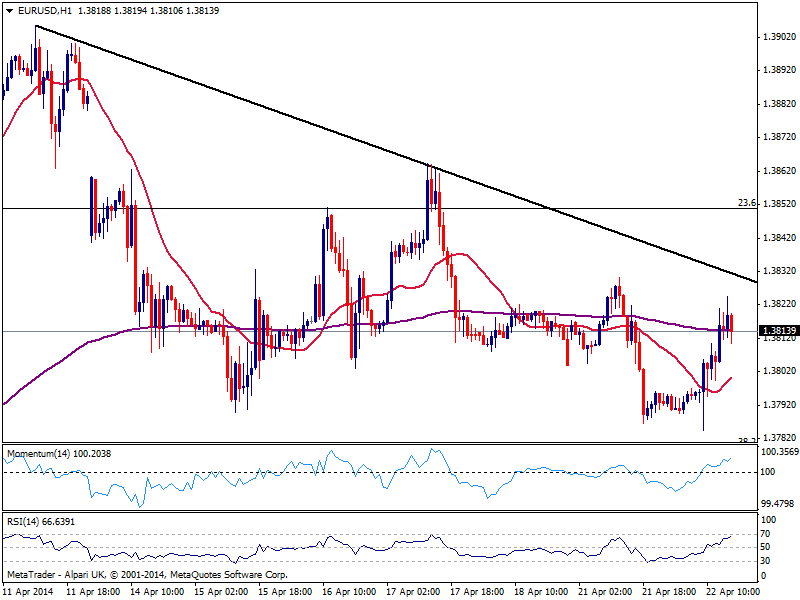

EUR/USD Current price: 1.3803

View Live Chart for the EUR/USD

Tuesday ended up being a more interesting and lively day across the FX board, disregarding of course the EUR/USD, stubbornly confined to its 50 pips range. At this point, seems like while buyers are still defending the downside, they are also reluctant to push it higher amid ECB’s officers jawboning from the past weeks, and there is a good chance the pair will remain range bound until upcoming Central Bank meeting brings light on economic policies. That won’t be the case if Putin strikes and unwinds panic, but that’s something yet to be seen.

Anyway, strong earnings helped US stocks soar along with positive manufacturing and housing readings: immediate market response to the releases saw dollar gain some, albeit movements were quickly reversed. Technically, the EUR/USD keeps finding support in the 1.3780/90 price zone and capped below 1.3825, with technical readings in the hourly chart presenting a quite neutral technical stance. In the 4 hours chart price holds below a slightly bearish 20 SMA, helping keep the upside limited. Nevertheless, only below 1.3730 price zone the pair will increase the risk of a bearish continuation and not before.

