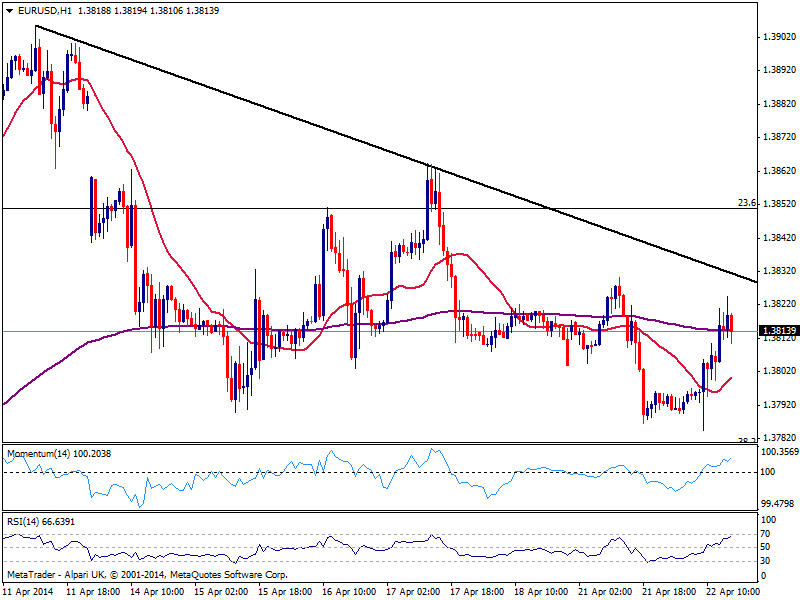

EUR/USD Current price: 1.3813

View Live Chart for the EUR/USD

Hovering inside recent range, the EUR/USD shy advanced was contained by 1.3825 static resistance area, entering US session with a slightly positive tone according to the hourly chart that shows indicators heading north above their midlines and price above its 20 SMA. In the 4 hours chart however, technical readings maintain a neutral stance while a daily descendant trend line coming from past Friday’s high converges with the mentioned static resistance. Dollar weakness may keep the pair supported, albeit only a price acceleration above mentioned 1.3825 resistance would favor an upward continuation today.

Support levels: 1.3780 1.3750 1.3720

Resistance levels: 1.3825 1.3860 1.3890

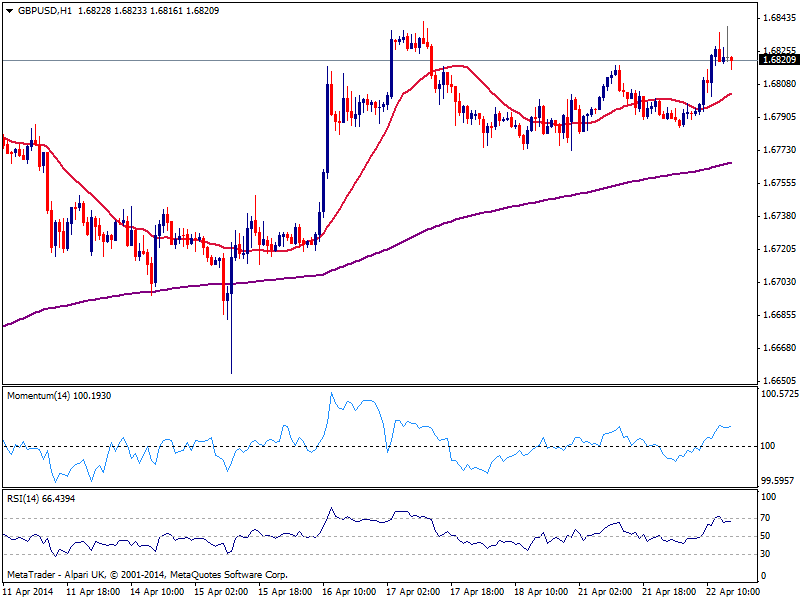

GBP/USD Current price: 1.6821

View Live Chart for the GBP/USD

Despite the limited moves, the GBP/USD managed to extend its gains up to 1.6839, flirting with the year high a couple pips above. The hourly chart shows an overall positive tone coming from technical readings, albeit with not enough upward strength at the time being, while the 4 hours chart presents a pretty similar picture, with indicators turning flat in positive territory. A break higher remains favored eyeing 1.6870 in the short term, and 1.7000 for the upcoming sessions.

