9420 or a break below 0.9370 is required now to set a clearer intraday trend, with the upside still favored on carry trade.

Support levels: 0.9370 0.9330 0.9300

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.