Support levels: 1.3780 1.3750 1.3730

Resistance levels: 1.3825 1.3860 1.3890

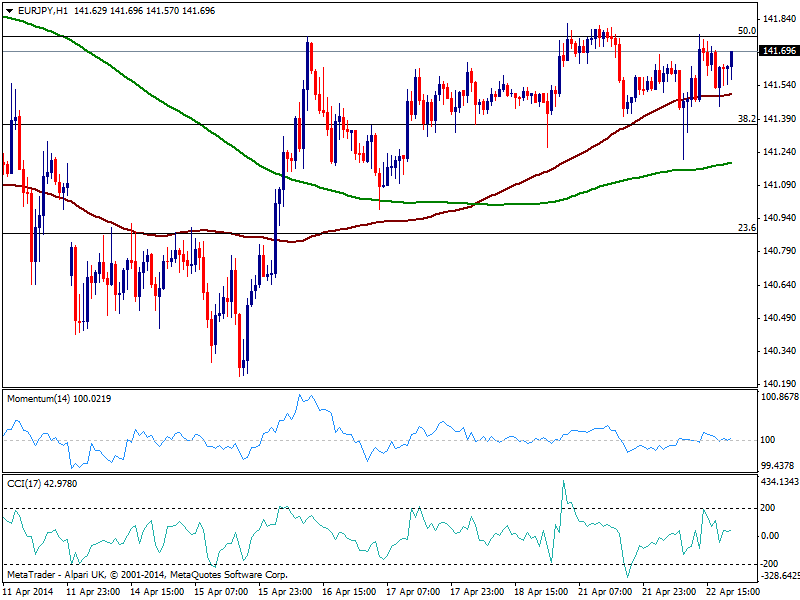

EUR/JPY Current price: 141.69

View Live Chart for the EUR/JPY

The positive tone of US indexes along with rising yields earlier on the day, gave support to yen crosses that rose modestly on the day. For the EUR/JPY price stands near the 141.80 static resistance area ahead of Asian opening, with a mild bullish tone according to the hourly chart, as price holds above 100 SMA and indicators run flat right above their midlines. In the 4 hour chart however, the technical stance is pretty neutral as the pair has been trapped in range for almost a week already. Steady gains above 142.20, 61.8% retracement of the latest daily fall is what it takes to see the pair running higher, eyeing then a retest of the 143.40 highs posted early this month.

Support levels: 141.35 140.90 140.40

Resistance levels: 141.80 142.20 142.60

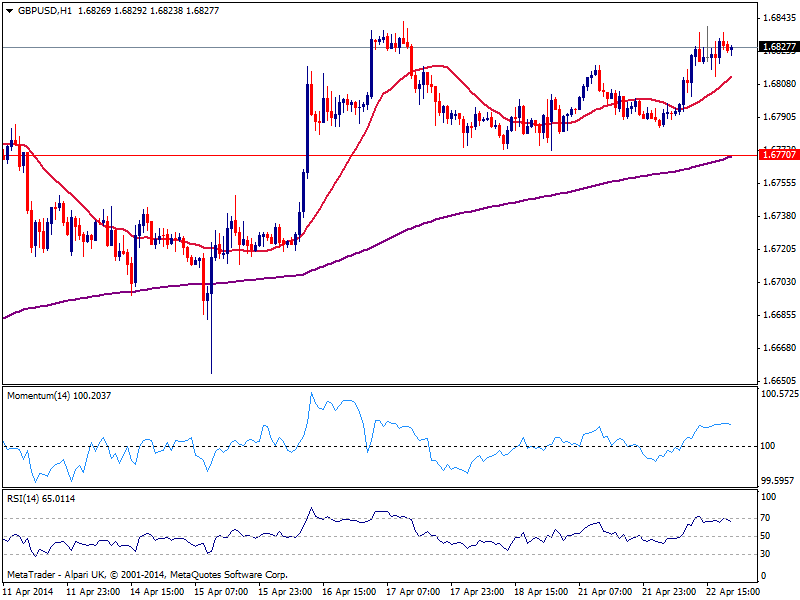

GBP/USD Current price: 1.6827

View Live Chart for the GBP/USD

The GBP/USD advanced up to its year high around 1.6840, establishing for now a short term double roof at the level, with its neckline around 1.6770 static support. With no data coming from the UK, there was little support for buyers, but indeed there are not much sellers around the pair. Technically, the hourly chart shows price above a slightly bullish 20 SMA while indicators stand in positive territory thus not showing momentum at the time being. In the 4 hours chart however, technical readings maintain a strong upward momentum that favors a break of mentioned high in route to 1.7000 for the upcoming sessions.