Support levels: 1.6770 1.6745 1.6710

Resistance levels: 1.6820 1.6870 1.6915

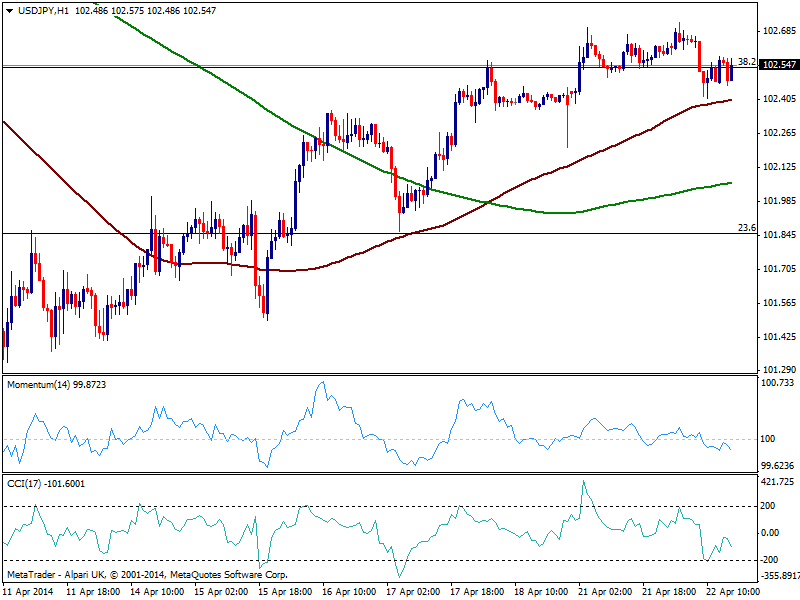

USD/JPY Current price: 102.54

View Live Chart for the USD/JPY

Unchanged since last updates, the USD/JPY seems unable to advance beyond key 102.60 price zone, albeit the pressure over the level remains. The hourly chart shows price found intraday support around a bullish 100 SMA, while indicators diverge lower, presenting a slightly bearish tone below their midlines. In the 4 hour chart indicators also turned south yet hold around their midlines, showing not enough selling interest at the time being.

Support levels: 102.35 102.00 101.55

Resistance levels: 102.95 103.20 103.70

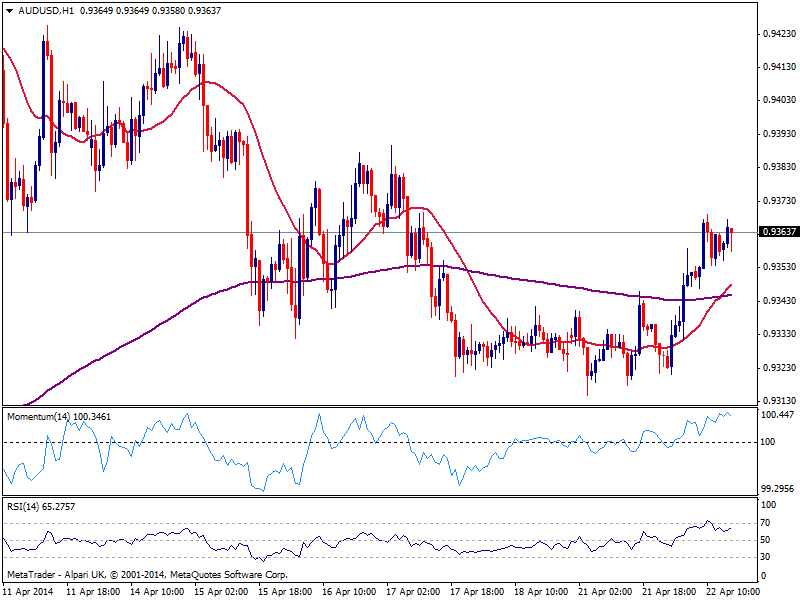

AUD/USD Current price: 0.9364

View Live Chart for the AUD/USD

Aussie recovered ground against the greenback, with the pair founding buyers around key 0.9320 static support zone. The hourly chart presents a mild positive tone, with price above its moving averages and indicators in positive territory, while the 4 hours chart also presents a mild positive tone with scope to test 0.9400 price zone if stocks maintain the upward momentum.

Support levels: 0.9320 0.9290 0.9260

Resistance levels: 0.9390 0.9435 0.9460

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.