Support levels: 1.6770 1.6745 1.6710

Resistance levels: 1.6820 1.6870 1.6915

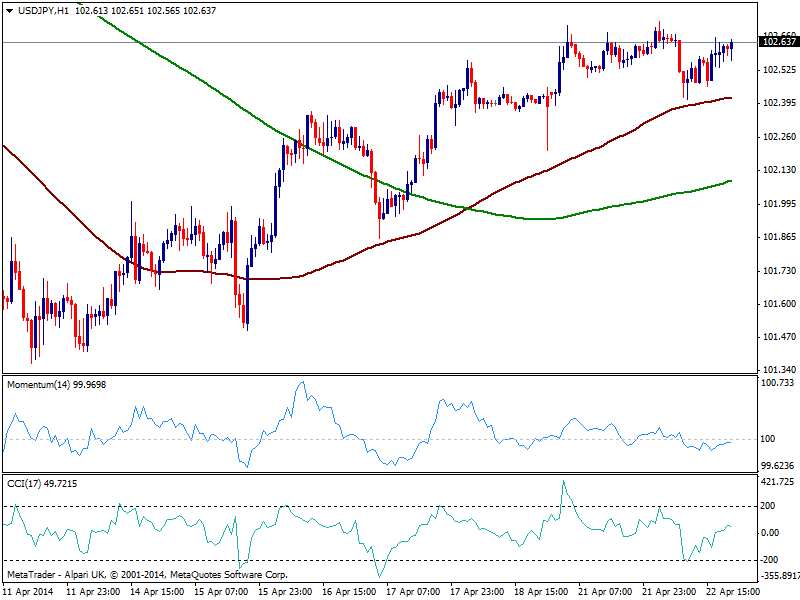

USD/JPY Current price: 102.63

View Live Chart for the USD/JPY

The USD/JPY remains unchanged from past updates, steady around 102.60. As commented before, the pair pressures over the strong static resistance area, but seems unable to advance further: the hourly chart shows price above 100 SMA while indicators hold in neutral territory, losing the mild bearish tone seen early US. In the 4 hour chart, indicators bounce from their midlines supporting a probable test of 103.00 over the upcoming hours.

Support levels: 102.35 102.00 101.55

Resistance levels: 102.95 103.20 103.70

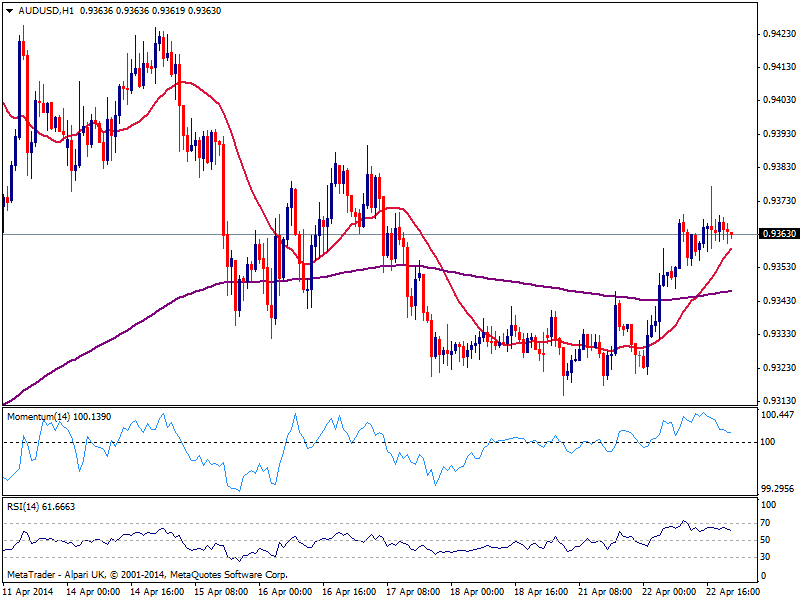

AUD/USD Current price: 0.9363

View Live Chart for the AUD/USD

The AUD/USD holds near the 0.9377 daily high, with the hourly chart showing price steady above a bullish 20 SMA and indicators losing upward strength above their midlines. In the 4 hours chart the technical picture is pretty bullish, which supports a test of the 0.9400 level for the upcoming session, moreover if Australian inflation readings surge above expected.

Support levels: 0.9320 0.9290 0.9260

Resistance levels: 0.9390 0.9435 0.9460

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.